Overview

With more nations working to fight climate change, Indonesia plays a key role in global decarbonization as the world’s 4th most populated country. Management consultancy, Kearney, states that Indonesia is in a unique position to become a global leader in the green transition. In a report just released entitled “Indonesia’s Path to Net Zero 2060”, the consulting firm outlines Indonesia’s potential to become a global model for sustainable development.

Indonesia stands at a critical juncture, grappling with challenges in two key areas to transition: First, Economy. Despite achieving 5.05% GDP growth in 2023, the figure remains below prepandemic levels of 6.3% (2016–2019); and the government’s newly ambitious 8% growth target presents a challenge of its own. Second, Environment. Indonesia faces frequent natural disasters, including floods, droughts, and tsunamis. Jakarta, as the nation’s capital and economic hub, is among the world’s fastest-sinking cities, with nearly half its area now below sea level. Addressing these risks requires decisive action, particularly in reducing GHG emissions to mitigate climate impact.

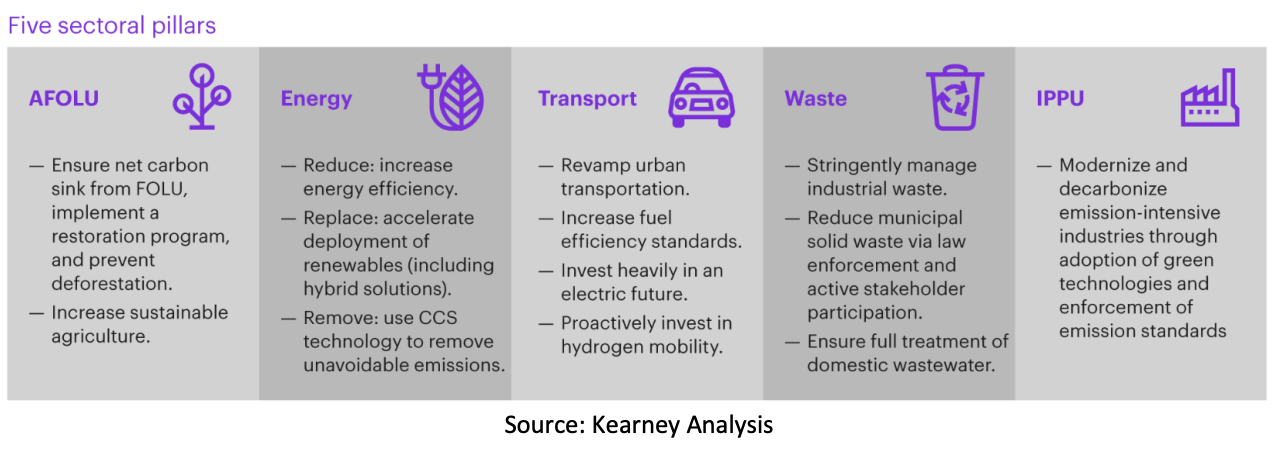

Kearney’s research identified five main sectors that contribute to Indonesia’s GHG emissions: 55% from Agriculture, Forestry, and Land Use (AFOLU), 26% from Energy, 8% from Transportation, 8% from Waste, and 3% from Industries Process and Production Use (IPPU). Each of the five sectors contributing to Indonesia’s GHG emissions comes with a unique set of challenges, implying that a targeted set of actions will be required for each. In Kearneys’ view, these sector- specific actions, referred to as five sectoral pillars, will need to be supported by five cross-sector enablers. The report presents a practical framework, illustrated in the graphic below, that outlines key actions from each sectors required to help Indonesia achieve its 2060 net-zero ambition:

In addition to the targeted actions outlined above, Indonesia’s integration of Environmental, Social, and Governance (ESG) principles will play a pivotal role in attracting investments in the coming years. ESG-related investments and assets are projected to grow from US$35 trillion in 2021 to US$50 trillion by 2025. As investors increasingly prioritize ESG metrics, nations and industries that fail to meet these standards will face greater challenges in securing funding.

The practice of ESG is continuously gaining traction in Indonesia as businesses and organisations recognise its importance in sustainable development. This year, several notable ESG projects have emerged, reflecting Indonesia’s commitment to integrating ESG principles into various sectors. For instance, the launch of Orange Bonds in July 2024 by the Ministry of National Development Planning/National Development Planning Agency (Bappenas) together with the Ministry of Finance and Impact Investment Exchange. The Orange Bonds are issued as a support to the Orange Movement mission to offer an innovative financing solution that promotes social and economic inclusion by providing greater financial access to women and marginalised groups (Bappenas, 2024).

Another significant milestone in Indonesia is the issuance of SEC-registered dual currency bonds, which include a USD1.8 billion global bond and an EUR750 million Sustainable Development Goals (SDG) global bond (Ministry of Finance, 2024). This marks the largest global USD and EUR bond by Indonesia, demonstrating Indonesia’s commitment to integrate ESG principles into its financing strategy. Indonesia will use the bond issuance to fund projects under Indonesia’s SDGs Government Securities Framework, which aligns with the International Capital Market Association (ICMA) principles.

ESG Integration in the Industry Sector

The industry sector has long embraced the principles of sustainability, evident through the integration of the green industry concept in the umbrella law of industry, namely Law No 3 of 2014. The Law defines green industry as industries that prioritise the efficiency and effectivity of natural resources sustainably in order to align industrial development with environmental functions as well as to provide benefit to the public. One of the primary manifestations of green industry is the “green industry standard”. The green industry standard aims to establish a green standard for each economic activity, comprising:

- raw materials, auxiliary materials and energy;

- production processes ;

- products;

- business management; and

- waste management

The standard can either be voluntary or mandatory. Some of the standards issued by the Ministry of Industry are green industry standard for ceramic tile, textile, snack, fertiliser, and batik industries. Industrial companies meeting the green industry standard will receive a green industry certificate, symbolising their commitment to eco-friendly practices.

In a further step towards sustainable industrial development, the Indonesian government recently issued Government Regulation No 20 Year 2024 on Industrial Zoning that introduces the concept of an Eco-Industrial Park – a centralised industrial area equipped with supporting infrastructures and facilities to ensure sustainability through integrated social, economic and environmental aspects in location selection, planning, development and management.

The Regulation describes 4 performances that an Eco-Industrial Park shall cover and manage continuously, namely area/park, environmental, social, and economic performance to create an eco-friendly ecosystem for a sustainable investment.

Further regulation on the Eco-Industrial Park will be provided in a Minister of Industry Regulation, which is expected to provide detailed provisions on implementing and managing the Parks effectively. The introduction of an Eco-Industrial Park marks a significant step towards embedding ESG principles directly into industrial development, helping companies adopt more sustainable practices. Through the four aspects of an Eco-Industrial Park, the framework encourages industrial companies to reduce their carbon footprints, utilise renewable energy sources, and promote social inclusion and economic benefits for local communities. By embracing ESG principles, Indonesia can not only attract global investments but also strengthen its position as a competitive player in the rapidly evolving global economy.

Latest Update

- Kadin Signs MoU with Tokyo SME Support Center

- The Mou signing between Kadin and and Tokyo SME Support Center was done on December 3, 2024, Kadin Tower, Jakarta.

- The points of cooperation in the signing of the MoU include supporting mediumsized enterprises in Indonesia and Tokyo to expand their business to the global market, facilitating business matching opportunities to build strategic partnerships between Indonesian and Japanese SMEs, as well as monitoring the progress of cooperation and providing regular assistance.

- In addition, this cooperation also encourages the exchange of important information related to business practices, market conditions, and business opportunities in both countries. In the future, this cooperation is also expected to expand support 4 programs for medium-sized enterprises, such as international exhibitions and seminars.

- Mitsuru Nakanishi, President & CEO Tokyo SME Support Center stated that they will conduct comprehensive research to find the compatibility between the needs of Indonesian SMEs and Japanese SMEs. He mentioned that the composition of SMEs in Tokyo is still dominated by manufacturing. However, the fields of AI and information technology are also starting to develop in the city.

- Previously Kadin has collaborated with JETRO (Japan’s trade organization) to support the development and capacity building of medium-sized enterprises between countries, especially in opening global market access for SMEs on July 5, 2024, through the WikiExport Programs that was created by Kadin back in 2022.

- The MoU between Kadin and JETRO includes cooperation in developing materials and providing certified export training, providing a 24-hour information service platform for MSMEs, as well as collaboration in research and development of networking and business matching.

- One of its success stories were in 2023, when Kadin and JETRO collaborated to organize business matching in Tokyo, Japan by bringing 9 Indonesian SMEs that had completed export training through WikiExport and passed the curation, namely Pipiltin Cocoa, Alko Sumatra Coffee, Sukkha Citta, Shiroshima, House of Tea, Balista Coffee Liqueur, Sambal Pecah, Jamune, and Ohana Mie. This activity has proved to have significant impact for the growth of some of these businesses until present time and was expected to book SME exports to Japan amounting to US$ 1 Million.

- 3 New Japanese and Chinese Investors Enter KITB

- KITB signed an Industrial Land Utilization Agreement and a Ready-to-Use Factory Building Lease Agreement with three companies: PT Nesinak Manufacturing Indonesia (Japan), PT Youmi Medika Industri (China), and PT Luban Material Indonesia (China).

- PT Nesinak Manufacturing Indonesia was the highlight of the event as the first Japanese tenant at KITB and has been operating in Indonesia for more than 27 years. With an investment of IDR 20 billion, the company occupies 1.8 Ha of land and 2 Ready-to use factory units (3,768 m2) to produce rubber components for electronics and automotive, which will be exported to Japan, the United States, and Europe. PT Nesinak supplies electronic components to big companies such as Epson & Yamaha, and its automotive parts to Denso Indonesia.

- PT Youmi Medika Industri, which has been operating for more than 20 years in the medical device sector, also strengthened its position at KITB by taking 8 Ready-toUse Factory units covering an area of 8,316 m². The company focuses on the production of cotton swabs and provides canteen facilities for its employees.

- PT Luban Material Indonesia produces aluminum-based windows, doors, and trellises, utilizing local raw materials and employing more than 50% of the Indonesian workforce. Its land size utilization in KITB was not mentioned.

- Indonesia Obtains BP’s US$ 7 Billion Investment Commitment for Carbon Capture Utilization & Storage (CCUS)

- After meeting with 19 company representatives of United Kingdom in the CEO Roundtable Forum as what was mentioned in W4 November Insight Report, BP has expressed its commitment to invest a total of US$ 7 Billion (IDR 110.6 Trillion) for Tangguh Expansion Phase 2.

- The investment commitment was also announced by BP through the company’s official statement published in London. The Indonesia-BP collaboration is called the Tangguh Ubadari, CCUS, Compression Project or called Project UCC, which can produce about 3 trillion cubic feet of additional gas resources in Indonesia, which will help meet Asia’s growing energy needs.

- The UCC project will extend the gas feed to Tangguh LNG with the potential to reduce Tangguh LNG’s operational emissions via CO2 sequestration and Enhance Gas Recovery (EGR). Once completed, Tangguh EGR/CCUS itself will have three injection wells, one offshore injection platform, one offshore CO2 pipeline, and onshore facilities for CO2 removal, processing, and compression.

- Gas production from the Ubadari field is scheduled to begin in 2028. The project is also expected to absorb about 15 million tons of CO2 in the initial phase, with the possibility of a larger capacity, given the large CO2 storage potential in the area.

- Tangguh CCUS is projected to be the first CCUS project developed on a large scale in Indonesia. The Indonesian government has designated this project as a national strategic project, which is a continuation of the development of Tangguh LNG after the addition of the 3rd LNG train in 2023, which increases LNG liquefaction capacity to 11.4 million tons per year.

- As an additional information, BP is the operator of Tangguh LNG, acting on behalf of Tangguh Production Sharing Contract Partners. BP operates Tangguh with 40.22% participating interest, with partners MI Berau B.V. (subsidiary of Mitsubishi Corporation) (16.30%) CNOOC Muturi Limited (13.90%), Nippon Oil Exploration, Ltd. (12.23%), KG Berau Petroleum Ltd (8.56%), KG Wiriagar Petroleum Ltd (1.44%), Indonesia Natural Gas Resources Muturi Inc. (7.35%).

- ExxonMobil Corporation Plans to Build a US$ 15 Billion Carbon Capture & Storage in Indonesia

- BP’s commitment to inject US$7 Billion for CCUS projects in Indonesia has sparked ExxonMobil to invest, after 50 US businessmen from the US-ASEAN Business Council came to the State Palace on December 3, 2024.

- Minister of Investment and Downstream/Head of the Investment Coordinating Board (BKPM) Rosan Roeslani revealed that ExxonMobil Corporation plans to build a petrochemical refinery and Carbon Capture and Storage (CCS) facility in Indonesia worth US$15 Billion (IDR 239.25 Trillion). Further information was not disclosed.

- Eza Hill Enters Indonesia, Acquired 3 Logistics Company Worth US$ 148 Million

- EZA Hill Property Management, Singaporean based company has acquired a portfolio of three logistics properties in Indonesia worth US$148 Million (IDR 2.3 Trillion) from LILV Portfolio, a fund managed by ESR Group, one of APAC’s biggest and leading economy real asset manager, based in Hongkong.

- EZA Hill is a real estate investment platform backed by alternative investment manager Hillhouse Investment, a global private equity firm with Asset Under Management (AUM) of over US$ 73 Billion (IDR 1,153 Trillion) through its real assets division, Rava Partners. o All three logistics assets in the portfolio are located in Greater Jakarta, namely in the Industrial Park and logistics sub-markets of Cikarang, Cibitung and Cileungsi.

- EZA Hill said the “high-quality income-generating” assets total 137,000 m2 of builtup net lettable area (NLA). o Two of these assets have a further 274,000 m2 of developable NLA, which the company intends to utilize to further grow the portfolio.

- Though the exact location of the logistics asset acquired by EZA Hill was not disclosed, it is relevant to note that in 2023, ESR Group collaborated with Mitsubishi Logistics and the Indonesia Investment Authority (INA) on logistics projects at Cikarang I Logistics Park (GIIC), Cikarang II Logistics Park (GIIC), and Karawang I Logistics Park (Surya Cipta). ESR Group is also the shareholders of LOGOS, a logistic company that is also operational in Indonesia and has logistic warehouse in Cileungsi and Cibitung. These locations could provide context or potential connections to the acquired asset.

- The deal represents EZA Hill’s first acquisition in Indonesia and marks an important milestone beyond Singapore and into South-east Asia, entering Indonesian logistic market.

- Indonesia Will Build IDR 19 trillion Methanol Factory in East Java

- Energy and Mineral Resources Minister Bahlil Lahadalia said Indonesia will build a biodiesel feedstock plant with an investment value of US$1.2 billion (IDR 19.02 trillion).

- The plant will be located in Bojonegoro, East Java. Upon completion, it will have a production capacity of 800,000 tons of methanol per year. The facility is also designed to support the government’s plan to accelerate the development of B50 biodiesel, a mixture of vegetable oil and diesel, with a ratio of 50% each, that was introduced in 2021, to help reduce solar import, due to the fact that 80% of the methanol mixture for the B50 Biodiesel is imported from other countries.

- Indonesia is not only dependent on methanol imports but also continues to import ethanol as a raw material for bioethanol production, according to Bahlil. To address this, the government also plans to establish a domestic ethanol production facility.

- The implementation of the B50 biodiesel program is targeted for 2026 and is currently undergoing technical trial phases. Meanwhile, the B40 biodiesel program is set to be implemented starting January 1, 2025.

- Land Bank Agency Targets 140,000 Ha of Land Ownership in 2025

- The Land Bank Agency aims to acquire 140,000 Ha of land in 2025, way more than the target in 2024.

- oHead of the Land Bank Agency, Parman Nataatmadja, said that until now his party has controlled around 27,169 Ha of land. Until the end of 2024, Parman targets 35,000 Ha of land to be under the control of the Land Bank Agency.

- In total, with the acquisition plan of existing land to date, in 2025 it aims to touch 175,000 Ha.

- As of October 2024, they have managed land in 19 provinces in Indonesia, with some of the biggest land banks located in areas outside Java such as Poso in Central Sulawesi (6,648 Ha); Luwu in South Sulawesi (4,960 Ha); North Penajam Paser in East Kalimantan (4,162 Ha); South Halmahera in North Maluku (3,890 Ha).

- The guarantee of land availability is for public interests such as Hospitals, SEZs, Industrial Parks, Tourism Areas, Food Estate, Sports Infrastructure, Reservoirs, Roads, Schools and Telecommunications and Information Networks.

- The target of acquiring large tracts of land in 2025 is driven by rising investor demand to utilize Land Management Rights (Hak Pengelolaan atas Tanah/HPL) through the Land Bank Agency. Notable examples include JTrust Bank, a Japanese bank, planning to develop Eco City in Penajam, Swiss investors seeking land for coffee plantations, Vietnamese investors aiming to establish a 10,000 Ha cattle farm in Poso, and many more. However, this interest cannot currently be accommodated, as the Land Bank’s ownership is limited.

- Axiata & Sinar Mas Merge Telecommunication Company

- PT Smartfren Telecom Tbk (FREN)’s parent company, Sinar Mas Group, has announced plans to acquire 13.1% of Axiata Group’s shares in the new entity resulting from the merger with PT XL Axiata Tbk (EXCL), becoming PT XLSmart Telecom Sejahtera Tbk/XLSmart.

- In line with the permission obtained from the Board of Directors of XL Axiata, Smartfren, and SmartTel, the XL-Smartfren merger process is still awaiting regulatory and shareholder approval. The process targets completion in the first half of 2025.

- When the transaction is completed, Axiata Group and Sinar Mas will both become joint controlling shareholders, with a stake of 34.8% each. The equalization of ownership requires Sinar Mas to deposit up to US$475 Million (IDR 7.52 Trillion) to Axiata Group.

- The transaction payment is divided into two stages. First, after the merger transaction is closed, Sinar Mas will deposit US$400 million Second, an additional US$74 million will be made at the end of the first year.

- Europe Shows More Interest to Invest in Indonesia’s Renewable Energy Than Nickel Production

- Chairman of the European Business Chamber of Commerce Indonesia (EuroCharm Indonesia) Francois de Maricourt on December 9 at Ministry of Investment and Downstream Industry, emphasized that the main focus of European companies is currently not on nickel mining, but on new renewable energy projects which are considered more in line with their advantages in the field of sustainable technology.

- European companies have demonstrated interest in investments, including ventures into nickel mining and its ecosystems. However, critical minerals are not considered a primary strength. Greater investment is anticipated from Europe in sectors such as renewable energy, FMCG, and engineering, where their expertise is more established, providing greater interest to invest in Indonesia.

- In addition to investment, the Indonesian government and the European Union are also accelerating the completion of the Indonesia-European Union Comprehensive Economic Partnership Agreement (IEU CEPA) trade agreement to boost economic growth and trade investment between the two parties.

- Francois underlined that currently, European companies in Indonesia find it difficult to compete as there are no special tariffs for Indonesian companies as CEPA has not been signed and sincerely hope that there will be progress in the signing of this Indonesia-EU trade agreement to greatly supports trade and investment flows.

- Sojitz Eyes Large-Scale Renewable Energy Initiative in West Java

- Japan’s Sojitz Corporation seeks partnerships with PT PLN and other stakeholders to develop a large-scale renewable energy project in or near Deltamas’ Greenland International Industrial Center (GIIC), Bekasi, West Java. The project aims to meet the rising green energy demand from regional data centers, which have preference for green energy.

- Sojitz projects that electricity demand in Deltamas, primarily driven by data center expansion, will increase tenfold by 2035, reaching over 2.5 GW compared to the current demand of around 250 MW. Data centers, especially AI-driven data centers consume two to three times more electricity than traditional ones.

- In December 2023, during the AZEC Tokyo Meeting, Sojitz and Sinarmas Land signed an MoU to study energy solutions for decarbonization in Deltamas City. The company is currently conducting a feasibility study under the Global South Subsidy Program from Japan’s Ministry of Economy, Trade, and Industry (METI), focusing on renewable energy, energy-as-a-service (EaaS), and biogas/biomethane solutions.

- Sojitz has also established PT Surya Nippon Nusantara (SNN), a rooftop solar energy provider for commercial and industrial sectors, jointly owned by SUN Energy (51%) and Sojitz (49%). SNN aims to install 100 MWp of solar power capacity within the Greenland International Industrial Center, part of the Kota Deltamas area, by 2030.

- PT Vale Indonesia Collaborates with Esri Indonesia to Introduce Geospatial VIGIS for Mining Efficiency

- Indonesia’s leading mining company PT Vale Indonesia Tbk is working with Esri Indonesia to deliver an innovative platform designed to improve operational efficiency and sustainability in the mining industry, the Vale Indonesia Geospatial Information System (VIGIS).

- VIGIS utilizes an integrated Geospatial Information System (GIS) to collect, store, analyze and manage mapping survey data and geospatial information.

- GIS will optimize Vale Indonesia’s operations, including mine planning, resource modeling, monitoring, and efficiency. It will also enhance risk management through real-time monitoring and analysis to identify and mitigate safety hazards in mining operations.

- Vale Indonesia was also awarded the GeoInnovation Award 2024 by Esri Indonesia, in the GeoInnovation Indonesia 2024 event in Jakarta. This award was given for Vale Indonesia’s innovation in utilizing geospatial technology in its operations.

- GeoInnovation Indonesia 2024 is a gathering that brings together award-winning leaders, technical experts, and GIS professionals from across Indonesia. The event aims to share insights on how geospatial technology can influence decisions and policies that contribute to Indonesia’s growth. Attendees could explore award-winning solutions that utilize advanced spatial tools, highlighting the nation’s commitment to technological advancement.

- PLN to Auction Several Wind Power Plants in 2025

- PT PLN has announced plans to auction several Wind Power Plant projects in 2025, across various locations in Indonesia, with a total combined capacity of 713 MW.

- Zainal Arifin, Executive Vice President of Renewable Energy at PLN, revealed that the auctioned projects will include a 100 MW in Banten, a 3 MW in Sumba, a 60 MW in Sukabumi, a 50 MW in West Java, and an additional 500 MW across other locations. The documents for the 3 MW in Sumba is ready progressing with auction by procurement team. The other projects are still in the data preparation stage.

- Indonesia’s wind potential is estimated at 154.6 GW, including 60.4 GW of onshore wind and 94.2 GW of offshore wind. o Eastern Indonesia, including Maluku, Papua, and Nusa Tenggara, accounts for approximately 40% of the country’s total wind potential. However, as of October 2024, only 152.3 MW of Indonesia’s wind potential has been harnessed for Wind Power Plants. The government has set a target to increase installed capacity to 37 GW by 2060.

- FID for Tuban Refinery Faces Further Delay

- The Final Investment Decision (FID) for the Tuban grassroot refinery (GRR) and petrochemical project in East Java Province has been delayed, again. Minister of Energy and Mineral Resources Bahlil Lahadalia stated that PT Pertamina Rosneft Pengolahan dan Petrokimia (PRPP) is now expected to finalize the FID by March next year.

- In October, Bahlil had announced that Pertamina planned to complete the FID by November. The FID for the GRR project has faced multiple delays; it was initially expected in the first quarter of 2024. PT Kilang Pertamina International (KPI), the refinery subsidiary of state-owned oil and gas firm PT Pertamina, had originally aimed for project completion by 2027, assuming construction could begin in 2023. However, due to this delay, the completion timeline has now been pushed to 2029.

- PRPP is a joint venture, with KPI holding 55% ownership and Russia’s Rosneft holding 45%. o Last year, the ministry raised concerns about Rosneft’s capacity to continue with the proposed multi-billion-dollar oil refinery project in Tuban amid Western sanctions, suggesting that Pertamina might need to seek a new partner.

- The proposed refinery is designed to process 300,000 barrels per day (BPD) of crude oil, producing 80,000 BPD of Euro V standard gasoline, 100,000 BPD of gasoil, 10 and 30,000 BPD of jet fuel. It will also include an integrated petrochemical plant with a capacity of 3,750 kilotons per annum (KTPA).

- IKN’s 9th Groundbreaking Includes Sojitz’s Investment

- Head of the Archipelago Capital Authority (OIKN) Basuki Hadimuljono said that there are currently five new projects in IKN that are ready for the 9th groundbreaking by President Prabowo Subianto. It was agreed that the groundbreaking procession will happen in December 2024.

- Basuki said that the 5 new projects are all privately owned. They include office buildings, hotels, housing, greenery, and restaurants. One of them is Sojitz, a Japanese company that will build housing in the new capital city project.

- Deputy for Funding and Investment Agung Wicaksono signalled that the investment value that will be realized in the near future is around IDR 5 Trillion (USD 309.18 million).

- In total, The IKN Authority has carried out 8 stages of groundbreaking which were carried out in 2023 to 2024. The total investment that has been pocketed is IDR 58 Trillion (USD 3.58 billion). This achievement is still below the IKN Authority’s investment target to reach IDR 100 Trillion (USD 6.18 billion) by 2024.

-end-

REFERENCES

- Skylight Analytics Hub

- https://lestari.kompas.com/read/2024/12/09/092436886/indonesia-berada-di-posisiunik-untuk-pimpin-transisi-hijau-global

- https://www.kearney.com/service/sustainability/article/indonesia-s-pathway-to-net-zero2060

- https://www.liputan6.com/news/read/5819124/berdayakan-pelaku-umkm-kadin-dki-dantokyo-sme-gelar-mou?page=2

- https://daelpos.com/2024/12/03/kadin-indonesia-dan-tokyo-sme-support-centertandatangani-mou-untuk-penguatan-daya-saing-usaha-menengah-antarnegara/

- https://www.antaranews.com/berita/4183503/kadin-dan-jetro-perkuat-kerja-samapeningkatan-kapasitas-umkm

- https://www.idntimes.com/business/economy/vadhia-lidyana-1/kit-batang-makin-lariskini-dilirik-perusahaan-jepang?page=all

- https://www.antaranews.com/berita/4484361/prabowo-raih-investasi-7-miliar-usd-daribp-untuk-gas-papua-barat

- https://nasional.kontan.co.id/news/british-petroleum-komitmen-investasi-senilai-us-7- miliar-di-indonesia

- https://ekonomi.bisnis.com/read/20241203/44/1821129/tak-mau-kalah-dari-bpexxonmobil-siap-investasi-rp239-triliun-di-ri

- https://www.bp.com/en_id/indonesia/home/who-we-are/tangguh-lng/enhanced-gasrecovery-carbon-capture-utilization-and-storage.html

- https://www.bp.com/en_id/indonesia/home/who-we-are/tangguh-lng/enhanced-gasrecovery-carbon-capture-utilization-and-storage.html

- https://www.hillhouseinvestment.com/ https://www.esr.com/ https://www.esr.com/our-properties/indonesia/cikarang-logistics-park-1/

- https://www.businesstimes.com.sg/international/asean/hillhouses-eza-hill-buys-us148- million-jakarta-logistics-portfolio-esr-fund

- https://www.topbusiness.id/100408/perusahaan-singapura-ini-akuisisi-properti-logistikusd148-juta.html

- https://www.antaranews.com/berita/3561318/ina-esr-dan-mitsubishi-berkolaborasikembangkan-pergudangan-modern

- https://www.esr.com/news/esr-group-accelerates-full-integration-of-logos/

- https://market.bisnis.com/read/20220209/192/1498369/ini-alasan-astra-asii-danhongkong-land-kepincut-dengan-logos

- https://nasional.kontan.co.id/news/upaya-bank-tanah-menjaring-investor-dan-perluaslahan

- https://economy.okezone.com/read/2024/06/20/320/3023794/apa-yang-dimaksuddengan-biosolar-b50

- https://www.detik.com/properti/berita/d-7664067/badan-bank-tanah-incar-kuasai-140- 000-ha-tanah-di-2025

- https://nasional.kontan.co.id/news/upaya-bank-tanah-menjaring-investor-dan-perluaslahan

- https://www.fortuneidn.com/market/tanayastri/akan-akuisisi-13-1-saham-axiata-sinarmas-siapkan-dana?page=all

- https://www.cnnindonesia.com/ekonomi/20241209143634-92-1175367/investor-eropalebih-naksir-energi-bersih-ri-dibanding-nikel-cs#goog_rewarded

- https://www.petromindo.com/news/article/sojitz-eyes-large-scale-renewable-energyinitiative-in-west-java

- https://id.investing.com/news/economy-news/gandeng-esri-indonesia-pt-vale-indonesiakenalkan-platform-geospasial-vigis-untuk-efisiensi-tambang-2676965

- https://www.petromindo.com/news/article/pln-to-auction-several-wind-power-plantsnext-year

- https://www.petromindo.com/news/article/fid-for-giant-refinery-faces-further-delay

- https://www.tempo.co/ekonomi/basuki-hadimuljono-klaim-ada-groundbreaking-proyekikn-tahap-9-perkantoran-hotel-hingga-rumah-makan-1179176