Overview

Indonesia could become a prime destination for factory relocations from China, which seeks to diversify its supply chain while enhancing its existing manufacturing base. According to Jones Lang LaSalle (JLL), global supply chains are expected to increasingly target Southeast Asia and India for production over the next decade. This shift is driven by manufacturers seeking better locations and financing options amid supply chain volatility. JLL’s Asia Pacific Head of Manufacturing Strategy, Michael Ignatiadis, noted that many Chinese companies are already exploring relocation.

The Indonesian Government’s policy of allowing 100 percent foreign ownership in key sectors including logistics and e-commerce, continued efforts to meet the targeted 2050 Net Zero Emission, and various incentives to attract foreign investments is considered conducive.

Farazia Basarah, JLL Indonesia’s Country Head of Logistics and Industrial, added that higher demand for industrial land, coupled with rising wages and raw material costs in China, makes Indonesia a more cost-effective investment location. Factors such as skilled labor, infrastructure, environmental regulations, proximity to suppliers and customers, and political stability will be considered for the long-term success and sustainability of factories.

Highlight

COLD CHAIN LOGISTICS INDUSTRY

On the basis of geography, the demand for cold chain logistics in the Asia Pacific region is projected to grow the fastest and biggest compared to other regions. The market size in this region accounted for USD146.2 billion in 2023 and is estimated to reach around USD603.1 billion by 2033, with a high Compound Annual Growth Rate (CAGR) of 15.3% from 2024 to 2033. This growth is driven by increased government investments in cold chain logistics infrastructure development across various nations in the region, especially in Japan, Korea, and China. To invite players from Japan and Korea, a brief understanding on the two market shall be helpful.

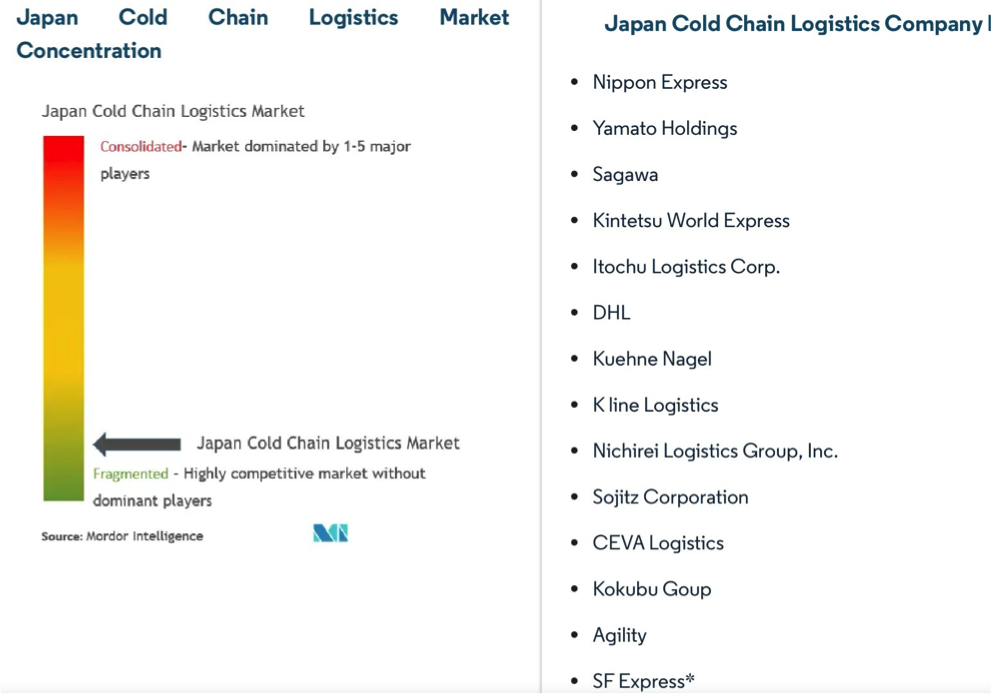

Japan is regarded as a mature market for cold chain logistics and is dominated by several players. Rapid advancements in biopharmaceuticals and regenerative medicine recently increased the demand for the cold pharmaceutical chain in Japan. This trend is expected to continue with the COVID-19 vaccines introduction and other treatments. Cold chain logistics in Japan was initially established for the fresh, refrigerated, and frozen food industries, focuses on the timely distribution of products within a constantly controlled temperature and humidity environment.

Most cold storage facilities in Japan are owned and operated by major cold chain corporations, with only a small number available for lease.

South Korea cold chain market is more dynamic, whereas competition is fragmented in nature with multiple domestic and international players, organized 3PLs, and unorganized small players operating in the market. There are several large and small companies operating in the cold chain industry providing both cold storage and cold transport facilities. Most of these companies operate

in major cities including Seoul, Incheon, and Busan due to the presence of various end-user industries in these areas and due to the presence of well-developed road connectivity and port infrastructure. Companies were observed to compete on the basis of parameters such as warehousing space, temperature range offered, location, the price per pallet, existing clientele, product range catered to, and value-added services.

Indonesia, with its vast archipelago, varying climatic conditions, and booming consumer market, presents unique challenges and opportunities for cold chain logistics. The increasing consumption of fresh produce, dairy, meat, and seafood, by the burgeoning middle class, as well as the demands of cold storage logistics for pharmaceutical companies has also significantly driven the Indonesia cold chain logistics market demand. According to the report released by Mckinsey & Well, the Indonesian cold chain logistics market reached a value of USD 4.72 billion in 2022, and projected to further grow at a CAGR of 10.1% between 2023 and 2028 to reach a value of USD 8.21 billion by 2028, and USD 12.59 billion by 2031.

Cold chain logistics especially for food is in high demand for Indonesia. Food losses in fishery products are still high on an average of 35%, making the value loss price of products that do not use the cold chain to reach 50%. For food losses in chicken meat products, an average of 30% (with a note that hot chicken meat (meat temperature between 10-20 degrees Celsius) can be sold in a maximum of 8 hours), with product value loss reaches 25%. For food losses in beef products, an average of 15% and the selling price of beef that does not use the cold chain, the value loss reaches 20%, according to Asosiasi Rantai Pendingin Indonesia (ARPI).

Based on desktop review, a survey conducted by Capricorn Indonesia Consult, a local researcher hailing from Indonesia, stated that at the end of 2018, there were around 69 major cold storage companies throughout Indonesia with a total capacity of 370,000 tons per year. Most of these 69 major companies came from Indonesia. This was due to the previous restriction on cold storage business for foreign investors, making cold storage foreign investment in Indonesia stagnant.

In the investment guideline regulation, Presidential Regulation No. 39/2014, the cold storage business sector is included in the trade sub-sector with restrictions on foreign capital ownership and location. For Sumatra, Java, and Bali, the maximum foreign ownership is 33%. As for Eastern Indonesia such as Kalimantan, Sulawesi, Nusa Tenggara, Maluku and Papua, the maximum is 67%. However as of 2016, the cold storage industry was open to 100% foreign ownership, stimulating more movements to invite Japanese players entering Indonesia market.

- In 2017 Kawanishi Warehouse Co. Ltd built a cold storage warehouse in MM2100 with an investment of approximately JPY 7 billion or IDR 274 billion; started operating in October 2017 with 5,500 pallet positions. In November 2022 they expanded the capacity of additional 18,000 pallets, with a current total capacity of 23,500 pallets.

- In 2019, the government of Indonesia has invited Japanese companies to invest in fish shipment and cold storage services to take advantage of Indonesia’s growing fish production, especially in the eastern part of the country. The Maritime Affairs and Fisheries Ministry held a meeting with 13 Japanese companies, including trading company Hanwa, temperature-controlled logistics company Nichirei Logistics Group and logistics transport provider PT Seino Indomobil Logistics Services.

- In 2022, Japan Mayekawa Mfg., Co., Ltd. signed an MoU with Anson Trading Indonesia to jointly work on cold chain infrastructure by selling cooling compressors including building high quality customized ice plants.

- In October 2023, Japanese Mitsui Co.Ltd made a cooperation agreement with Pangan Lestari, a local food distribution and cold-chain logistics company, taking advantage of its dry and cold-chain logistics.

Supply Chain Indonesia (SCI), said that the cold chain sector has enormous potential for growth, especially in relation to fresh commodities such as agriculture, livestock, and fisheries; which has a perishable rate of up to 40%. It is recorded that the current 12.5 million cubic meters of cold chain facilities provided in Indonesia are not sufficient to meet the demand for frozen food. Needs outside Java Island are still not covered even though the demand is not as much as in Java. Indonesia must have at least 40 million cubic meters of cold chain facilities to fulfil the demand of the frozen food industry. Due to shifting dietary preferences, expanding e-commerce, and expanding economies, the demand for processed foods such as frozen and chilled foods is expected to expand further in the future. On the other hand, the food distribution and logistics in Indonesia is still considered inefficient structure which prevents the exponential growth of the frozen and chilled product market.

The above companies have facilities all over Indonesia’s biggest cities, such as Jakarta, Surabaya, Medan, Makassar. With some known facilities of these companies located in Industrial Parks such as:

Enseval Putera Megatrading with 3 Distribution Center which are:

- Pulogadung Industrial Park, established on an area of more than 12,000m2 with a capacity of more than 16,000 pallets

- Greenland International Industrial Center (GIIC) of Kota Deltamas, established on an area of 11,104m2 with a capacity of more than 13,500 pallets

- Surabaya, located in the SIER and established on an area of 3,700m2, with a capacity of more than 5,000 pallets.

Other companies such as Diamond Cold Storage which is located in MM2100; MGM Bosco in Sidoarjo Rangkah Industrial Estate (SiRIE); Kiat Ananda Cold Storage in Jababeka Industrial Park; Dua Putera Perkasa in Cipendawa Industrial Park on a 1.8 Ha of land with a 20,000 ton of capacity; GAC Samudera in Lippo Cikarang Industrial Park.

Latest Update

- Chinese Firm SEG To Develop Petrochemical Industry in Indonesia

- Minister of Industry, Agus Gumiwang Kartasasmita, met with Sinopec Engineering Group (SEG), a subsidiary of China’s largest oil and gas company, Sinopec Group, on June 13. During the meeting, Agus extended an invitation to SEG to develop the petrochemical industry in Indonesia, mentioning SEG Projects in in Southeast Asia, such as Vietnam and

- As of 2023, SEG managed 1,043 projects worldwide, predominantly in the petrochemical

- According to Minister Agus, the collaboration between Indonesia and China in the petrochemical industry will benefit both countries. Indonesia’s current petrochemical production capacity exceeds 14 million tons per year, yet domestic demand is not fully

- SEG President and Executive Director, Zhang Xinming, welcomed the Indonesian government’s invitation to develop the petrochemical industry in Indonesia. He confirmed his plans to visit Indonesia next month to further discuss the cooperation.

- In 2023, Indonesia imported a total of 5 million tons of petrochemical products, valued at USD 9.5 billion, a significant increase from 7.75 million tons in 2022.

- BASF & Eramet Withdraws Investment In Teluk Weda Industrial Park

- Germany’s leading chemical company BASF and French Eramet has canceled its investment plan for nickel-cobalt refining at the Sonic Bay project in North Maluku.

- The USD 2.6 billion project is the construction of a nickel refining plant with High Pressure Acid Leach (HPAL) technology at the Indonesia Weda Bay Industrial Park (IWIP) that produces Mixed Hydroxide Precipitates (MHP). The decision was obtained after conducting various evaluations, including significant changes in nickel market conditions with potential over supply of EV battery material and alternative for non-nickel battery

- Minister of Investment / BKPM Bahlil Lahadalia denied the project cancellation, arguing that currently the electric car market in Europe is experiencing a decline, as is the case in America which applies a 100% import tax on electric cars, especially tax on cars imported from China. “Because the market is going down, they are putting the brakes on. Eramet and BASF are not cancelling, they are postponing it temporarily until global market conditions becoming more conducive”, said Bahlil, adding that the Indonesian government would respond to global electric car competition, without giving further details.

- Anhui Guangxin Agrochemical’s Plan in Developing 1,000 Ha of Land in East Kalimantan

- Acting Governor of East Kalimantan Akmal Malik states Chinese agricultural company Anhui Guangxin Agrochemical Co Ltd will invest USD 800 million in the region. The investment will be divided into two phases, with initial investment of USD 300 million and further development of USD 500 million, for agricultural chemicals such as pesticides, herbicides, glyphosate and others.

- Guo Xuejun, the Vice-President of Anhui Guangxin Agrochemical, has reportedly surveyed several locations in Indonesia for the investment, before finally deciding to invest in East Kalimantan. The sister-province cooperation between East Kalimantan Province and Anhui Province provides an opportunity to find land for the company’s new business location.

- The company needs around 1,000 Ha of land to build and develop an integrated Industrial Park with a complete supply chain and a strategic position at the waterfront.

- New China’s Textile Factory Investment Plan in Java

- Amids the country’s uncertainty on textile industry, Coordinating Minister for Maritime Affairs and Investment Luhut Binsar Pandjaitan said there is one Chinese garment company that will soon invest in a textile factory in Indonesia, as soon as their land issue is resolved.

- Luhut proposed that the textile industry to invest in Kertajati, Majalengka Regency, West Java (Minimum Regional Wage (UMR) of IDR 2.257 million). He communicated with Minister of Agrarian and Spatial Planning/Head of the National Land Agency (ATR/BPN) Agus Harimurti Yudhoyono to issue land status to the Chinese industry within a week starting from June 20, 2024. Construction is forecasted to start next month. Once completed, the Chinese textile industry will create jobs for up to 108,000 workers, who will also receive housing facilities in dormitories

- In addition, the industry also has a desire to build in Sukoharjo, Central Java Province, which has an UMR of IDR 2.215 million.

- The government is giving a ‘red carpet’ to the garment industry from China because of its export-oriented nature; its export value has the potential to reach USD 18 Its investment value however was not yet disclosed.

- For the record, Luhut had also mentioned that his Deputy for Investment and Mining Coordination Septian Hario Seto, received an investment commitment after visiting a textile company in Ningbo, China, which is integrated with well-known companies such as Nike, Adidas, Puma and Uniqlo.

- President Jokowi Nominates Setangga SEZ Through Government Regulation No.26 of 2024

- President Joko Widodo has established the Setangga SEZ through Government Regulation Number 26 of 2024 on June 13, The 668.3 Ha SEZ is located in Tanah Bumbu district, South Kalimantan.

- With an investment realization target of IDR 67.69 trillion (USD 4.2 billion) and job creation goals of almost 79,000 workers, Setangga SEZ will focus in the smelter industry, biodiesel & refinery, fractionation industry which is expected to contribute to increasing national palm cooking oil production, iron industry, rubber industry, and packaging industry, such as sacks, bottles, pouches, jerry cans to meet the packaging needs of industries in the Setangga SEZ.

- Not only focusing on industrial activities, the SEZ will develop R&D center with a mission to drive innovation, sustainability and growth in the industrial sector while offering one-stop services for companies seeking research, development and training

- With the establishment of the Setangga SEZ, there are now officially 22 SEZs spread across Indonesia, and have recorded an investment of IDR 187.5 trillion with the creation of a workforce of 126,506 people until March 2024.

- Kings’ College London in KEK Singhasari

- British university, King’s College London (KCL) will open a campus in the Singhasari Special Economic Zone (SEZ), Malang, East Java.

- The government reportedly has handed over the Establishment Permit of KCL Branch Campus on June 20,2024.

- The arrival of KCL, which is ranked 6th in UK, and ranked 38th worldwide as of 2024, provides a significant milestone in Indonesia’s education, especially around East Java and Malang.

- For the implementation of education, KCL will take a full role in the implementation of master’s degree program education. The initial phase will focus on the digital economy through the MSc Digital Economies Program in September 2024, and also giving opportunity for Indonesian students to study in King’s College London through Place Based Trans-National Education.

- Singhasari SEZ, situated in a 120 Ha of land, will take a full role in providing infrastructure, facilities, and learning facilities for On that occasion, Minister Airlangga also gave directions to KCL to accommodate at least 1,500 students, to develop the human resources in Indonesia.

- Discontinuation of 6 Textile Factory in West & Central Java In 2024

- Massive layoffs and discontinuation of factories in the textile industry has been increasing in West & Central Java. Based on desktop review, there are 6 textile factories that were closed since the beginning of 2024

- PT Dupantex, Central Java: 700 layoffs

- PT Alenatex, West Java: 700 layoffs

- PT Kusumahadi Santosa, Central Java: 500 layoffs

- PT Kusumaputra Santosa, Central Java: 400 layoffs

- PT Pamor Spinning Mills, Central Java: 700 layoffs

- PT Sai Apparel, Central Java: 8,000

- Based on data compiled by the Central Java Statistics Agency (BPS), exports of goods in Central Java in April 2024 decreased by 52% compared to the previous month. This indirectly indicates a decrease in demand for textile products in Central Java, as Central Java’s main commodity is textile and textile products.

- Potential layoffs may increase in the coming months There are several factors contributing to this, such as lower demands from the market; illegal imports of textile and textile products’ raw material, resulting in unsold local goods; and the weakening of the Rupiah against the US dollar, which has heavily impacted textile

- With an exchange rate of IDR 16,400/USD, the medium-sized textile industry categorized around 7,000 workers are expected to only be able to survive for another three months, while the large-scale textile industry with more than 10,000 workers will still be able to survive due to the large cash flow and export-oriented business.

- Massive layoffs and discontinuation of factories in the textile industry has been increasing in West & Central Java. Based on desktop review, there are 6 textile factories that were closed since the beginning of 2024

- Expansion and Investment Strategy of Harita Nickel

- PT Trimegah Bangun Persada or known as Harita Nickel (NCKL), one of Indonesia’s biggest nickel player is planning on their strategic investment to increase their nickel market share in Indonesia, by acquiring nickel mines across the country.

- This is in response to the question that arises in using the Rights Issue funds of a total 18.92 billion shares, around IDR 19.39 trillion (as of June 23,2024 1 share of NCKL is about IDR 1,025). Rumor has it that there are three big companies ready to execute the Rights Issue, namely Glencore, a massive Swiss multinational company in trading and mining, Itochu, and Astra International subsidiary United Tractors (UNTR).

- While there are no specific details on the value of the investment, the company will consider the location, size, reserves and resources of the mine in the decision-making process, forecasting an increased demand from the EV battery industry and stainless steel production in 2025.

- Industrial Park in North Kalimantan Targeted to be Finish in 4 Years

- Luhut Binsar Pandjaitan revealed that the Industrial Park in North Kalimantan could be completed in From the meeting with the NDRC (National Development and Reform Commission) in China, he hopes that in the next month groundbreaking and construction can be done, and within four years the project will be completed.

- The Minister requested that the NDRC can support the implementation of the Industrial Park in North The Industrial Park project was also highlighted by President Joko Widodo and Xi Jinping back in 2023, regarding company’s joint call in the form of collaborative proposals in the fields of petrochemicals and hydropower in North Kalimantan.

- Kawasan Industri Hijau or KIHI, covering an area of about 13,000 Ha, an ultimate development of about 30,000 Ha in Bulungan Regency, North Kalimantan is estimated rake in an investment value of up to USD 132 billion. The project is only 185 km from New Capital City Nusantara (IKN).

- Several projects planned to be built, includes:

- A petrochemical plant with a capacity of 4×16 million tons per year, which will be the largest in Indonesia;

- An alumina processing and refining facility with a capacity of three million tons;

- An iron and steel plant with a capacity of five million tons per year;

- An electric vehicle battery factory;

- A renewable energy-based power plant with a capacity of 265 GWh;

- A polycrystalline silicon factory with a capacity of 4 million tons per year.

- East Java Has Gas Supply Surplus, Potential for West Java Supply

- Kurnia Chairi, Deputy for Finance & Monetization at the upstream oil and gas authority SKK Migas, announced that East Java currently has a gas supply surplus of 90 MMSCFD without Meanwhile, in West Java, a gas deficit of 144 MMSCFD was recorded in 2024.

- SKK Migas sees the potential to channel gas supply from East Java to West Java through the construction of the Cirebon-Semarang (Cisem) gas pipeline, which will link Cirebon in West Java and Semarang in Central Java. The upstream oil and gas industry in West Java currently cannot meet the gas demand in the region, necessitating additional supply from Sumatra via the WNTS (West Natuna Transportation System) pipeline and gas supply from East and Central Java.

- The existing gas pipeline from East Java and Central Java is already connected from Kangean-Porong/Surabaya (East Java) to Semarang-Batang (Central Java/Cisem Phase 1 pipleine). The construction of the Cisem 2 gas pipeline network (linking Batang in Central Java) and Kandang Haur Timur in West Java) will soon begin.

- To enhance the benefits of the Cisem Phase 1 and Phase 2 pipelines, in addition to industrial gas, household gas will also be developed in the cities around the Cisem network, to cater demand from households, hotels, and more, to reduce LPG.

- The gas price from the Cisem network issaid to be very affordable because its construction is funded by the state budget. The toll fee for Cisem 1 is USD0.4 per MMBTU, the gas price for end users is less than USD6 per Currently, Cisem 1 has successfully delivered 2 MMSCFD of gas to the industries in Batang. In 2025, gas absorption by the Batang industries from the Cisem 1 pipeline is expected to increase to 20 MMSCFD.

- The operator of the Cisem 1 gas pipeline is a consortium of the Public Service Agency (BLU) Lemigas and Pertagas. As for Cisem 2, whose construction will begin in July 2024, the toll fee will be the same as Cisem 1, potentially engaged the same operator.

- Minister of Industry Requests JETRO’s Collaboration

- Indonesia and Japan continue to strengthen cooperation in the industrial sector by holding a meeting between Industry Minister Agus Gumiwang Kartasasmita and Japanese Minister of Economy, Trade and Industry (METI), Ken Saito, in Tokyo on June 21, 2024.

- The meeting highlighted four main issues that the two countries focus on:

- Energy transition;

- Protocol to Amend the Indonesia-Japan Economic Partnership Agreement (IJEPA), hoping for IJEPA’s implementation and New MIDEC (Manufacturing Industry Development Center) activities;

- Cooperation in the automotive sector to build EV ecosystem in Indonesia;

- Exchange for industrial human resources between Indonesia and Japan, to improve the competence of Indonesian human resources through training in

- To increase collaboration between Japan and Indonesia, Agus Gumiwang requests JETRO to conduct more research analysis to accelerate the investment of Japanese companies in Indonesia, which has a tremendous effect on Japanese’s sentiment towards Indonesia; given the quantity of Japanese investment in the country is currently below Thailand.

- Chairman Jetro Ishiguro Norihiko states that JETRO can play a role in bringing together Indonesian companies with Japanese companies to establish cooperation in the desired field.

-end-

REFERENCES

- Skylight Analytics Hub

- https://www.medcom.id/properti/news-properti/Rb1YAYAb-indonesia-jadi-kawasan-pusat- manufaktur

- https://www.precedenceresearch.com/cold-chain-logistics-market

- https://www.mordorintelligence.com/industry-reports/japan-cold-chain-logistics- market/companies

- https://www.kenresearch.com/blog/2020/05/south-korea-cold-chain-industry-growth-ken- research/

- https://arpionline.org/cold-chain-logistics-market-in-the-asia-pacific-pacific-2024-2033/ https://arpionline.org/cold-chain-data/

- https://mckinseywell.com/products/indonesia-cold-chain-logistics-market-report-and-forecast- 2023-

- 2028?pr_prod_strat=e5_desc&pr_rec_id=154cfe2e2&pr_rec_pid=9004561563954&pr_ref_pid=9 004587811122&pr_seq=uniform

- https://www.kenresearch.com/blog/2023/01/indonesia-cold-storage-players/

- https://indonesiabusinesspost.com/risks-opportunities/fresh-factory-secures-investment-for- accelerated-growth-in-cold-chain-fulfillment/

- https://www.hukumonline.com/berita/a/bisnis-icold-storage-i-diusulkan-terbuka-sepenuhnya- untuk-asing-lt565c14e7c552d

- https://www.hukumonline.com/berita/a/dni-berubah–asing-makin-leluasa-berinvestasi- lt56c083bc0cc8a/

- https://www.join- future.co.jp/english/investments/achievement/index.php?c=investment_en_view&pk=16031834 60

- https://www.thejakartapost.com/news/2019/02/14/indonesia-invites-japanese-firms-to-invest- in-fish-shipment.html

- https://pressrelease.kontan.co.id/news/anson-company-bekerjasama-dengan-mayekawa-untuk- kelangsungan-bisnis-rantai-pendingin

- https://www.mitsui.com/jp/en/topics/2023/1247619_13949.html

- https://www.enseval.com/content/pusat-distribusi/4/15

- https://www.petromindo.com/news/article/industry-minister-invites-chinese-firm-seg-to- develop-petrochemical-industry-in-indonesia

- https://katadata.co.id/ekonomi-hijau/investasi-hijau/667cbcc3a306c/ini-alasan-basf-keluar-dari- proyek-bahan-baku-baterai-di-indonesia

- https://www.bloombergtechnoz.com/detail-news/41964/imbas-isu-basf-eramet-minat-investasi- baterai-ev-di-ri-bisa-drop

- https://www.narasi.co/tertarik-berinvestasi-di-kaltim-pengusaha-tiongkok-butuh-lahan-1-000- hektare/

- https://ekonomi.bisnis.com/read/20240605/257/1771233/posisi-china-terhimpit-bersiap-banyak- relokasi-pabrik-ke-indonesia

- https://www.bloombergtechnoz.com/detail-news/41364/luhut-china-akan-investasi-tekstil- lahan-disiapkan-di-kertajati/2

- https://investor.id/market/364498/begini-strategi-ekspansi-dan-investasi-harita-nickel-nckl/2

- https://kek.go.id/media/press/dorong-pertumbuhan-ekonomi-inklusif-presiden-jokowi-resmi- tetapkan-kek-setangga

- https://www.kompas.com/properti/read/2024/06/21/093000021/kantongi-izin-pendirian- kampus-asal-inggris-akan-buka-cabang-di-kek?lgn_method=google&google_btn=onetap

- https://www.cnbcindonesia.com/news/20240624064359-4-548595/dolar-tembus-rp-16400- napas-industri-tekstil-tinggal-3-bulan

- https://www.cnbcindonesia.com/news/20240618144823-4-547251/6-pabrik-tekstil-ri-tutup-phk- 11000-an-pekerja-ini-data-lengkapnya

- https://www.antaranews.com/berita/4162263/menperin-optimalkan-kerja-sama-indonesia- jepang-melalui-riset-jetro

- https://www.viva.co.id/otomotif/1725848-industri-otomotif-indonesia-jadi-sorotan- jepang?page=1

- https://www.petromindo.com/news/article/e-java-has-gas-supply-surplus-potential-for-w-java- supply