By Hendry Santoso, Market Research and FS

Overview of the Petrochemical Industry

The petrochemical industry is one of the most critical enablers of industrial and consumer economies worldwide. It transforms raw hydrocarbons—mainly natural gas and crude oil derivatives—into essential chemical building blocks used in everything from plastics, packaging, textiles, automotive parts, construction materials, fertilizers, detergents, adhesives, solvents, to cosmetics and medical devices. In short, petrochemicals form the chemical infrastructure behind thousands of products that drive both modern industry and daily life.

In the Indonesian context, the petrochemical sector holds immense strategic significance. It supports national industrialization efforts, reduces dependency on imported basic materials, and acts as a catalyst for downstream industries such as textiles, electronics, automotive, agriculture, and food processing. Despite this importance, Indonesia remains largely import-dependent for key petrochemical materials, particularly olefins and polyolefin like polyethylene (PE) and polypropylene (PP).

The petrochemical industry can be broadly divided into three segments:

- Basic Petrochemicals: Ethylene, propylene, benzene, toluene, xylene, butadiene, methanol, etc.

- Intermediates and Derivatives: Styrene, ethylene glycol, acrylonitrile, PTA, MEG, and others.

- Polymers and Plastics: Polyethylene (HDPE, LDPE, LLDPE), polypropylene, polyvinyl chloride (PVC), and polystyrene.

Indonesia’s petrochemical production is focused on:

- Naphtha cracking (used to produce ethylene and propylene)

- Aromatic products like benzene, toluene, xylene

- Polyolefins (PE, PP)

- Ammonia and fertilizer

- Oleochemicals from palm oil

The value chain typically starts with refined hydrocarbons or natural gas (e.g., naphtha, LPG) and moves toward more value-added products. Most petrochemical facilities require high capital investment and are often integrated with oil refineries or gas processing plants. In Indonesia, PT Chandra Asri Petrochemical is the only domestic producer with an integrated naphtha cracker.

The majority of domestic producers focus on polymers and basic intermediates, while specialty and fine chemicals are still underrepresented in the national portfolio. This leaves significant room for industrial diversification and import substitution.

Market Trends of Petrochemical in Indonesia

Overview of the Petrochemical Market in Indonesia

Indonesia’s petrochemical industry is central to the nation’s industrial ecosystem, contributing key raw materials to sectors such as automotive, packaging, agriculture, construction, and consumer goods. Between 2019 and 2024, the market witnessed consistent growth with an estimated compound annual growth rate (CAGR) of 6–7%. The total market value reached approximately USD 27.2 billion in 2022 and is forecasted to grow to USD 47.6 billion by 2030. The core products include ethylene, propylene, polyethylene (PE), polypropylene (PP), methanol, benzene, toluene, and xylene. Among these, ethylene has remained the highest revenue-generating segment, followed by polypropylene and methanol.

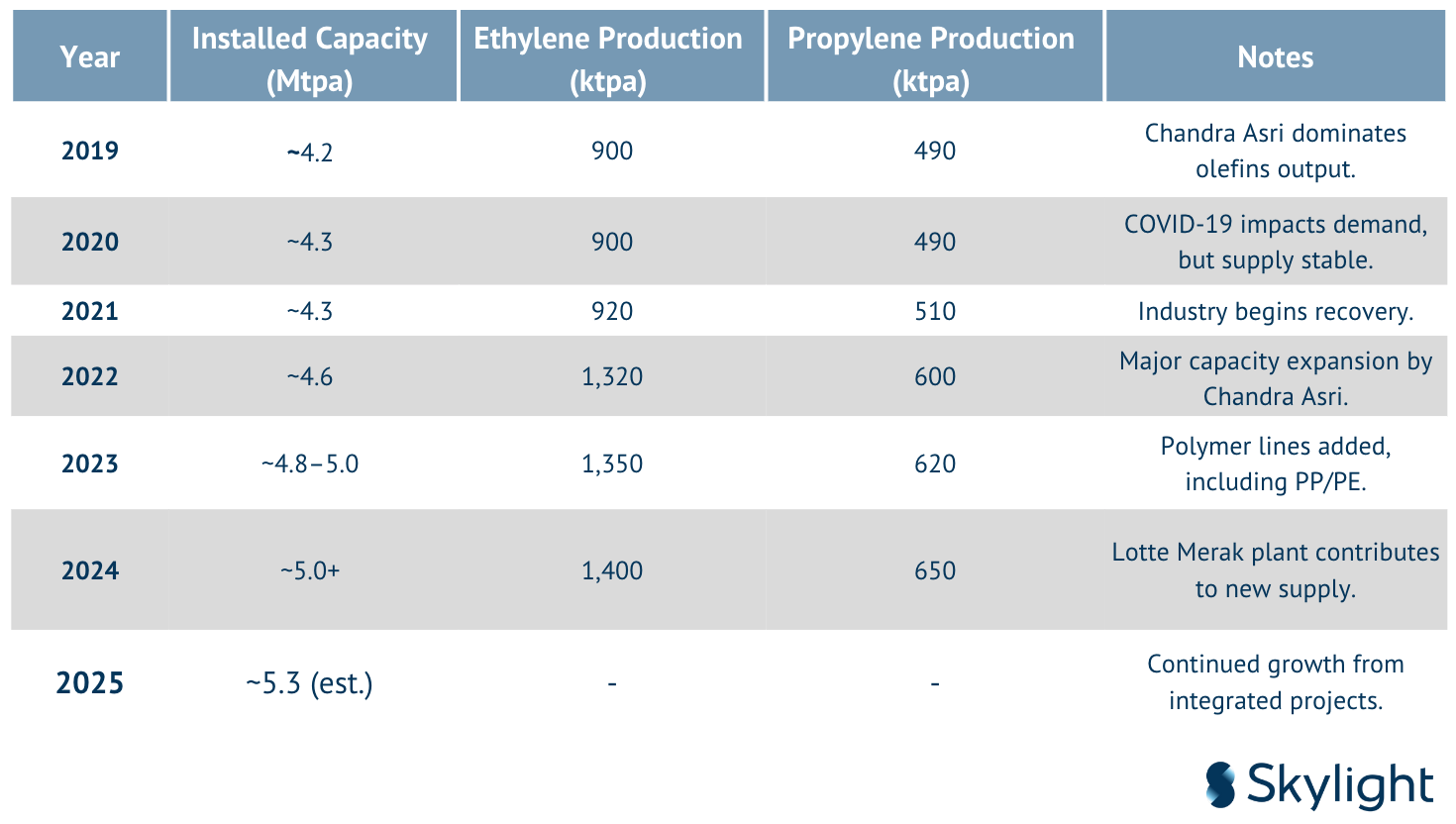

Capacity and Production Trends (2019–2024)

Import Dependence and Trade Flows

Despite capacity increases, Indonesia remains heavily reliant on imports:

- Olefin imports: ~33% of domestic

- Polyethylene: ~42%

- Polypropylene: ~57%

In 2023, Indonesia imported approximately:

- 749 Kt of LLDPE & HDPE (~45% of demand).

- 25 Mt of PP (~65% of demand), sourced mainly from Malaysia, Thailand, Vietnam, Singapore, and China.

Operating Efficiency and Utilization

Operating rates across Southeast Asia remain below optimal thresholds due to high feedstock costs and global competition:

- PE average operating rate: ~70%

- PP average operating rate: ~67%

- In Indonesia: HDPE ~64%, LLDPE ~69%, LDPE ~91%

This underutilization reflects a broader regional trend driven by China’s overcapacity and margin pressures.

Pricing Trends (2019–2024)

Petrochemical pricing in Indonesia is primarily influenced by:

- International oil benchmarks (Brent, Dubai)

- Feedstock type and cost (naphtha-based cracking dominates)

- Regional supply-demand imbalances

Prices in Southeast Asia averaged $45–65/ton higher than Northeast Asia due to:

- Lower plant utilization

- Smaller scale

- High dependency on import

Feedstock Strategies

Current Challenges:

- High reliance on imported naphtha

- Volatile naphtha prices linked to oil fluctuations

- Underdeveloped domestic gas-based feedstock alternatives

Strategic Developments:

- Chandra Asri’s acquisition of Shell Bukom refinery (Singapore) for integrated feedstock supply

- Planned refinery-petrochemical integration projects (e.g., Pertamina-Rosneft Tuban Refinery)

- LPG import schemes under Lotte Chemical

- Green feedstock exploration: CCS projects, palm-oil-based oleochemicals

- Feedstock diversification and domestic integration remain key to improving cost competitiveness

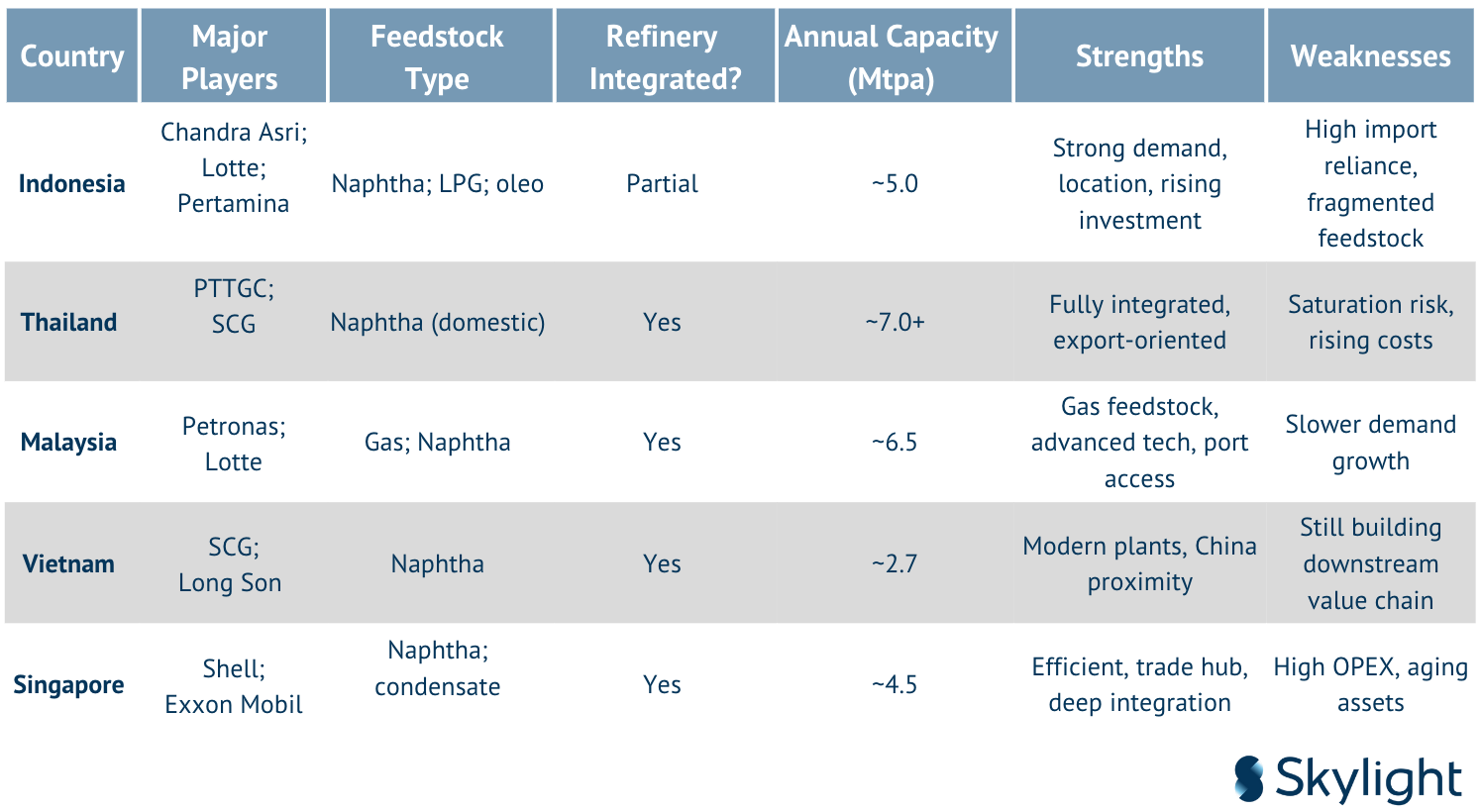

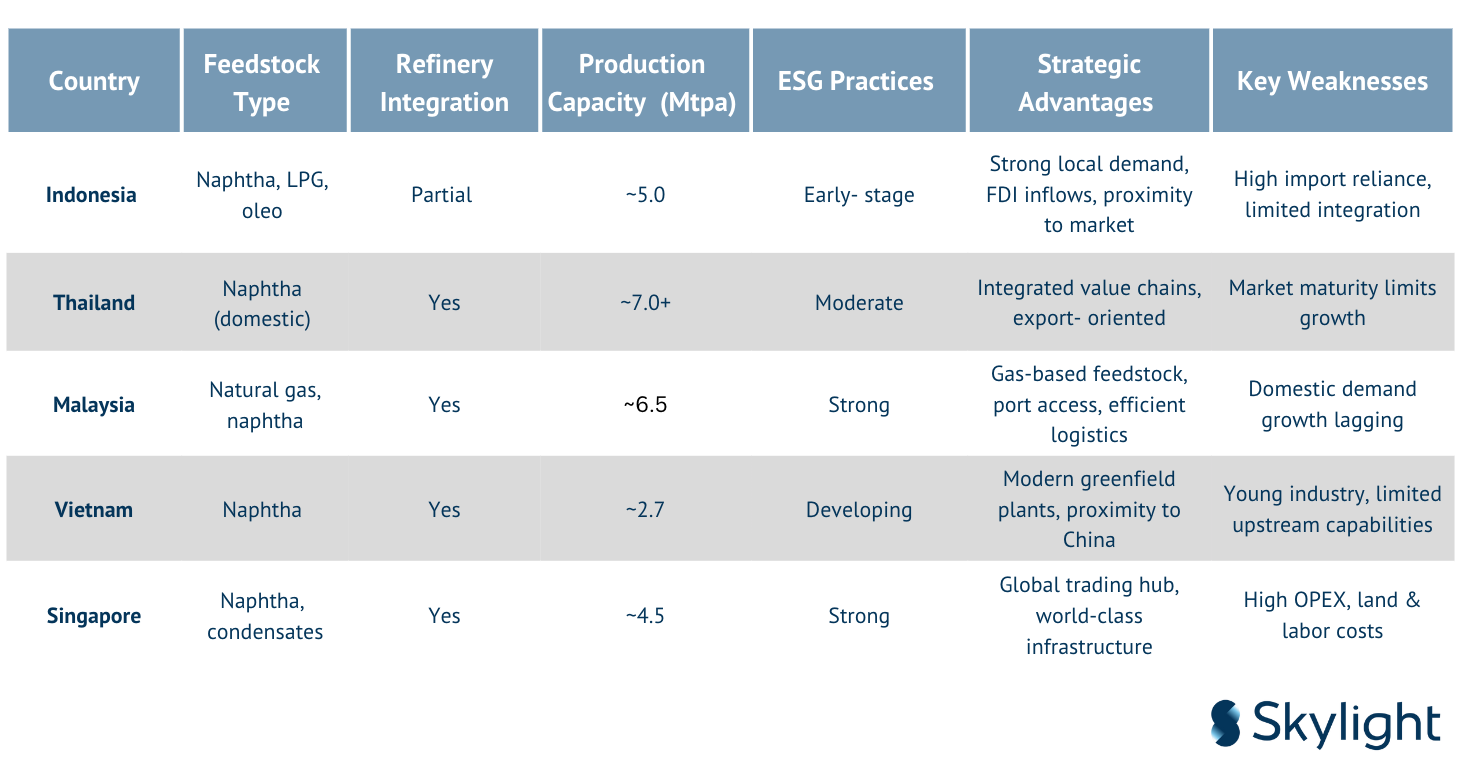

ASEAN Comparison Table

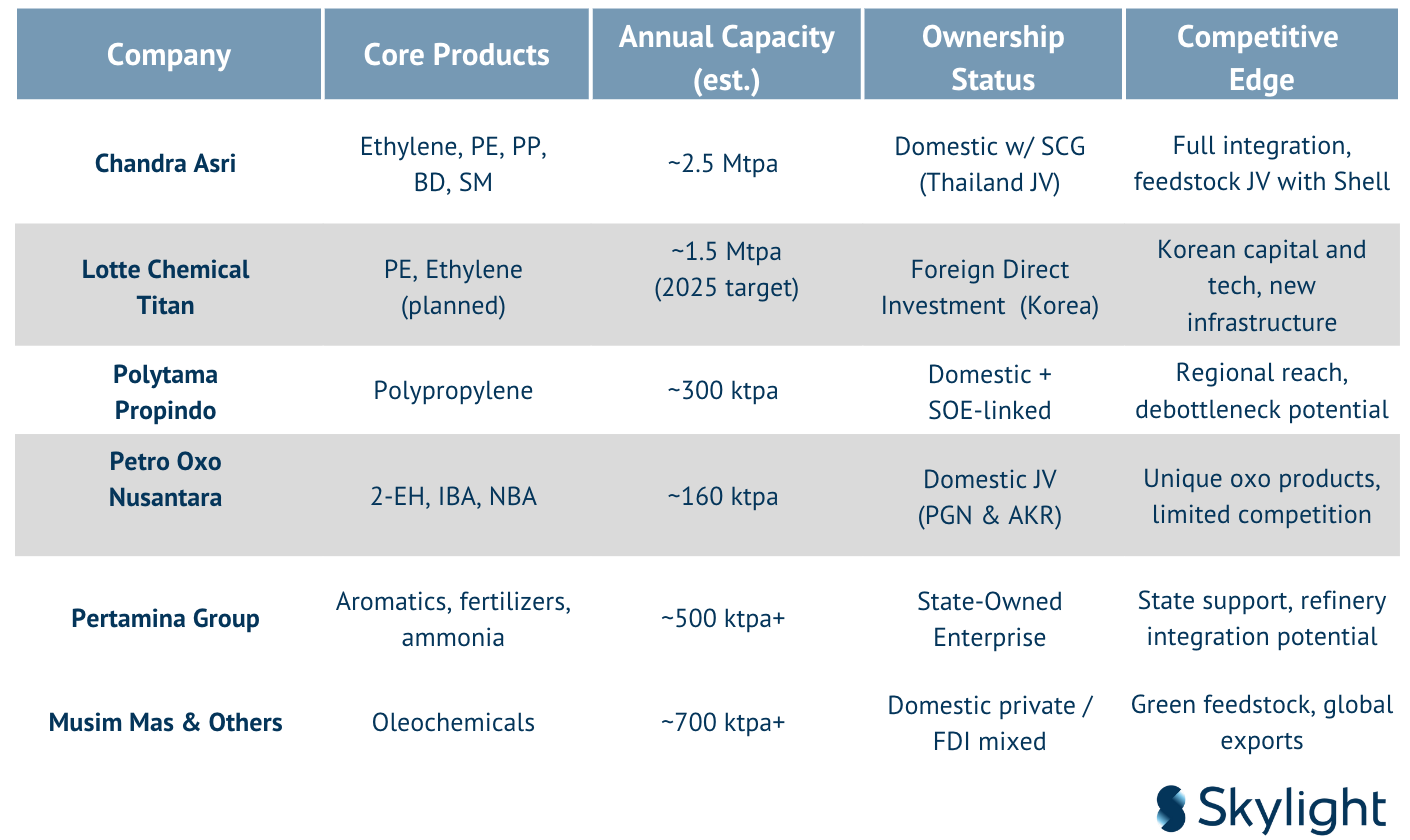

Major Players in the Industries

Indonesia’s petrochemical sector is driven by a combination of domestic conglomerates, multinational joint ventures, and state-owned enterprises. These key players are actively expanding capacities, integrating upstream-downstream operations, and forming strategic alliances to reduce import dependence, enhance feedstock security, and address environmental sustainability.

As of 2024, Indonesia is home to approximately 60+ petrochemical-related companies, spanning core producers (olefins, aromatics, methanol), intermediate processors (plastic resins, solvents), and specialty/sub-sector operators (oleochemicals, coatings, fertilizers). Among these, around 15–20 companies dominate primary petrochemical production, with several others operating as subsidiaries, toll manufacturers, or joint ventures under larger corporate groups.

1. PT Chandra Asri Petrochemical Tbk (CAP)

Status: Domestic-based investment with partial foreign strategic partnership (Thailand’s SCG Chemicals).

Company Profile:

- Indonesia’s largest and only fully integrated petrochemical producer

- Operates the country’s sole naphtha cracekr

- Subsidiary of Barito Pacific Group, in partnership with Thailand’s SCG Chemicals Chemicals

Production Facilities (Cilegon):

- Naphtha Cracker

- Polymer production lines (PE, PP)

- Butadiene extraction plant

- Styrene monomer plant

Core Products & Annual Capacity:

- Ethylene: 900 ktpa

- Propylene: 490 ktpa

- Polyethylene (HDPE, LLDPE): 400 ktpa

- Polypropylene: 590 ktpa

- Butadiene: 100 ktpa

- Styrene Monomer: 340 ktpa

Recent Developments:

- PE and PP lines expanded in 2022 by +400 kt and +110 kt respectively

- 2023: Acquired Shell’s Bukom Refinery in Singapore with Glencore, gaining access to regional feedstock.

- CAP2 complex (under Chandra Asri Perkasa II) to double cracker capacity to 2 million tpa by 2027.

Strategic Advantages:

- Only integrated naphtha cracker in Indonesia

- Strategic location near Java’s industrial corridor

- Long-term investment in logistics and port infrastructure

Challenges:

- High capital expenditure requirements

- Environmental and permitting delays for CAP2

2. Lotte Chemical Titan Nusantara

Status: Foreign direct investment (South Korea).

Company Profile:

- Indonesian subsidiary of South Korea’s Lotte Chemical

- Based in Merak, Banten; long-established regional presence

Current Facilities:

- Swing plants producing HDPE and LLDPE

- Terminal and jetty facilities for raw material imports

Capacity & Projects:

- HDPE/LLDPE (swing): ~450 ktpa

- Ethylene (planned): 1,000 ktpa

- Total PE capacity (after Lotte Chemical Indonesia integration): 800+ ktpa

Strategic Investment:

- $3.9 billion investment in Lotte Chemical Indonesia (LCI) mega-project

- LCI complex includes cracker, PE lines, and tank farm

- Backed by strong bilateral ties and state support from South Korea

Strengths:

- Technological excellence in plant operation

- Efficient, modern greenfield setup

- Large-scale investment with long-term upstream-downstream integration

Risks:

- Dependence on LPG

- Delay risks in mechanical completion

3. PT Polytama Propindo

Status: Domestic-based investment with partial state ownership (via Tuban Petro and Pertamina).

Company Overview:

- Specializes in polypropylene (PP) production

- Located in Balongan, West Java, near Pertamina’s refinery

- Partly owned by PT Tuban Petrochemical Industries

Annual Production Capacity:

- Polypropylene: ~300 ktpa

Supply Chain:

- Procures propylene feedstock domestically and via imports

- Proximity to Balongan refinery facilitates supply linkage

Projects and Upgrades:

- Debottlenecking to enhance throughput by 15–20%.

- Mid-term goal to build integrated propylene facility

Strengths:

- Niche focus on PP

- Regional accessibility

Challenges:

- Feedstock volatility

- Technological obsolescence

4. PT Petro Oxo Nusantara (PON)

Status: Domestic joint venture (PGN – SOE and AKR Corporindo).

Company Background:

- Founded as a joint venture between PT AKR Corporindo and PT Perusahaan Gas Negara (PGN).

- Specializes in oxo-intermediates and alcohols

Main Products & Capacity:

- 2-Ethylhexanol (2-EH): ~80 ktpa

- Normal Butanol (NBA): ~40 ktpa

- Iso Butanol (IBA): ~40 ktpa

Market Role:

- Supplies domestic and regional customers for plasticizer and resin industries

- Competes with imports from South Korea and China

Strengths:

- Exclusive domestic producer in oxo chemical

- Strategic location in East Java

Challenges:

- Exposure to raw material and utility price fluctuations

- Low economies of scale

5. Pertamina Group

Status: State-owned enterprise (SOE).

Overview:

- Indonesia’s national oil & gas company with expanding petrochemical ambitions

- Operates through subsidiaries including PT Pertamina Plaju, Petrokimia Gresik, and Pupuk Indonesia

Major Production Sites & Outputs:

- Plaju: Aromatics (benzene, toluene)

- Balongan: PX, PTA, Benzene (~250 ktpa total)

- Cilacap: Benzene and basic chemicals

- Gresik (via Petrokimia): Ammonia, sulfuric acid, urea (fertilizer)

Projects:

- Tuban Refinery & Petrochemical Complex (w/ Rosneft): 300,000 bpd capacity + 1 Mtpa petrochemicals

- Expansion of aromatics and sulfur recovery units

Advantages:

- Government backing and access to national reserves

- Strategic national role in fertilizer and fuel supply

Weaknesses:

- Non-integrated value chains

- Aging facilities

6. Musim Mas and Other Oleochemical Players

Status: Domestic-based private conglomerate with international export orientation.

Musim Mas Group:

- One of the world’s largest vertically integrated palm-based oleochemical producers

- Facilities across Indonesia: Sumatra, Kalimantan, Java

Product Lines:

- Fatty acids, glycerin, esters, alcohols, soap noodles

- Annual capacity exceeds 700 ktpa for oleochemical derivatives

Sustainability Profile:

- Certified by RSPO and ISCC

- Supplies multinational brands in personal care and detergents

Other Key Players:

- PT Lautan Luas: Industrial and performance chemicals

- PT Avia Avian: Coatings and decorative chemical products

- Kao Chemicals: Consumer and industrial chemicals (FDI)

- Ecogreen Oleochemicals: Bio-based chemical producer (FDI)

Strengths:

- Export-oriented, globally certified

- Strong integration with palm oil upstream supply

Limitations:

- Subject to CPO price volatility

- High dependency on European demand

Summary Table

Indonesia’s petrochemical industry is evolving through strategic investments, foreign partnerships, and capacity expansion. While local players like Chandra Asri and Polytama are reinforcing upstream security, global firms like Lotte and Musim Mas bring world- class technology and sustainability credentials. The competitive future of the industry will be shaped by its ability to secure feedstock, integrate operations, modernize plants, and meet global ESG standards.

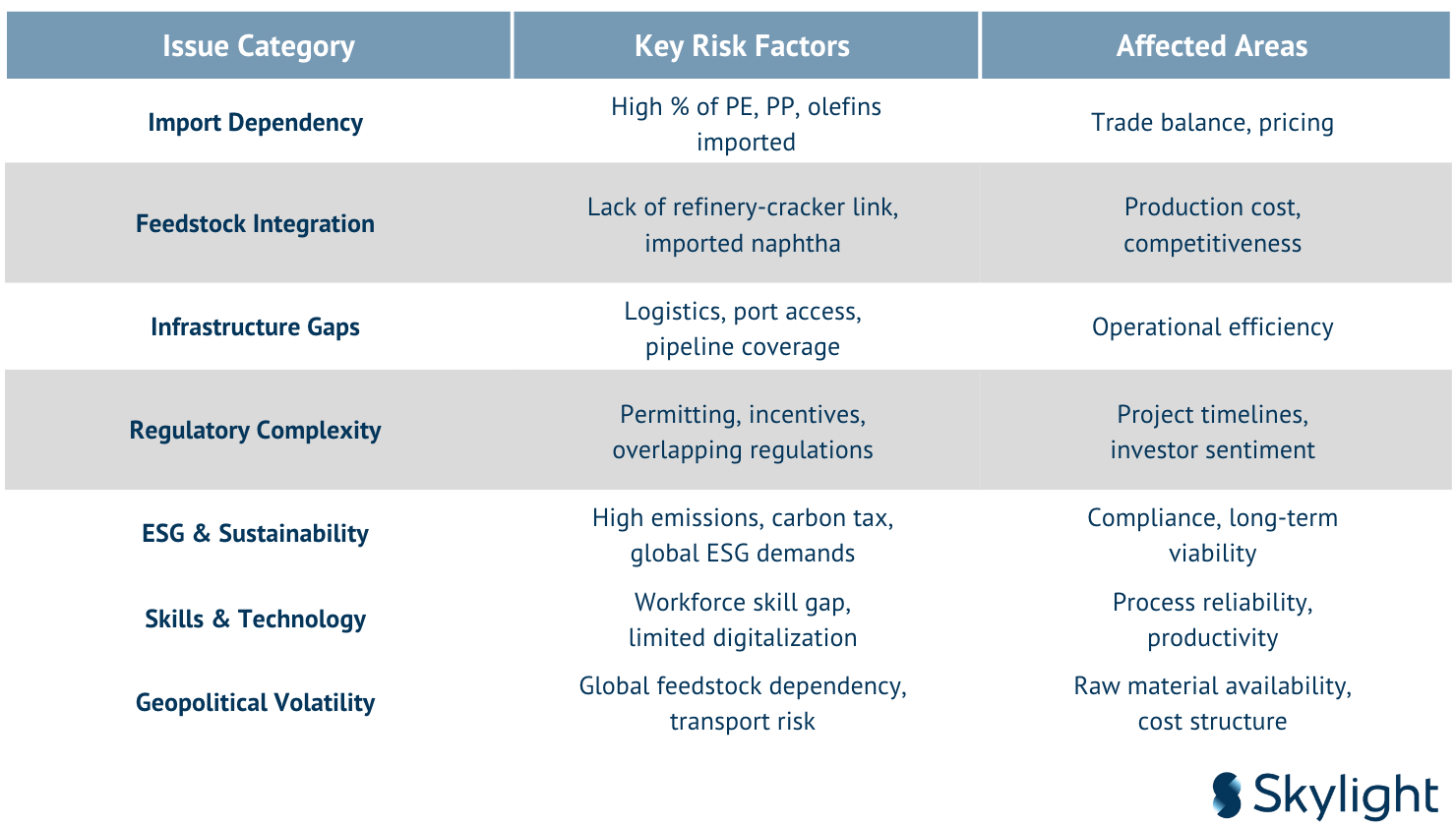

Potential Issues

Despite steady growth and investment across Indonesia’s petrochemical sector, a range of structural and operational challenges continue to hinder its full potential. The country faces persistent issues such as heavy reliance on imports, underdeveloped feedstock integration, infrastructure gaps, regulatory bottlenecks, and emerging ESG (Environmental, Social, and Governance) expectations. These issues affect cost competitiveness, project viability, and long-term sustainability of the industry.

Indonesia’s petrochemical industry has significant long-term potential but must address these layered structural and operational issues. The next stage of sectoral transformation will depend on how successfully the country can integrate upstream resources, strengthen logistics, modernize regulations, and invest in sustainability and innovation.

Benchmark / Common & Best Practices

Benchmarking Indonesia’s petrochemical sector against global and regional peers is essential for identifying performance gaps and growth opportunities. Key comparison metrics include feedstock strategy, infrastructure integration, ESG alignment, production efficiency, technology adoption, and policy frameworks.

Regional Benchmarking: ASEAN Peers

Findings:

- Indonesia’s lack of fully integrated refinery-cracker complexes places it behind Thailand and Malaysia.

- Strong demand and investment climate are positives, but competitiveness remains hampered by reliance on imported feedstock.

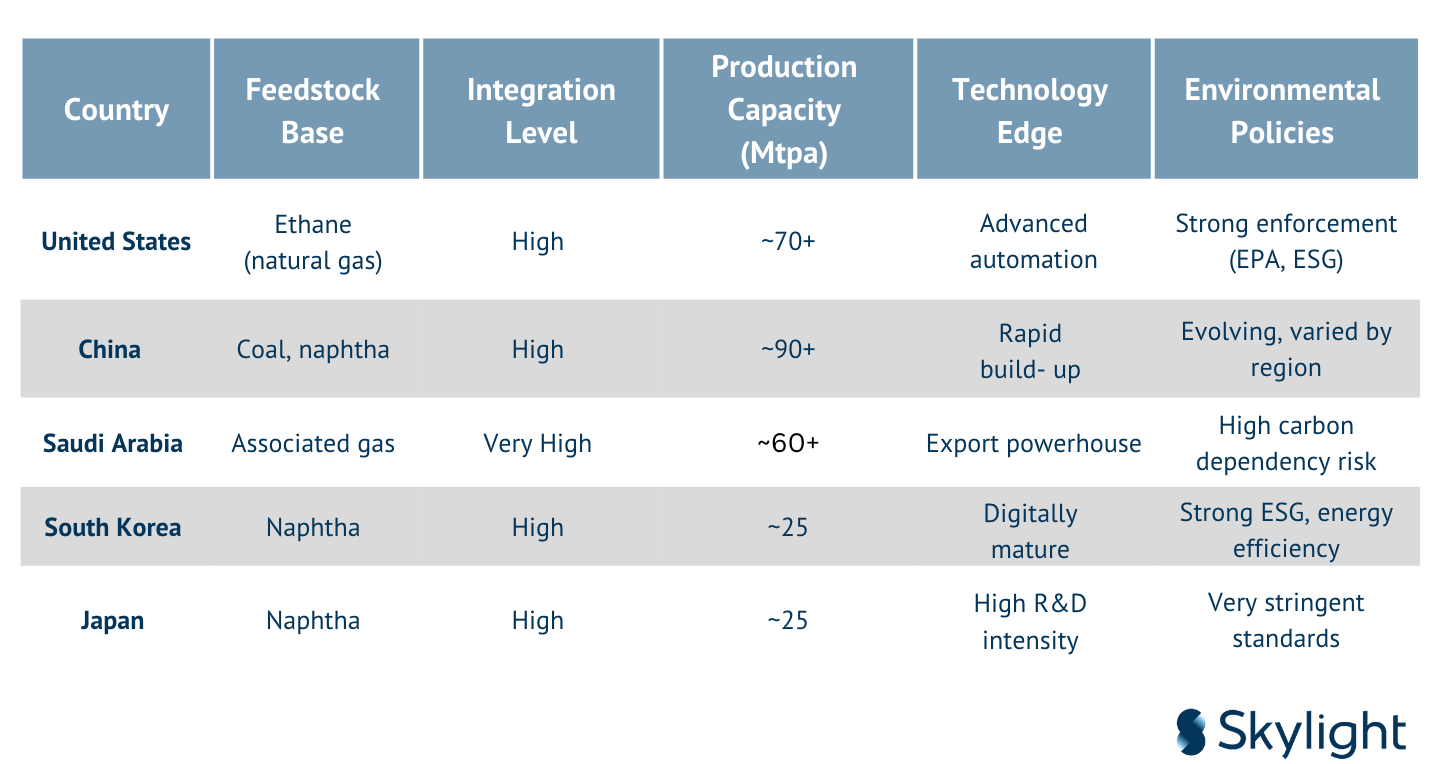

Global Benchmarking: Leading Producers

Findings:

- S. and Middle East producers benefit from low-cost gas-based feedstocks and large-scale economies.

- South Korea and Japan lead in ESG alignment and high-tech plant

- China dominates volume but struggles with sustainability

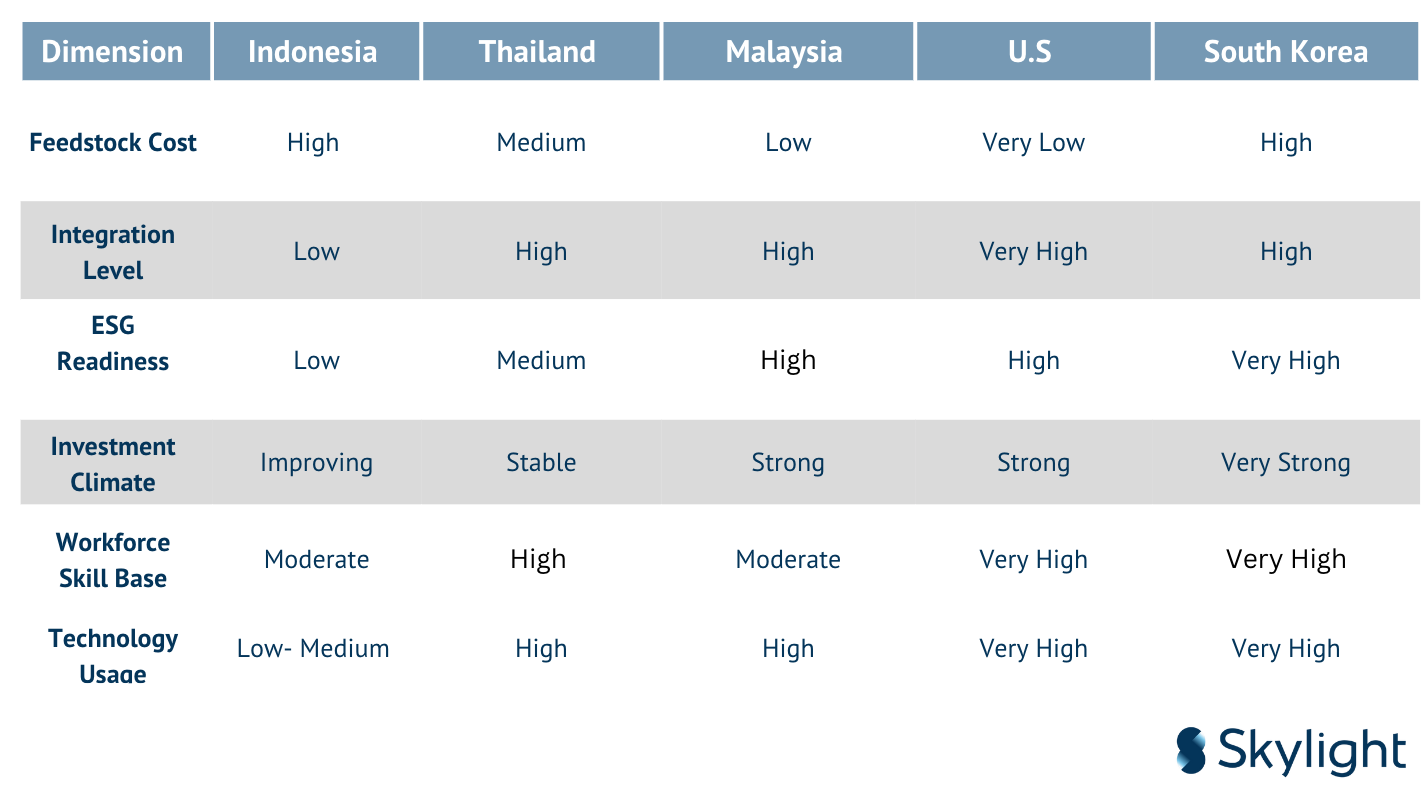

Comparative Performance by Dimension

From the table above, it is evident that Indonesia’s competitive strengths lie in its large market size, strategic geographic access, and strong investment momentum. However, the country lags in feedstock strategy, ESG performance, and technology adoption, which may limit its long-term industrial edge. These gaps highlight the need for stronger policy alignment, targeted R&D funding, and sustained infrastructure investment to enhance competitiveness and capture future growth opportunities.

Strategic Learnings and Recommendations

- Feedstock Integration: Develop refinery-linked petrochemical clusters like Thailand’s Map Ta Phut or Malaysia’s RAPID complex.

- ESG Framework: Adopt enforceable ESG benchmarks to remain compliant with export standards and attract global financing.

- Technology Adoption: Incentivize digital transformation (IoT, AI) in plant operations for productivity and emissions control.

- R&D and Workforce Development: Invest in specialized technical education and public-private innovation centers.

- Policy Reform: Simplify permitting, fast-track key projects, and provide clearer fiscal incentives for green and integrated projects.

Indonesia stands at a critical juncture. Learning from regional and global peers can accelerate the evolution of its petrochemical sector from import-reliant to self-sufficient, from low-tech to high-efficiency, and from resource-intensive to ESG-aligned.

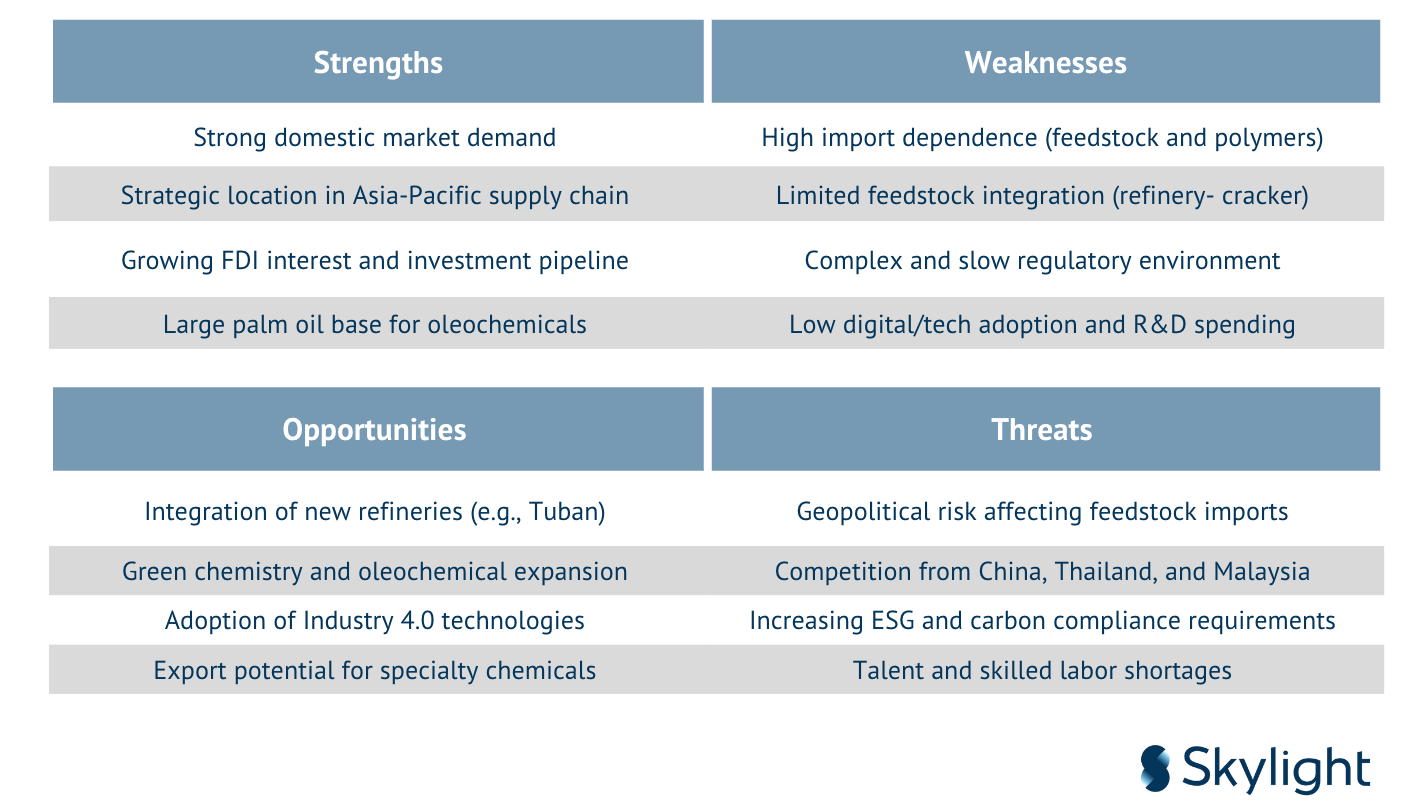

SWOT Analysis: Indonesia’s Petrochemical Industry

Perspective on Petrochemical Industry

Indonesia’s petrochemical sector stands at a critical inflection point. As Southeast Asia’s largest economy, the country holds immense potential to move up the industrial value chain and emerge as a regional hub for high-value chemicals. The government’s ambition, as reflected in the “Making Indonesia 4.0” roadmap, places chemical manufacturing at the center of its industrial transformation.

However, this potential is undercut by persistent issues such as high dependency on imports, weak integration between refining and petrochemical facilities, aging infrastructure, and overlapping regulatory frameworks.

The industry is shaped by a paradox: strong local demand paired with underdeveloped domestic production capabilities. Despite Indonesia’s sizable oil, gas, and palm oil resources, many petrochemical producers still rely on imported naphtha, LPG, and feedstock derivatives. Only a limited number of players—primarily Chandra Asri and Lotte Chemical Titan—possess the infrastructure and capital strength to expand integrated operations. Without broader integration of refinery-to-chemical value chains, Indonesia will continue to face margin pressure and high volatility in pricing.

Strategic projects such as the Chandra Asri Perkasa II complex (CAP2) and the Pertamina- Rosneft Tuban refinery offer a blueprint for the future. These projects aim to close the supply-demand gap and enhance self-sufficiency. Yet their success depends on timely regulatory approvals, synchronized infrastructure development, and supportive policies.

At the same time, Indonesia must address ESG (Environmental, Social, and Governance) demands through enforceable emission standards, early adoption of carbon capture technologies, and alignment with global disclosure norms. The adoption of Industry 4.0 tools—such as predictive maintenance, automation, and digital twins—can help improve operational efficiency and competitiveness.

Indonesia also benefits from intrinsic strengths: a domestic market of over 270 million people, a favorable geographic location within key maritime trade routes, a dominant global position in oleochemical feedstock (palm oil), and increasing interest from foreign direct investors.

These advantages, if matched with improved policy coordination and investment incentives, can help propel the industry toward becoming a regional and global leader. The country could focus on export-led growth in specialty chemicals, oleochemicals, and bio- based polymers to differentiate itself from commodity-focused peers.

In conclusion, the future of Indonesia’s petrochemical industry depends not just on infrastructure expansion or investor interest, but on national execution capacity. What is needed is a synchronized strategy involving the government, private sector, academia, and international partners. With coherent leadership and long-term commitment, Indonesia can shift from being a high-cost, import-dependent market to a globally respected center of sustainable chemical production, technological innovation, and industrial resilience.

Conclusion

The Indonesian petrochemical industry has experienced significant development between 2019 and 2024. Capacity expansions, the emergence of strategic investments, and increasing government attention have all contributed to reshaping the sector’s landscape. With a market value surpassing USD 27 billion and an expected compound annual growth rate (CAGR) of 6–7%, the industry is poised to remain a cornerstone of Indonesia’s broader industrial transformation. It supports critical downstream sectors including packaging, automotive, construction, electronics, and agriculture.

Despite this momentum, the industry faces persistent structural challenges:

- Heavy reliance on imports, with over 40% of PE and 50% of PP still sourced from

- Limited upstream integration, due to insufficient connections between domestic refineries and petrochemical crackers.

- Inadequate infrastructure, including underdeveloped port logistics, storage capacity, and inter-facility pipeline networks.

- Slow regulatory processes, which hamper project execution and investor

- Nascent ESG alignment, with low adoption of carbon tracking, circularity, and sustainable certification.

Benchmarking against regional peers such as Thailand and Malaysia, and global leaders like the U.S. and South Korea, highlights several opportunities for Indonesia to accelerate progress:

- Feedstock security through integration of refining and petrochemical

- Specialization in niche segments, such as oleochemicals, bio-based plastics, and

- Digital transformation of production using AI, IoT, and predictive

- Stronger ESG compliance, to meet export market standards and attract green

- Public-private collaboration in education, R&D, and technology

Indonesia’s flagship projects—Chandra Asri Perkasa II (CAP2) and Pertamina-Rosneft Tuban—symbolize the sector’s future. If executed with urgency and strategic coherence, these megaprojects can shift Indonesia’s position from being a net importer of basic petrochemicals to a competitive exporter of value-added and sustainable chemical products.

To support this transformation, key actions must include:

- Developing a national petrochemical development

- Fast-tracking infrastructure and permitting

- Creating fiscal incentives for ESG-aligned and export-oriented

- Building technical talent pipelines through vocational and university-industry

In conclusion, Indonesia’s petrochemical industry holds immense strategic potential. The window of opportunity lies in the next five years. The choices made by policymakers, investors, and industry leaders during this period will determine whether Indonesia becomes a passive consumer in the global chemical supply chain—or emerges as a resilient, integrated, and sustainable regional leader.

Sources

- Skylights Analytics Hub

- Badan Pusat Statistik (BPS). Statistik Industri Besar dan Sedang Indonesia 2019– 2023. https://www.bps.go.id

- Ministry of Industry (Kementerian Perindustrian). Peta Jalan Making Indonesia 4.0. https://kemenperin.go.id

- Indonesian Investment Coordinating Board (BKPM). FDI Statistics by Sector and Country. https://bkpm.go.id

- PT Pertamina (Persero). Annual Reports 2020–2023. https://pertamina.com

- PT Chandra Asri Petrochemical Investor Presentations 2021–2024. https://www.chandra-asri.com

- Lotte Chemical Titan Corporate Reports and Project Briefs. https://www.lottechem.co.id

- Indonesian Oleochemical Producers Association (APOLIN). http://apolin.org

- The Business Research Indonesia Petrochemicals Market 2022–2030 Forecast. https://www.thebusinessresearchcompany.com

- YCP Solidiance. Indonesia’s Chemical Industry Outlook 2023. https://ycpsolidiance.com

- McKinsey & Company. Making Indonesia’s Industry 4.0 Strategy a Reality. https://mckinsey.com

- IHS Markit. Southeast Asia Petrochemical Demand and Capacity Report. https://ihsmarkit.com

- ICIS Chemical Business. Polyolefins Trade Flows in ASEAN. https://icis.com

- International Energy Agency (IEA). Future of Petrochemicals: Global Scenarios and Regional Trends. https://iea.org

- Journal of Cleaner Production. Sustainability Challenges in Petrochemical Development in Emerging Markets. https://journals.elsevier.com/journal-of-cleaner-production

- ASEAN Centre for Energy. Feedstock and Energy Efficiency in Southeast Asian Petrochemicals. https://aseanenergy.org

- News articles on Chandra Asri–Shell JV, Lotte Chemical investment, and Tuban refinery updates. https://www.reuters.com

- Indonesia’s Refinery Expansion and Impact on Petrochemicals. https://www.bloomberg.com

- The Jakarta Indonesia’s Strategy to Cut Chemical Imports. https://www.thejakartapost.com

- Bisnis Industry project updates and government regulation coverage. https://bisnis.tempo.co

- UN Comtrade Database. Indonesia’s Import and Export Data for PE, PP, and Methanol. https://comtrade.un.org

- CEIC Indonesia Petrochemical Production and Trade Metrics. https://www.ceicdata.com

- Comparative Chemical Industry Indicators. https://www.aseanstats.org