Overview

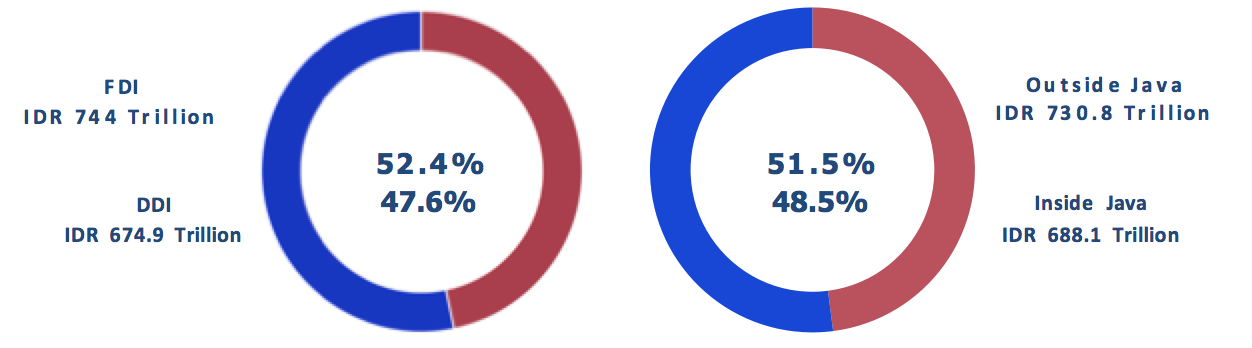

The Ministry of Investment / Investment Coordinating Board (BKPM) noted that investment realization throughout 2023 reached IDR 1,418.9 trillion, exceeding the 2023 target of IDR 1,400, an increase of 17.5% YoY, opening employment for 1,823,543 people.

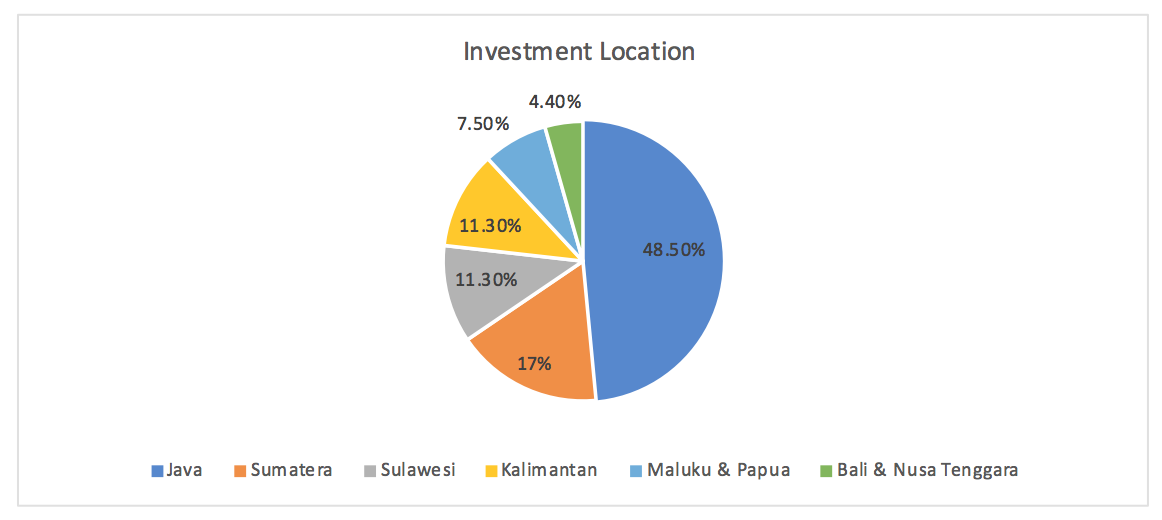

Java remains the mainstay of FDI and DDI destination. BKPM data shows 4 top regions as the following:

- West Java IDR 6 trillion

- DKI Jakarta IDR 166.7 trillion

- East Java IDR 145.1 trillion

- Banten IDR 9 trillion

Top 5 sectors in 2023:

- Basic Metal, Metal Goods, Non-Machinery and Equipment of IDR 3 trillion

- Transportation, Warehouse and Telecommunications of IDR 8 trillion

- Mining of IDR 5 trillion

- Housing, Industrial Park and Office of IDR 2 trillion

- Chemical and Pharmaceutical of IDR 105 trillion

In the 2024 Indonesian Government’s Work Plan (Rencana Kerja Pemerintah – RKP), several business sectors with high multiplier effect will be accelerated to strengthen economic resilience and quality growth. These are:

- The tourism industry

- Processing industries and smelters, renewable energy development and energy conservation

- The MSME and food security through Kawasan Sentra Produksi Pangan

- Industry 0 in 7 priority subsectors, namely food and beverage, automotive, chemical, textile and textile products, electronics, and health.

No new incentives have been launched. Fiscal incentives such as tax allowance, tax holiday, investment allowance for labor incentives, super deduction for vocational and research programs, exemption from import duties on capital goods, as well as incentives for research and vocational training, and area-based incentives such as Special Economic Zones (SEZ) are still in place, to be granted on application basis, subject to government’s approval.

Indonesia SEZ

- Indonesia’s government has made the development of the country’s special economic zones (SEZ) a priority policy with the aim of attracting over USD 50 billion in foreign investment over the next decade, particularly for SEZ-oriented Buoyed by the success of the free trade zones, SEZs were developed to further increase foreign investments into the country. As such, the first-batch applications were approved in 2012 and the first SEZs started in operation since 2015.

- For foreign investors, entering Indonesia’s SEZs and taking full advantage of what they offer requires a long-term outlook. Companies must first ensure their industry is suited to the infrastructure and benefits afforded in the SEZs, as well as understand the long-term domestic and regional policies that could impact their industry.

- As per November 2023, as many as 20 SEZs have been awarded throughout the Indonesian archipelago, targeting investments totalling USD 11.36 billion and employment for 117, 492 workers. In 2023, a significant IDR 66 trillion increase in investment was recorded from the previous year, with additional 57,005 workforce and a growth in the number of companies/industries by 89. For 2024, the SEZs are targeting an additional investment of IDR 77.5 trillion and additional workforce of 38,277.

- In December 2023, the SEZ Council awarded three new SEZs, namely Setangga SEZ, Tanjung Sauh SEZ, and Nipa SEZ, boosting Indonesia’s SEZ to 23 by 2024.

- The 23 SEZs:

- Sei Mangkei SEZ – North Sumatra, the first SEZ in Indonesia approved in 2012, focused on the development of large-scale downstream palm oil and rubber industries. The total land area is 2,002.7 Ha with Unilever, Aice, and Pertamina as the first Strategic location in the palm plantation areas and logistics is one of its competitive advantages, supported by the dry port which directly connects Sei Mangkei with the two large ports of Belawan and Kuala Tanjung.

- Arun Lhokseumawe SEZ – Aceh, a consortium of PT Pertamina, PT Pupuk Iskandar Muda, PT Pelindo 1, together with PT. Aceh Development, State Asset Management Institute, and industrial park developer PT Patriot Nusantara SEZ status was granted in 2017 for the area of 2,422.68 Ha with investment target of USD 3.8 billion, focusing on the energy sector, petrochemicals, food and agroindustry, paper craft production and logistics.

- Batam Aero Technic SEZ – operates as a SEZ from 2021 and focuses on aircraft Maintenance, Repair and Overhaul (MRO) and logistics. This SEZ, which covers an area of 30 Ha and integrated with Hang Nadim Airport, also offers certified mechanic training.

- Galang Batang SEZ – Bintan, Riau Islands, developed as a bauxite processing industrial center with PT Bintan Alumina as the anchor tenant, a Chinese Indonesia joint venture, targeting investments of IDR 36.25 trillion by 2027. This SEZ is one of the fastest in its development, completed with independent power plant and other supporting facilities, and has exported smelter grade alumina (SGA) amounting to IDR 9.4 trillion in 2023. Projected to employ 23,200 workers, as of 2023 its workforce has reached 4,547 people.

- Kendal SEZ – Central Java, is the first industrial SEZ approved in Java Island in 2019, targeting textile and fashion industry, furniture and game industry, food and beverage industry, automotive industry, and electronics industry with total investment of IDR 72 billion by 2025, employing 20,000 As its first development of 1,000 Ha has reached more than 50% occupancy rate in the first half of 2023, the developer has been seeking expansion approval for another 1,200 Ha.

- JIIPE Gresik SEZ – East Java, approved in 2021, hosting Freeport Indonesia as its anchor tenant in copper processing, the SEZ has been targeting heavy to medium industry in metal processing, electronic, chemical, energy and logistics for the registered 2,167 Ha of industrial park and port area.

- Sorong SEZ – Southwest Papua, covering an area of 523.7 Ha, currently is in the evaluation for revocation due to insignificant progress. The SEZ status was granted in 2019, targeting nickel processing, palm oil and plantation products.

- Bitung SEZ – North Sulawesi, targeting coconut and fisheries processing industry in its 534 Ha of Currently the SEZ is in the evaluation for revocation due to land acquisition and funding issues.

- Palu SEZ – Central Sulawesi, is the first SEZ designed by the Indonesian government as an integrated logistics and mining processing in the Sulawesi economic corridor in 2016 over an area of 1,500 Ha, targeting targeting base metal industry, cocoa and coconut As of June 2022, hundreds of hectares of land have been plotted for 27 tenants at various investment stages. Unfortunately there was no clarity regarding the construction plans and some were still waiting for equity partners.

- Maloy Batuta Trans Kalimantan (MBTK) SEZ, Kutai Regency – East Kalimantan, awarded as SEZ in October 2014 covering 34 Ha of land, targeting downstream palm oil processing and center for downstream mineral, gas and coal with an investment target of IDR 34.3 trillion until 2025. However, as of January 2024, the developer could only secure investment of IDR 100 billion, and currently the SEZ is in the revocation process.

- Nongsa SEZ – Batam, approved in 2022 covering 45 Ha, and designed as the Indonesian Silicon Valley, the SEZ hosts the National Data Center of the Ministry of Communication and Information which is planned to be commercial in 2024, the Global Data Solution Data Center – a Chinese investment, and First Nongsa One Data Center from Singapore, and IT academy in collaboration with Apple Indonesia for mobile developer education. The SEZ aims to be a Digital Hub, with modern facilities and international fiber optic network with speeds of up to 1 terabyte per second (Tbps).

- Tanjung Kelayang SEZ – Bangka Belitung – a tourism SEZ developed by consortium of Dharmawangsa Group on 324 Ha of Per December 2022, as many as 7 investors have committed investments in hospitality and infrastructure.

- Tanjung Lesung SEZ – Banten, a tourism SEZ developed by the Jababeka The staging development started in 2015 from 104 Ha out of 1,500 Ha. In 2022, as many as 7 hotels and villas have been in operation. However, the progress is deemed relatively slow.

- Lido SEZ – Bogor, a tourism SEZ developed by the MNC Land on 1,040 Ha of land, targeting 1.4 billion domestic tourists and 7.4 billion foreign tourists. The SEZ application was approved in 2021, proposing an international theme park, golf course, concert venue, movie studio, and retail and dining area.

- Morotai SEZ – North Maluku, targeting fisheries processing industry and Approved in 2014, the development of 1,101.76 Ha area is led by Jababeka Group, targeting IDR 30,44 trillion investments by 2025. Investment achievement up to December 2022 was recorded at IDR 449.95 billion with 3 investors. The developer was reported to actively seek an anchor tenant.

- Likupang SEZ – North Sulawesi, a tourism SEZ on 200 Ha land. Currently in the evaluation process for revocation of the SEZ status, the Indonesian government encouraged the developer, PT Minahasa Permai Resort Development, a subsidiary of the Sintesa Group, to secure its anchor tenant.

- Mandalika SEZ – Lombok, West Nusa Tenggara, a tourism SEZ on 1,035 Ha of land. Developed and managed by ITDC, a state-owned enterprise, the SEZ aims to become the new Meeting, Incentive, Convention and Exhibition (MICE) center in Indonesia. ITDC offers to issue HGB certificates (on top of its HPL) for investors with construction progress reach 30%, to ease funding application to financial institutions. The Indonesian government continues to promote this SEZ for international events. However, the progress is relatively slow.

- Kura-Kura SEZ – South Denpasar, Bali, a newly awarded tourism SEZ set on 492 Ha land, targeting 1.2 million visitors in 30 years. The developer planned to build the first international standard marina in Indonesia. A collaboration with Mitsubishi Estate Group was announced in December 2023, for a USD 100 million investment in an outlet shopping mall.

- Sanur SEZ – Bali, aimed to be a health tourism destination in South East Asia attracting domestic patients with its first class medical & wellness tourism packages. The Indonesian government expects to absorb 240,000 patients who previously sought treatment abroad, by 2030 with a saving in foreign exchange by IDR 86 Developed by the tourism state- owned holding company, InJourney, the SEZ targets to complete an international hospital and a Korean Aesthetic hospital by end of 2024.

- Singhasari SEZ – Malang, East Java was designed as the first education SEZ in Indonesia. Application approved in 2021, the SEZ has been engaging various parties for collaboration in the human development and technological London’s King Collage will start its first Digital Economy class in the SEZ from Sepember 2024.

- Setangga SEZ – South Kalimantan, has a land area of 668.3 Ha with an investment target of IDR 67.69 trillion and employment of 78,999 workers by 2053. KEK status is given on the basis that the developer has acquired more than 50% of the land, with an anchor tenant in the nickel smelting The SEZ is proposed for the refinery & biodiesel industry, rubber industry and nickel processing, iron and plywood industry.

- Tanjung Sauh SEZ – Batam, targets investments of IDR 199.6 trillion and employment of 366,087 workers by 2053, targeting the electronic component industry, assembly and heavy industry, and solar panels. PT Panbil Utilitas as the anchor tenant targets commencement in operations by 2027.

- Nipa SEZ – Batam, Riau Islands targets investments of IDR 46 trillion and employment of up to 40,949 workers within 50 years, proposed cargo trading and bunkering business for ships, as well as storage and trans-shipment services.

Latest Update

- Patimban Port

- The government will begin construction of the 37 km Patimban Access toll road early this year to support activities at Patimban International Port, consisting of 22.94 km of the government portion and 14.11 km of the Toll Road Business Entity (BUJT) portion. With an investment value of IDR 43.22 trillion, Patimban International Port is expected to reduce traffic congestion in Jakarta. Covering an area of 369 Ha, the port is also targeted to have a significant impact on the Rebana Metropolitan – Subang, Indramayu, Cirebon, Majalengka, Sumedang, Kuningan and Cirebon City, boosting the regional economic growth to 7.16%, opening up 4.39 million jobs, and increase investments by 7.77%.

- Local media reported plans for an industrial area with National Strategic Project (PSN) status to support the Patimban International Port which focuses on the production of semi- conductors, electronics and petrochemicals with projected investments of IDR 169.5 trillion.

- Data Center Zone

- Greenland International Industrial Center (GIIC) allocated 300 hectares for Data Center Park, of which 90 hectares was occupied per 2022, hosting 14 local and international tenants, including PT Telkom Indonesia and the National Data Center by the Ministry of Communication and Informatics, and data center companies from Singapore, Australia, the United States, and Europe. The Data Center Zone is equipped with high-tech infrastructure like fibre optic networks and a 993 mega volt ampere power supply from PT PLN. dIndonesia’s large population and high internet penetration rate make it an attractive market for global data centre players. The Center of Economic and Law Studies (Celios) projects the data center business could reach USD3.3 to 4 billion by 2026. Indeed it has been a significant revenue driver for GIIC. As of September 29 2023, Deltamas recorded a revenue of IDR 984 billion, with the industrial segment contributing IDR 736 billion.

- West Sumatera Strengthens Halal Industry

- The West Sumatra Provincial Government intends to strengthen the halal industry in its Medium and Long-Term Development Plan (2025-2045) in order to increase its Gross Regional Domestic Product (GRDP). Indonesia stands out as the largest halal market in the world. By capitalizing on its huge Muslim-population and growing middle-income Muslim consumer base in the country, the Indonesian halal market is projected to continue to expand in the coming years, encompasses Sharia-based products and services, which include food, fashion, pharmaceuticals, cosmetics, media, tourism, and Islamic banking.

- New Option to Replace LPG to CNG

- The First Commercial Bio-CNG / Biomethane Plant in Indonesia, located in Blangkahan, North Sumatra Province, was inaugurated on Monday, 22nd January 2024, after going through a construction process for approximately one year and three months. The plant was built by PT KIS Biofuel Indonesia as the first milestone of the targeted 25 Bio-CNG plants by December 2024 in North Sumatra with a total investment value of USD110 million, boosting capacity of 15,500 M3 Bio-CNG/day each, for a total of 387,500 M3 Bio-CNG per day, which is expected to result in a reduction of 3.7 million tons of Co2 per year and generate 3.7 million carbon credits per year.

- Unilever will be the first company in Indonesia and Asia to use bio-CNG to replace fossil fuels on a large scale.

- Pertamina Rosneft Announces Re-bid for Tuban Refinery EPCC Tender

- PT Pertamina Rosneft Pengolahan dan Petrokimia (PRPP) has reopened the prequalification process for the Engineering Procurement Construction and Commissioning (EPCC) tender of the Grass Root Refinery &Petrochemical Project P1 in Tuban, East Java, in a re-bid initiative, aiming to attract companies with the requisite expertise, qualifications, and financial capabilities for such large-scale projects. The project is a vital component of the larger Tuban Grass Root Refinery (GRR) project, a joint venture between PT Kilang Pertamina Indonesia (KPI, a subsidiary of Indonesia’s state-owned oil and gas firm PT Pertamina) and Russia’s Rosneft, projected to significantly enhance Indonesia’s refining capabilities. Amidst concerns over the participation of Russian company Rosneft due to Western sanctions and project delays pushing the completion from 2027 to 2028, PRPP has decided to re-initiate the prequalification process. Taufik Adityawarman, President Director of KPI, said in November of last year that the final investment decision (FID) is slated for March 2024.

- DOWA To Spearhead Waste Plastic-To-Fuel Project In West Java

- Environmental management and recycling company DOWA ECO-SYSTEM CO LTD, a subsidiary of DOWA HOLDINGS CO LTD has announced plans to develop a waste plastic-to- fuel project in Cileungsi, West Java Province. The project is currently in the feasibility study process, which is expected to conclude by the end of next month.

- DOWA’s local unit, PT Prasadha Pamunah Limbah Industri (PPLi), will oversee the development of the project. The company has set ambitious targets, aiming for a waste plastic processing capacity of 3,600 tons/year and projecting oil production of 2,520 kilo liters (equivalent to diesel fuel oil) annually.

-end-

REFERENCES

- Skylight Analytics Hub

- https://www.suarasurabaya.net/info-grafis/2024/investasi-2023-capai-rp1-4189-triliun/

- https://nasional.kontan.co.id/news/di-sepanjang-2023-realisasi-investasi-paling-besar- masuk-ke-luar-pulau-jawa

- https://databoks.katadata.co.id/datapublish/2024/01/29/5-provinsi-penerima-investasi- terbesar-2023-mayoritas-di-jawa

- https://www.detik.com/edu/sekolah/d-7160794/20-kek-di-indonesia-rekrut-tenaga-kerja- lokal-dari-vokasi

- https://peraturan.bpk.go.id/Details/170783/pp-no-71-tahun- 2021#:~:text=PP%20ini%20mengatur%20mengenai%20penetapan,Kabupaten%20Gresik% 2C%20Provinsi%20Jawa%20Timur.

- https://www.cnbcindonesia.com/news/20220902102553-4-368727/semua-ada-di-kek- nongsa-silicon-valley-di-kota-industri-ri

- https://perwakilan.bpbatam.go.id/en/data-center-kek-nongsa-diperkirakan-mulai- beroperasi-tahun-2024/

- https://sorong.tribunnews.com/2023/10/30/kek-kab-sorong-minim-progres-warga-bahas- pembayaran-tanaman-pelepasan-tanah-dan-lapangan-kerja

- https://jateng.solopos.com/kek-kendal-ditarget-rampung-3-tahun-investasi-rp72-miliar- 1183828

- https://www.ekon.go.id/publikasi/detail/4678/akselerasi-investasi-di-kek-batam-aero- technic-menko-airlangga-dorong-bisnis-aviasi-berbasis-mro-dilakukan-di-dalam-negeri

- https://www.cnbcindonesia.com/news/20231201071523-4-493593/tok-airlangga-sahkan- pembentukan-3-kek-baru-di-ri

- https://www.kompas.id/baca/nusantara/2023/06/08/strategi-tak-jelas-kek-bitung-dan- likupang-telantar

- https://palu.tribunnews.com/2022/06/29/pt-bpst-minta-27-tenant-segera-realisasikan- investasinya-di-kek-palu

- https://kekmbtk.co.id/

- https://kompaspedia.kompas.id/baca/paparan-topik/pesona-tanjung-kelayang-menuju- destinasi-unggulan-indonesia

- https://travel.kompas.com/read/2023/04/01/120100527/4-fakta-kek-lido-calon-wisata- baru-di-bogor?page=all

- https://kompaspedia.kompas.id/baca/paparan-topik/pulau-morotai-surga-tropis-di- maluku-utara

- https://lombokpost.jawapos.com/ntb/1502796536/target-investasi-di-kek-mandalika- tahun-2023-turun-dibandingkan-tahun-2022

- https://www.detik.com/bali/bisnis/d-7100680/marina-internasional-pertama-di- indonesia-bakal-dibangun-di-kek-kura-kura-bali

- https://www.cnbcindonesia.com/news/20230830192545-4-467644/target-bos-injourney- kek-kesehatan-bali-tuntas-desember-2024

- https://ekon.go.id/publikasi/detail/5439/wujudkan-kek-pendidikan-pertama-kings- college-london-hadir-september-2024-di-kek-singhasari

- https://www.detik.com/bali/berita/d-7168688/kek-sanur-diresmikan-nilai-investasi-capai- rp-10-3-triliun

- https://ekonomi.bisnis.com/read/20240124/98/1735189/akses-pelabuhan-patimban- butuh-investasi-rp502-triliun-buat-apa-saja

- https://www.esdm.go.id/id/media-center/arsip-berita/pabrik-biocng-komersial-pertama- di-indonesia-diresmikan

- https://koran.bisnis.com/read/20240124/451/1734931/energi-baru-terbarukan-opsi- baru-pengganti-lpg

- https://sharia.republika.co.id/berita/s7gr0m490/sumbar-akomodasi-industri-halal-dalam- rpjmd-20252045

- https://www.petromindo.com/news/article/pertamina-rosneft-announces-re-bid-for- tuban-refinery-epcc-tender

- https://www.petromindo.com/news/article/dowa-to-spearhead-waste-plastic-to-fuel- project-in-w-java

Disclaimer

The content provided within this biweekly update (“Report”) is proprietary to Skylight and protected under copyright and intellectual property laws. This Report may be shared with relevant parties strictly for informational purposes, provided it remains unaltered and is attributed to Skylight. Unauthorized reproduction, distribution, or use of this Report beyond this condition requires prior written consent. The information and insights shared are intended for general informational purposes only and do not constitute professional advice. Please note that the data, projections, and insights presented herein are subject to updates and changes over time, and may not reflect the latest industry developments. Skylight and its contributors disclaim all liability for decisions or actions taken based on this Report, and no guarantees are made regarding the accuracy, completeness, or outcomes derived from the content. Accessing and using this Report does not create any contractual, professional, or advisory relationship with Skylight. By reviewing this Report, you acknowledge and agree to these terms.

© 2025 Skylight Strategic Indonesia. All rights reserved.