Overview

The development of industrial parks stands at the intersection of economic progress, innovation, and sustainable urban planning. Industrial Park Association (Himpunan Kawasan Industri – HKI) reported that land sales in industrial parks reached 203.9 Ha in Q3/2023, compared to 139.7 Ha of Q3/2022, a 49.5% increase. HKI noted that industrial parks along the Jakarta-Cikampek (Japek) toll road continue to demonstrate robust performance with 59.65 Ha sales recorded from January to September 2023, reinstating their positionings as the favoured locations within the industrial landscape despite some relocations of the labor-intensive factories to Central Java. HKI Chairman, Sanny Iskandar said that the absorption of industrial land in 2024 will continue to grow positively in line with the growth of the automotive, data centre and industrial sectors.

This growth aligns with the national manufacturing industry’s positive trajectory, as indicated by the Indonesian Manufacturing Purchasing Managers’ Index (PMI) reaching 52.2 in December 2023, up by 0.5 points compared to November which stood at 51.7; sustaining expansion for 28 consecutive months. Additionally, the Industrial Confidence Index (IKI) in December 2023, reported by the Ministry of Industry, achieved 51.32 points, reflecting consistent expansion for over 13 months since November 2022. Looking ahead, the Ministry of Industry aims for a manufacturing processing industry growth target of 5.80 percent in 2024, surpassing the 4.81 percent target set for 2023.

What’s New in HKI

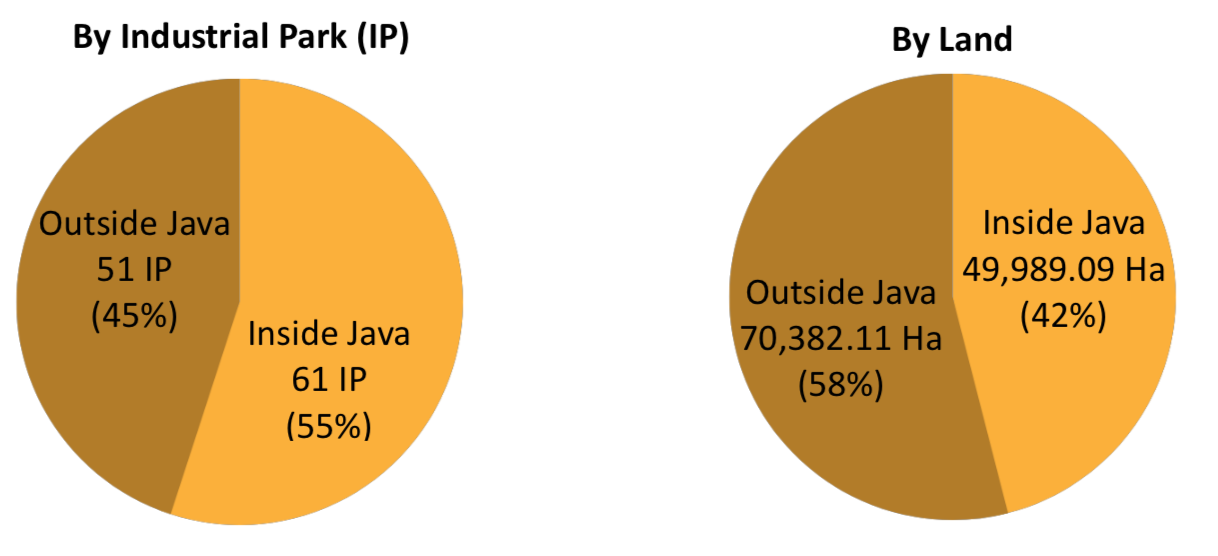

As per December 2023, there are 112 industrial parks registered in HKI with a total land of 120,371.2 Ha throughout Indonesia.

HKI data shows:

8 Industrial Parks currently in operation for East Java area.

| 1. KIG (Kawasan Industri Gresik) | 140 Ha |

| 2. Ngoro Industrial Park | 500 Ha |

| 3. SIER & PIER | 890 Ha |

| 4. JIIPE | 1,761 Ha |

| 5. Maspion Industrial Estate | 1,143 Ha |

| 6. Pergudangan dan Industri Safe n Lock | 372 Ha |

| 7. Wira Jatim Industrial Estate | 122 Ha |

| 8. Sidoarjo Rangkah Industrial Estate (SIRIE) | 105 Ha |

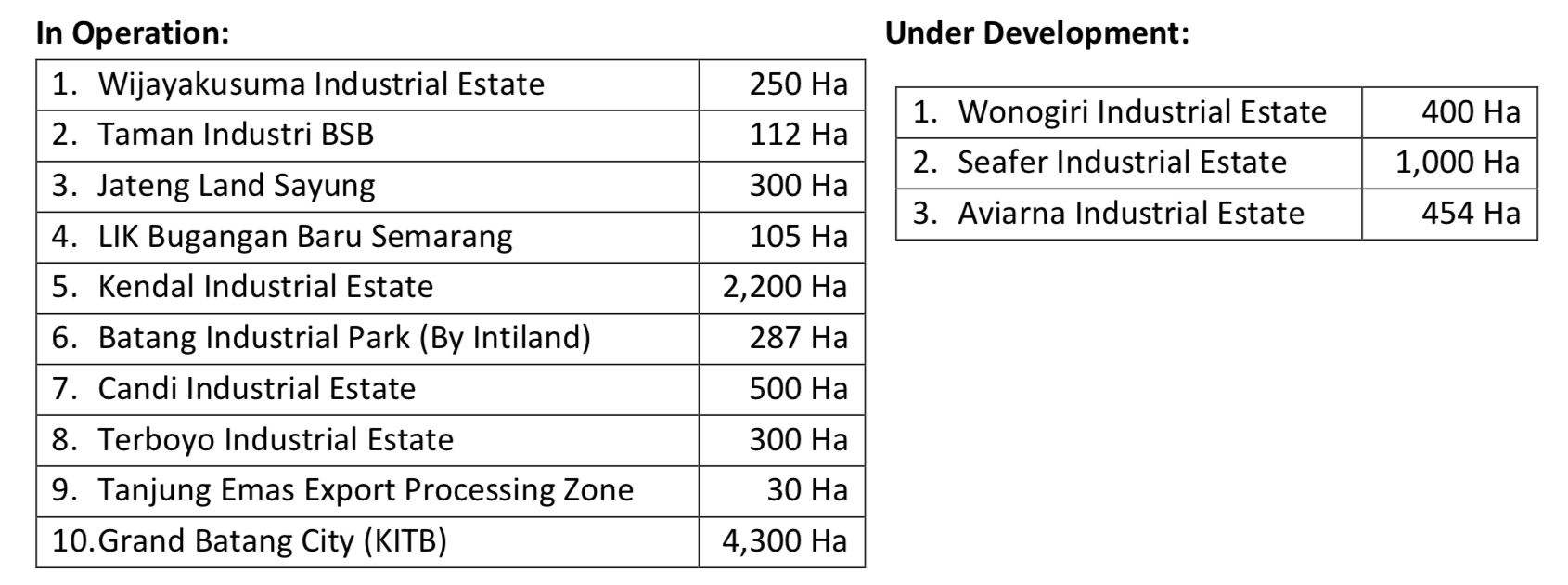

Central Java has more industrial parks, some are new development.

During 2023, 3 new members were registered in HKI:

1. SPIKE – Sinar Primera Industrial Karawang Eco-City

SPIKE sits on 1,500 Ha area that connects Jakarta & Bandung; its development masterplan focuses on variety of industries. The Eco City aims to invite industrial players from various sectors, including automotive & electric vehicle, logistics & supply chain, consumer goods & pharmaceuticals, electronic industry & data center.

2. IPIP – Indonesia Pomalaa Industry Park

Situated in Kolaka, it is a joint venture with Huayou Cobalt Co. Ltd, a Chinese investment. Huayou will build a High-Pressure Acid Leaching nickel smelter in cooperation with Vale Indonesia and Ford Motor in the industrial park. Aiming to create a complete lithium battery industry chain, the project is still in early stage of development. Land acquisition of the ultimate 11,808 Ha is still progressing. The project has received a National Strategic Project status in 2022.

3. Wiraraja Indonesia Industrial Park

Located in Kabil area, Batam City, Riau Islands, the 112 Ha industrial park secured 6 investments in the downstream of solar panel industry, as committed in the Germany Hannover Messe 2023 investment forum. The project was inaugurated by Coordinating Minister Airlangga Hartanto, on June 5, 2023.

*To join HKI, a new industrial park developer must first obtain Industrial Park Business License (IUKI). HKI facilitates its members with networking opportunities and latest updates on relevant regulations, in additions to discussions with the policy makers for common and specific issues.

Latest Update

East Java

- The upstream oil and gas authority SKK Migas is actively exploring solutions to manage the surplus gas supply from East Java’s oil and gas fields. Among the proposed solutions are the construction of a mini LNG plant, conversion to CNG, LPG, in addition to invite investors to build methanol plants to utilize the excess gas. The surplus issue is expected to be significantly alleviated upon the completion of the Cirebon-Semarang gas transmission pipeline (Cisem) Phase II project. Data from SKK Migas as of October 2023 indicates that gas lifting in East Java stands at an average of 747 MMscfd, while the downstream industry’s absorption capacity, including entities like PT PLN, PT PGN and PT Petrokimia Gresik, is around 565 MMscfd. Projections suggest that various gas work areas in East Java will peak in production between 2024 and 2026, leading to an estimated surplus of 200 The excess supply is identified to come from several prospective fields, including Jimbaran Tiung Biru (around 192 MMscfd), HCML Sampang (around 100 MMscfd), Medco Paus Biru (around 30 MMscfd), PCK2L Bukit Panjang Sampang (around 50 MMscfd), Energi Mineral Langgeng Sumenep (around 30 MMscfd), and MGA Utama Energi Sumenep (around 40 MMscfd).

- IDX-listed compressed natural gas (CNG) trader PT Citra Nusantara Gemilang Tbk. (IDX: CGAS) plans to develop an LNG station and three new mother stations as part of expansion The LNG station will be constructed this year in Tambun, West Java Province. The new mother stations, each to be located in Grobogan (Central Java) with a plant capacity of 1.5 MMscfd; Majalengka (West Java) with a capacity of 1 MMscfd; and in Gresik (East Java) with a capacity of 2 MMscfd. At present, CGAS has three main stations located in Cikarang (Bekasi, West Java) with a capacity of 5 million cubic meters per month; Sidoarjo (East Java) with a capacity of 2 million cubic meters per month, and Palembang (South Sumatra) with a capacity of 1.5 million cubic meters per month.

- PT AKR Corporindo Tbk. has signed an agreement on December 4, 2023 with BP Gas & Power Investments Limited to develop LNG in JIIPE. The project aims to provide a reliable gas supply for tenants in the JIIPE area, targeting operational in 2027.

- In 2023, PT SIER officially collaborated with the Ngawi Regency Government to develop an Industrial Park in Ngawi, in Widodaren and Karanganyar sub-district, covering an area of 1,200 Ha. SIER is considered successful in developing its industrial area in Pasuruan (PIER). The new industrial park in Ngawi will be developed as an environmentally based estate with integrated waste management, water treatment and green initiatives. SIER targets 4 years to prepare the infra and facilities, while project socialization has been carried out through several events in the country and overseas.

- The Nganjuk Regency Government plans to clear 1,200 hectares of forest to build the Nganjuk Industrial Park (KING) so that farmers’ agricultural land will not be converted into manufacturing KING is a National Strategic Project, will be developed in stages, phase 1 covers 646 Ha, phase 2 of 341 Ha, and phase 3 of 237 Ha. No details on the property management.

Central Java

- PT Kawasan Industri Terpadu Batang (KITB), announced investments totaling IDR 3 trillion for its Phase 2 expansion, whereas Wanxinda Group has invested IDR 1 trillion leasing 98 hectares of the 350-hectare area in the Phase 2 expansion. The ground- breaking ceremony by Wanxinda Group on December 10, 2023, marked the initiation of the project development. Wanxinda will build Standard Factory Buildings and warehousing facilities, targeting industrial users, not only from Mainland China.

- State-controlled gas distribution firm PT PGN is currently finalizing gas sales contracts with two companies located at the KITB – PT KCC Glass Indonesia and PT Rumah Keramik Indonesia, with their combined gas requirements totaling 12 billion British thermal units per day (BBtud).

- The Industry Ministry’s Industrial Services Standardization and Policy Agency (BSKJI) has created the “Udaraku” application that is part of the development of the Adaptive Monitoring System carried out by the The Semarang Center for Standardization and Industrial Pollution Prevention Services (BBSPJPPI) developed this application to improve air quality monitoring in the industrial sector, showing real-time air quality data information with the Air Pollution Standard Index (ISPU) according to P.14/MENLHK/SETJEN/KUM.1/7/2020.

Benchmark

Greenland International Industrial Centre (GIIC) – Cikarang, West Java

Managed by PT Puradelta Lestari Tbk, the project is fully supported by the Sojitz Corporation Japan, in cooperation with SinarMas Land. It covers an expansive 1,812 Ha land and hosting 140 tenants. GIIC is selected to be one of the industrial parks in the Global Eco-Industrial Parks Programme (GEIPP) Phase II, commencing on January 2024, aiming a transformation to an Eco-Industrial Park. The GEIPP Phase I is still ongoing with various obstacles, mainly in data collection, new facility investment, and new system adoption as the transformation requires collaboration with the stakeholders, including tenants and the principals, government and vendors.

Benchmarking points:

- Bulk (Cluster) Marketing – Indonesia-China Integrated Industrial Zone (Kawasan Industri Terpadu Indonesia-China or KITIC), occupies 200 Ha in GIIC.

- Commitment to Environmentally Friendly Infrastructure & International Standards – GIIC was awarded as the World Silver Winner in the Industry category at the FIABCI World Prix d’Excellence Awards 2022 in France and the Best Industrial Estate Development at the Property Guru Asia Property Awards 2022 in Thailand.

- Adoption of Smart System – energy-efficient electrical devices, LED lights, hybrid Public Street Lighting, solar panels, and electric cars for operational vehicles.

Flash News

The government of Indonesia is planning for the establishment of a Special Economic Zone (SEZ) to enhance the production and competitiveness of Indonesian wood and furniture products, aiming to address the current gap compared to Vietnam. As of December 2023, Vietnam’s export reached USD 15.7 billion, while Indonesia lagged at USD 2 billion. Recognizing the technological challenge faced by national timber entrepreneurs on the global stage, it is acknowledged that Indonesia processes wood with relatively outdated technology. A list of 30 potential locations has been proposed for Timber Industry SEZ, no details provided.

Potential Challenges

- Industrial Gas

General Chair of the Natural Gas Users Industry Forum (FIPGB), Yustinus Gunawan, stated that gas distribution in East Java was still less than the specified allocation amount, an irony in the midst of East Java oversupply. The Ministry of Industry last year proposed a flat gas pricing for all industrial activities, aiming for more competitive Indonesian products in the global market. However, the government of Indonesia has not announced any figures to satisfy the request. There were even plans to increase gas prices in the second half of 2023, including special pricing of USD 6.00/MMBTU

given to 7 industrial sectors. It is suspected that gas suppliers object reductions to gas pricing due to the high cost of gas transportation in Indonesia, low and scattered gas demand. The current average price for industrial gas is USD 9.32 / MMBTU. In Malaysia, upstream gas is priced at USD 4.50~6.00 / MMBTU, while price at user is USD 7.50~8.20/MMBTU.

- New Regulation

The Ministry of Industry is planning to revise the Law No. 3 of 2014 on Industrial Affairs (UU Perindustrian), targeting improvements in industrial practices – adopting new technologies and enhancing Environmental, Social, and Governance (ESG) initiatives to create manufacturing sustainability and more conducive business climate in the country. Digital-based manufacturing, carbon neutrality in the manufacturing sector, the efficiency of energy, logistics, and skilled workers will be covered in the revised version. Industrial Park developers will be the immediate targeted audience to comply.

-end-

REFERENCES

- Skylight Analytics Hub

- https://www.medcom.id/ekonomi/bisnis/Dkq07gVb-pmi-manufaktur-indonesia-capai-52-2-di- desember-2023

- https://www.idntimes.com/business/economy/trio-hamdani/pertumbuhan-industri-manufaktur- terganjal-harga-gas-dan-impor?page=all

- https://www.detik.com/properti/berita/d-7121087/giic-kota-deltamas-kawasan-industri- percontohan-nasional-bertaraf-global

- https://deltamas.id/greenland-international-industrial-center/ https://www.cnbcindonesia.com/news/20230605202034-4-443183/airlangga-resmikan-wiraraja- industrial-park-investasi-rp12-t

- https://www.liputan6.com/bisnis/read/5319902/hasil-hannover-messe-2023-wiraraja-industrial- park-batam-sudah-diisi-6-perusahaan-dengan-total-investasi-rp-12-triliun?page=2 https://huayouipip.com/id/culture-main/culture/ https://ekonomi.republika.co.id/berita/s6fsk7457/pemerintah-akan-bangun-kawasan-ekonomi- khusus-industri-kayu#google_vignette

- https://sinarprimera.com/id/portfolio/sinar-primera-kawasan-industri-karawang-eco-city/ https://www.cnbcindonesia.com/news/20220609141049-8-345698/minat-pma-meningkat-hki- kembangkan-kawasan-industri-hijau

- https://huayouindonesia.com/id/our-business https://ekonomi.bisnis.com/read/20231207/257/1721655/penjualan-lahan-kawasan-industri- kuartal-iii2023-tembus-2039-hektare https://market.bisnis.com/read/20231206/192/1721577/akra-gandeng-bp-kembangkan-proyek- lng-di-kek-jiipe

- https://www.beritasatu.com/ekonomi/2786573/kawasan-industri-terpadu-batang-siap-diguyur- investasi-senilai-rp-27-triliun

- http://bskji.kemenperin.go.id/2024/01/16/akselerasi-industri-hijau-kemenperin-ciptakan- aplikasi-pengawasan-kualitas-udara/ https://market.bisnis.com/read/20240108/192/1730299/setelah-ipo-citra-nusantara-gemilang- cgas-bangun-3-stasiun-gas-baru

- https://www.petromindo.com/news/article/skk-migas-evaluates-mini-lng-plant-option-amid-e- java-gas-surplus

- https://www.antaranews.com/berita/3897879/kemenperin-siapkan-dokumen-revisi-uu- perindustrian-genjot-manufaktur

- https://sier.id/blog/content/kenalkan-lahan-baru-di-ngawi-sier-ajak-investor-hong-kong- investasi-di-kawasan-industri-1684288182 https://dpmptsp.ngawikab.go.id/portal_web/index.php/portal/beritaView/172 https://surabayapagi.com/read/pemkab-nganjuk-ajukan-hutan-untuk-pendirian-kawasan-industri

Disclaimer

The content provided within this biweekly update (“Report”) is proprietary to Skylight and protected under copyright and intellectual property laws. This Report may be shared with relevant parties strictly for informational purposes, provided it remains unaltered and is attributed to Skylight. Unauthorized reproduction, distribution, or use of this Report beyond this condition requires prior written consent. The information and insights shared are intended for general informational purposes only and do not constitute professional advice. Please note that the data, projections, and insights presented herein are subject to updates and changes over time, and may not reflect the latest industry developments. Skylight and its contributors disclaim all liability for decisions or actions taken based on this Report, and no guarantees are made regarding the accuracy, completeness, or outcomes derived from the content. Accessing and using this Report does not create any contractual, professional, or advisory relationship with Skylight. By reviewing this Report, you acknowledge and agree to these terms.

© 2025 Skylight Strategic Indonesia. All rights reserved.