Overview

The Indonesian Solar Energy Association (AESI) has voiced concerns over the latest amendments to the solar rooftop regulation introduced by the Ministry of Energy and Mineral Resources (ESDM) under Government Regulation No.2/2024. According to AESI, the revision falls short of expectations in catalyzing the growth of solar rooftop installations across Indonesia.

Critical issues with the regulation:

- The discontinuation of the net metering system and the introduction of restrictive quotas. The net metering mechanism, which allowed solar rooftop users to sell surplus electricity back to the state electricity company PLN, has been abolished under the new framework, although existing systems are grandfathered for 10 years post-permit issuance. The association also pointed out the regulation’s restrictive application window for solar rooftop installations, which is limited to January or July each year.

- The regulation’s stance on carbon credits, stating that all credits produced would be claimed by the government. This clause could deter potential investors, as the ability to claim environmental credits significantly contributes to the financial viability and appeal of solar

- The requirement for installations over 3 MWp to include a Supervisory Control and Data Acquisition (SCADA) system, concern is over the high costs and necessity for solar

Latest Update

Java

- Freeport Indonesia’s Copper Smelter Start Commissioning in

- PT PLN has supplied an additional 60 Megavolt Ampere (MVA) of power to PT Freeport Indonesia’s copper smelter project in the JIIE Gresik SEZ, follows the September 2023 provision of an initial 30 MVA of electricity, while phase III of 110 MVA, and phase IV at 170 MVA will be accelerated, slated for completion in 2024. The smelter is expected to be completed in May 2024.

- East Java Explores MRT Project in Partnership with Japan

- East Java Provincial Government is currently exploring potential collaboration with the Japanese Government for a Mass Rapid Transit (MRT) project.

- Japan has been investing in East Java since 2010-2023, with 23 business sectors spread across 15 regencies/cities in East Java, amounting to a total investment of US$ 4.76 billion (Rp 19 trillion). The largest investment is recorded in the sectors of the basic metal industry, non-machinery metal goods, and their equipment.

- Easterntex Switches to PLN For Power Supply Source

- In response to the heightened reliability and cleanliness of electricity in East Java, polyester-cotton yarn and fabric maker PT Easterntex, a unit of diversified Japanese firm Toray Industries, has made a strategic decision to fulfill its 15 MW electricity needs by transitioning from self-generated power to PLN-supplied electricity through the Progressive Captive Power Acquisition (PCPA) program. The signing ceremony took place on March 8, 2024.

- The objective of the PCPA program is to encourage business and industrial customers to transition from self-owned power plants to electricity supplied by Through this initiative,customers not only have the opportunity to reduce production costs but also contribute to carbon emission reduction. PLN’s supplied electricity is sourced from a combination of renewable energy sources and Coal- Fired Power Plants with Ultra Super Critical technology, which is more efficient and environmentally friendly.

- Business Expansion, Jababeka is Developing an Industrial Zone for Film and Television

- Welcoming Indonesia’s rapidly growing film and television (TV) industry, Jababeka Movieland – a 35-hectare film and television industrial zone in Jababeka City developed by PT Jababeka Tbk, launched a catalog of filming location sets.

- A major challenge for TV and film crews is the inefficiency of managing distant and scattered filming locations, including the cumbersome processes of securing permits and ensuring security. Addressing this, Jababeka Movieland offers a solution with its extensive catalog of filming sets and one-stop integrated services, significantly simplifying the production process. This allows film and TV professionals to concentrate on their creative projects, from movies to commercials, without the logistical hassles of licensing and security.

- AEON Mall Opens in Deltamas

- AEON Mall Deltamas, with an area of 86,000 m2, will finally operate on Friday, March 22, 2024 or during the month of Ramadan. AEON Mall Deltamas is AEON’s fifth mall in Indonesia and the largest in Southeast Asia.

- The mall is located in the center of GIIC Cikarang, Bekasi Regency, targeting more crowds into the area by providing a new entertainment facility for the self-sufficient

- AEON currently has 6 malls operating around Jabodetabek – AEON Mall BSD, AEON Mall Jakarta Garden City, AEON Mall Tanjung Barat, AEON Mall Sentul City, AEON Mall Southgate, and AEON Store JGC Cakung.

Outside Java

- China to Build Petrochemical Plant in North Kalimantan

- Senior minister Luhut Binsar Pandjaitan recently revealed that China would make a major petrochemical investment in North Kalimantan. The investors already got China’s approval on the amount of investment they would put into the petrochemical industry in North Kalimantan.

- Luhut did not mention the name of the Chinese institution that would be making the investment. However, news outlet Reuters reported last year that polyester fiber producers Tongkun Group and Xingfeming Group were awaiting the Chinese government’s approval to build a refinery and petrochemical complex in North

- Luhut talked of another investment related to the stainless steel downstream industry, which will produce spoons, forks, and even injection needles.

- According to government data, Indonesia attracted Rp 375.4 trillion (US$24 billion) in total investment for the downstream industry in 2023. Of this, the petrochemical sector accounted for Rp 46.3 trillion, and about Rp 136.6 trillion was invested in nickel smelters. In 2023, China emerged as Indonesia’s second-largest source of foreign direct investment (FDI), contributing a total of US$7.4 billion to the Indonesian economy.

- Sembcorp & PLN Team up to Build Solar PV in Nusantara

- Singapore’s Sembcorp Industries (Sembcorp) announced on March 8 that its wholly- owned subsidiary, PT Sembcorp Renewables Indonesia, has formed a joint venture with PT PLN Nusantara Renewables, a 99%-owned subsidiary of PT PLN Nusantara Power, to build and develop a large-scale integrated project comprising 50MW of solar and 14MWh of battery energy storage system (the Project) in Nusantara, Indonesia’s new capital city.

- The joint venture, 49%-held by PT Sembcorp Renewables Indonesia and 51%-held by PT PLN Nusantara Renewables, will supply power to PT PLN, which has committed to a 25-year PPA to offtake the electricity generated by the The Project will generate up to 93GWh of clean energy to Nusantara and the East Kalimantan province annually, equivalent to avoiding over 100,000 tons of carbon emissions per year.

- No details on the timeline, when the project is expected to become onstream. The Project marks Sembcorp’s first entry into utility-scale solar development in Indonesia, following joint development study agreement signed with PT PLN in October 2023 on the export of green hydrogen from Indonesia to Singapore.

Benchmark – Industrial Park’s Partnership with Japan and Korea

- MM2100 (Argo Manunggal Group 40% & Marubeni Corp. 60%)

- Development area of 805 Ha – 3 phases:

- Phase I: 240 Ha (sold out)

- Phase II: 120 Ha (sold out)

- Phase III: 445 Ha (only 20 Ha left)

- Development area of 805 Ha – 3 phases:

Currently there are no plans for further expansion from MM2100.

- MM2100 Industrial Town advantage lies in its location beside Jakarta-Cikampek Toll Road with direct access to the Toll Road via Cibitung 35 km from Jakarta CBD (Central Business District); 35 km from Tanjung Priok Sea Port; 55 km from Soekarno-Hatta International Airport.

- Some notable facilities: Japanese standard – Asuka Hotel and Asuka Japanese Restaurant, Lotte Mart, Banks, Governmental Services, and SMK Mitra Industri – supporting industry 0. More about the vocational school: https://www.vokasi.kemdikbud.go.id/read/b/berbagi- praktik-baik-smk-mitra-industri-mm2100-sukses-menjadi-cerminan-bagi-smk-berbasis- industri-4-0

- MM2100 focuses on 5 main industries with some of renowned tenants:

- Automotive: Toyota; Daihatsu; Denso; Kawasaki; Yamaha; Mitsubishi Motors; JX Nippon Oil & Energy, Astra Otoparts, Asmo, KYB. JFE, etc.

- Food & Beverage: Sari Roti, Lotte, Indofood, Coca Cola, Nutrifood, Diamond, Mayora, Ultrajaya, etc.

- Logistics & Warehouse: Yusen Logistics, Pantos Logistics, Mitsubishi Logistics, Unilever, Huawei, Li & Fung, DHL, Linfox, CJ, etc.

- Equipment & Machinery: Hitachi, Tetra Park, Komatsu, Kobelco,

- IT & Electronics: Panasonic, Schneider, Fujitsu, Yamaha, LG,

- Others: Astra International, Faber-Castell, Jotun, Hogy, etc

- MM2100 focuses on 5 main industries with some of renowned tenants:

- Pricing:

- Clean Water: US$0.60/m3

- Wastewater: US$0.825/m3

- ESF: US$0.08/sqm

- Land Price: Rp. 3,200,000 – Rp. 3,500,000/sqm

- Pricing:

- Marubeni has been engaged in the industrial park business in Asia since the 1980s, and as of right is engaging in eight industrial park projects in six countries:

- Indonesia, established in 1990, having 178 tenants inside the 805 Ha area.

- Myanmar, Thilawa Special Economic Zone, having over 111 tenants inside the 650 Ha area. Established in 2014, the shareholders: Marubeni 12.5%, Mitsubishi Corp. 12.5%, Sumitomo Corp. 12.5%, JICA 10%, Myanmar Private 41%, Myanmar Government 10%.

- Vietnam, Amata City Chonburi Industrial Park, Amata City Halong Industrial Park is part of an integrated township development project on land with a total development area of 5,800 ha; the industrial park covers 4,100 Ha of the land and the remaining 1,700 Ha is developed into a The construction and plot sales of Amata City Halong Industrial Park are currently in progress, prior to the development of other areas. Developed by Amata Group in 2018. Marubeni acts as sales agency

- Philippines, Lima Technology Center, having over 150 tenants operating inside the 794 Ha Industrial Park, developed by Aboitiz Group – Marubeni acts as sales agency.

- Philippines, West Cebu Industrial Park, total area of 540 Ha of which the 279 Ha is developed for industrial area, hosting 11 companies. The shareholder composition is Aboitiz Group 60%, Tsuneishi Holdings Corporation 40% – Marubeni acts as sales agency.

- India, Model Economic Township, total area of 3,000 Ha. With industrial area of 690 Ha, the developer Reliance Group hosts over 400 tenants – Marubeni acts as sales agency.

- Thailand, Amata City Chonburi Industrial Park, has a total area of 4,000 Ha, with over 806 tenants, developed in 1989 by Amata Group. Marubeni acts as sales agency.

- Thailand, Amata City Rayong Industrial Park, has a total area of 2,900 Ha, with over 464 tenants, developed in 1995 by Amata Group. Marubeni acts as sales agency.

- In Q3 2023, there have been talks that Marubeni Corporation will invest in a new hi-tech Industrial Park in India, Karnataka with a total area of 720 acres (291 Ha), investing ₹10,000 crore (USD 1.2 Million).

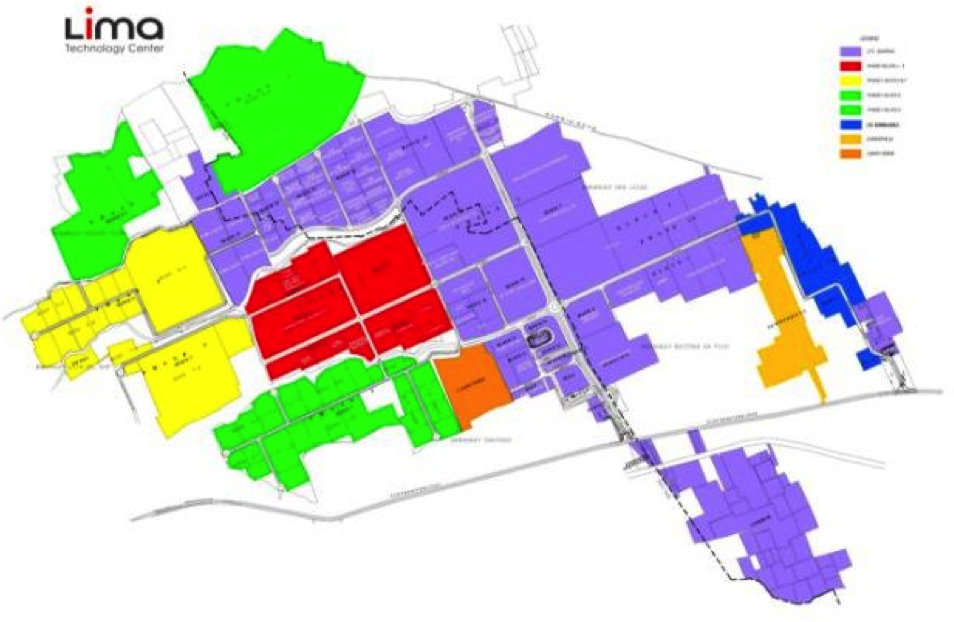

Philippines Lima Technology Center – 794 Ha

- KIIC (Sinar Mas Land 50% & Itochu Corp. 50%)

- Operating in 1993, it has a total of 1,500 Ha of land, hosting 170

- KIIC is constructed by Japanese companies:

- Design: Nippon Koei

- Construction: Takenaka Civil Engineering & Construction, TOKYU CONSTRUCTION CO., LTD., etc.

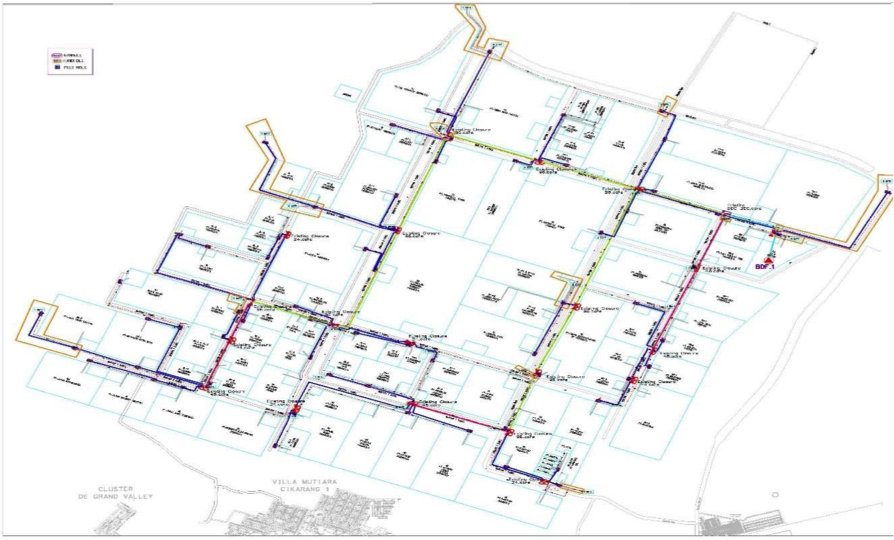

- Construction of water supply and drainage plant: Kurita Water Industries Ltd., Chiyoda Corporation, Toshiba Infrastructure Systems & Solutions Corporation, https://kiic.co.id/utilities-infrastructure/

- Land Development:

- Phase I: 465 Ha (sold out)

- Phase II: 398 Ha (sold out)

- Phase III: 351 Ha (sold out)

- Phase III (Stage 4): 160 Ha – On Sale

- Phase III (Stage 5 – starting August 2023): 110 Ha – On Sale

- Land Development:

- KIIC is hunting land for its expansion plan. In the effort of finding land with clear ownership status and competitive price, the management has been investigating land plots in West and Central Java.

- Karawang Regency where KIIC is located in central West Java, approximately 56 km from the center of Jakarta and 85 km to the International Airport Soekarno Hatta. Around 60 thousand people are working in KIIC.

- Notable facilities: Rental Facilities, Restaurants (Japanese and Indonesian), Banks (8 banks – Risona, J-Trust, Danamon, Maybank, BNI, Mandiri, etc), 4-star hotel, sports and recreational facility.

- KIIC has some renowned tenants in major industries:

- Automotive: Toyota; Astra Daihatsu Motor; Aisin; Isuzu; Yamaha Indonesia Motor Manufacturing; Toyoda Gosei, etc.

- Daily Product & Chemical & Textile: Uni-Charm Indonesia; P&G; Hoyu; Kao Indonesia; Sampoerna; 3M; Fumakilla, etc.

- Food: Ajinomoto Indonesia; Meiji; Firmenich; Freyabadi; Ogawa,

- Electronic & Machinery: Sharp Semiconductor Indonesia; Sumitomo Machinery; Mitsubishi Electronic; SIIX; Tsubaki Indonesia Manufacturing. Etc.

- Others: DNP; Arisu Graphic; Iwatani; Idemitsu; Kawai,

- Pricing:

- Clean Water: US$ 7/m3

- Wastewater: US$7/m3

- ESF: US$0.08/sqm

- Land Price: US$ 200/sqm

- KIIC has some renowned tenants in major industries:

- Itochu Corporation has real estate investment portfolio in Asia, including industrial parks in Thailand and Vietnam, where they have had formed a capital tie-up with AMATA Corporation, a leading industrial park However, no details were found about the industrial parks in those two respective regions.

- Itochu has partnership with Mapletree Investments Pte Ltd. Investments, the real estate arm of Singapore government, to build logistics center in China.

- In January 2015, CITIC Limited (CITIC), CP Pokphand Group Company Limited, and ITOCHU reached a capital participation agreement under which ITOCHU and the CP Group would ultimately acquire 20% of CITIC, China’s largest conglomerate and a constituent of the Hang Seng Itochu’s investment, at US$5 billion, was the largest ever in China by a Japanese company. The three companies reached agreement on a strategic business alliance and capital participation. As of March 31, 2016, the CP Group owned 4.7% of Itochu’s stock, making the CP Group one of Itochu’s major shareholders. Itochu holds 25% of the stock of C.P. Pokphand Co. Ltd., which is the core company in the CP Group and has feed, livestock, aquaculture, and food processing businesses in China and Vietnam, and 10% in CITIC. Synergies were targeted in an extremely wide range of fields, such as retail, processed foods, livestock, grains and other foods, brands and other apparel-related areas, communications, and medicine. https://www.itochu.co.jp/en/business/alliance/index.html

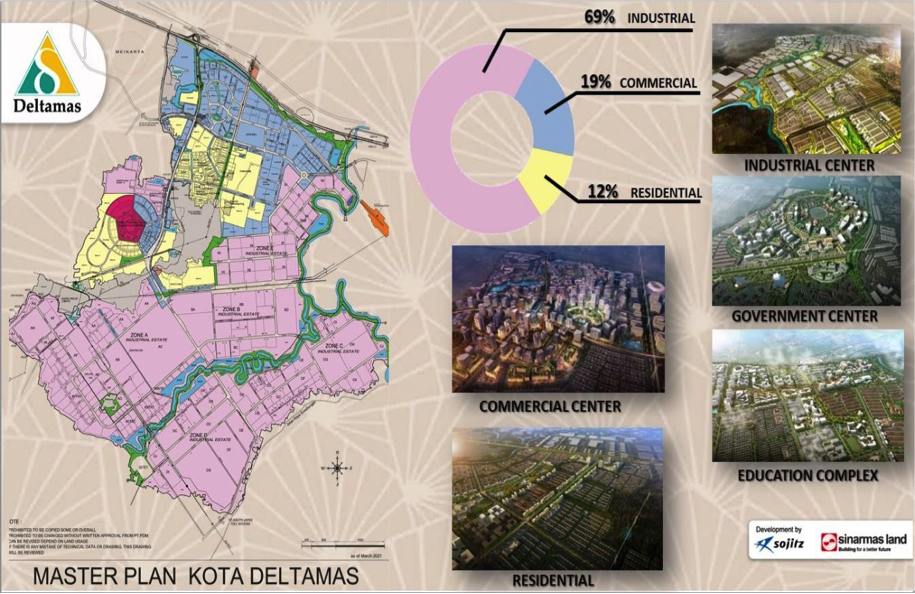

- GIIC (Sinar Mas Land 57.28%, Sojitz 25%, and Public 17.72%)

- Established in 1993, from the 3,000 Ha area, around 2,200 Ha was designated as industrial park, hosting 140 tenants.

- No more saleable land in the existing area; currently developing an expansion around 400 Ha in the surrounding area, set to be ready by 2025.

- Notable facilities: Education Complex, hosting Cikarang Japanese School (State School from Japan), K-Eduplex (Korean Education Complex – Jakarta International University), ITSB (Bandung Institute of Technology and Science) which is a collaboration between Sinar Mas and ITB (Bandung Institute of Technology). Apart from that, there are Pangudi Luhur High School, Ananda Mitra Industri Vocational School, Nur Rahman Islamic School, SIT Fajar Hidayah and SMU Negeri 2 Cikarang; 1.25 Ha Le Premier Hotel & Serviced Apartment, Bekasi Government Center, Mall & Commercial Center.

- Some of its famous tenants are:

- Automotive: Suzuki, Astra Honda Motors, Mitsubishi Motors, Hyundai, etc

- Chemical: Hitachi Chemical Indonesia

- Food: Kewpie Indonesia, Yili Indonesia Dairy

- Others: Samator Taiyo Nippon Sanso Indonesia

- Some of its famous tenants are:

- Utility:

- Clean Water: $0.85

- Wastewater: $0.80

- ESF: $ 0.08

- Land Price: Rp. 3,300,000-Rp. 3,500,000/sqm

- Utility:

- Sojitz boasts over 20 years of experience operating industrial parks in Vietnam, Indonesia, India, the Philippines, and Thailand.

- In Vietnam, cooperation with Thaison Group in 1996 to develop LOTECO, with USD 41 million total investment for 100ha of first phase, focusing on land and built-factory according to request of tenant. Projects in LOTECO were chosen with criteria that are modern technologies, limit bad impacts to environment such as electronic, mechanical, garments.

- In Vietnam, Sojitz was also involved in the development and operation of 270 Ha Long Duc Industrial Park (“LD Industrial Park”) since 2011 – Sojitz 57.3%; Daiwa House 22%; Kobelco Eco 7%; and DONAFOODS 12% .All available lots at LD Industrial Park were sold out in 2019, hosting 70 companies (of which 59 are Japanese). Just recently on November 2023, Sojitz Corp. signed a collaboration agreement with Vietnamese real estate developer, Thanh Golf Investment and Trading JSC (GLT) to develop LD 3 Industrial Park Project – 244.5 Ha land – to meet the growing demands of manufacturing industry in Vietnam. GLT, was established in 2005, has an extensive business development record of utilizing local capital to handle large-scale urban development, golf course development, condominium development, and renewable energy development. In Vietnam, Sojitz sees an ever-increasing need to expand the manufacturing industry to both grow export processing and respond to anticipated growth of the domestic consumer market against the backdrop of the China Plus One strategy and restructuring of corporate supply chains, among other significant changes in the manufacturing industry concurrent with growing demand. Sojitz has 17 joint ventures in Vietnam, including one with Vinamilk, the country’s largest dairy producer.

- This partnership started construction of a $500-million complex in Vinh Phuc province bordering Hanoi in March 2023 to raise cows and supply beef to northern Vietnam.

- Sojitz develops the Sojitz-Motherson Industrial Park (SMIP) that has an area of around 121 Ha of land on the outskirts of Chennai, Tamil Nadu, India through a joint venture with the Motherson Group starting 2013 – Sojitz 34% and Motherson 66%. The SMIP is the fourth overseas industrial park developed by Sojitz.

- In 2017, Sojitz has partnered with the Science Park of the Philippines, Inc. (“SPPI”), a major developer and operator of industrial parks, to conclude a sales agent agreement for the sale of two industrial parks developed and marketed by the SPPI, Light Industry Science Park (“LISP”) I-IV of 212 Ha and Hermosa Ecozone Industrial Park (“HEIP”) of 162 Ha.

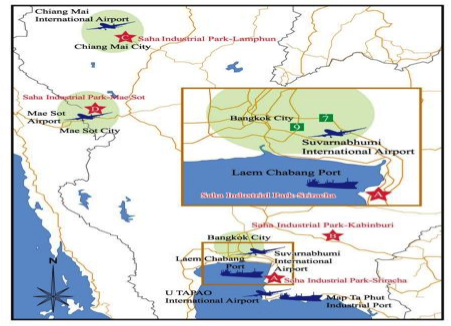

- In June 2019, Sojitz and major Thailand conglomerate Saha Group, have concluded an agreement to have Sojitz act as sale agent for Saha’s 4 industrial parks – Sri Racha of 288 Ha, Kabin Buri of 402 Ha, Lamphun of 371 Ha, and Mae Sot of 24 Ha. Sojitz is also advancing talks with Saha regarding a memorandum which would see the parties agree to use these industrial park sales as the starting point for consideration of joint develop industrial park and other business areas, strengthening the partnership between the two companies. Thailand’s long-term socioeconomic vision for the country—”Thailand 0”— aims to achieve greater industry sophistication and higher added value in the country. The Japan Bank for International Cooperation (JBIC) conducts an annual survey of foreign direct investment by Japan’s manufacturing sector, and in FY2018’s study, Thailand came in third place behind China and India for the most promising country in the medium-term (next three years). The study predicts yet more manufacturers will move into Thailand and expand their production facilities there. Sojitz aimed to offer prospective investors suitable industrial park matched to the client’s needs with 4 above-mentioned options. Furthermore, Sojitz’s support network—both on the Japan side and in Thailand— will provide detail-oriented backup to companies looking to enter Thailand.

EJIP (Sumitomo Corp. 49%, Spinindo Mitradaya 46%, Lippo Cikarang 5%)

- Established in 1990 on 320 Ha of land, hosting 91 tenants. No more saleable land, nor any plans for expansion as of February 2024. EJIP still opens for office and factory rental with various sizing to meet investors’ demand.

- Some of the tenants: Kawai, Schneider Indonesia, Air Liquide Indonesia, Indonesia Epson Industry, Jakarta Kyoai Medical Center, MUFG Bank, ANA Cargo Express.

- Notable Services: Periodic Socialization of New Regulations, Health & Safety, Taxation and Labor Issues; Support for Tenant Operation – from setting up operation, construction and expansion, to visa for foreign workers. EJIP pointed out operational support as their main focus as an industrial park developer, whereas the first measure taken was constructing water and waste water treatment plant, in addition to their Environmental Testing https://www.ejip.co.id/en/business_services https://www.ejip.co.id/en/facilities/e-_lab_ejip_laboratory

- Technology Adoption: Collaborating with PT Telekomunikasi Indonesia, EJIP implemented Microwave Radio Link a stand-alone Telephone Exchanges with a capacity of 10.000 telephone lines, in addition to an extensive Fiber Network Infrastructure covering the entire area, facilitating quick and reliable communication. Leveraging this Fiber Optic infrastructure, any Internet Service Provider (ISP) can deliver a variety of ICT solutions to EJIP’s Looking ahead, EJIP plans to develop ICT service with IoT facility, providing a comprehensive ICT solution package, including high-speed internet connectivity, integrated security services, facial recognition, and real-time traffic conditions.

- Pricing

- ESF: 1500/sqm

- Land Price: US$200-$230/sqm

- Pricing

- Sumitomo Corp. has a robust portfolio in Industrial Park’s overseas investments, including acquiring sales agent license to market industrial plots in Indonesia, Cambodia, Thailand and Marocco. In Indonesia, Sumitomo Corp. was the contracted sales and marketing agent for Surya Cipta Industry (SCI). Established in 1990, SCI is home to more than 147 tenant companies from Europe and Asia including Japan, Korea, China, Taiwan, Belgium, Switzerland, Indonesia and other ASEAN nations.

- Sumitomo Corporation’s industrial park business is on display at its grandest scale in Vietnam, where they have developed several industrial parks in the country: Thang Long Industrial Park in 1997 of 274 Ha; Thang Long Industrial Park II in 2006 of 526 Ha; and Thang Long Industrial Park III in 2015 of 213 Ha, housing a total of 209 tenants and employing around 90,000 people as of the end of 2021. On Q3 of 2023, Sumitomo Corp. and Thanh Hoá People’s Committee have signed a MOU to explore investment opportunities in constructing 650 Ha Industrial Park in the west of Thanh Hoá City, along with the establishment of its 5 Ha logistics and urban centres.

- The project is estimated to be implemented in 2024-2025 with a total capital of US$300-400 million – the 4th industrial park project of Sumitomo Corp. in Vietnam. The government of Vietnam urged Sumitomo Corp. to help Nam Dinh prefecture with a modern, large-scale eco-friendly industrial park. Nam Dinh boasted several advantages including a large population of 2.3 million and its proximity to Hanoi (90 kilometers), with fiber, beer, fabric and apparel as major products.

- Besides Vietnam, Sumitomo has developed the First Philippine Industrial Park (1996) – a 500-hectare SEZ located in the south of Metro Manila, targeting aerospace, automotive, consumer goods, electronics, medical devices, and office equipment; the Thilawa Special Economic Zone in Myanmar (2014) with an area of 632 Ha; Origins, Chennai in India with first development of 107 Ha in 2019. Following these, in 2021, the company started new development of Bangladesh Special Economic Zone (BSEZ) – 83 Ha, and is now expanding BSEZ for Phase 2A starting February 2024 – 107 Ha.

- Sumitomo Corp. aims to provide best-in-class infrastructure utilities to allow uninterrupted production, and supporting services for sound management of operations such as raw material procurement, logistics services, staff recruitment, and administration support etc. for their industrial park tenant companies. Through such “hard and soft infrastructure”, Sumitomo Corp. is committed to a long-term relationship with the customers as partners.

- Bekasi Industrial Estate (BIIE)

- Aiming to offer an optimal industrial site to Korean manufactures that are eager to expand their business to the South East Asian region, Hyundai Corporation has established PT Hyundai Inti Development as a joint venture with Lippo.

- The 200-Ha industrial park is one of 4 industrial areas in the Lippo Cikarang area, around 9 km from Soekarno-Hatta International Airport and 50 km to Tanjung Priok Port. PT Hyundai Inti Development began its first plot presale in 1991, hosting 104 companies including 26 Korean corporations. The tenants come from various industry, from printing to plastics, tires to toy, electronics to garment. The company website is inactive, and no further details were found on Hyundai’s investment portfolio in the Industrial Park business.

- Korean manufacturing companies tend to set up their facilities on a stand-alone basis, unlike the Japanese who prefers to join their communities in the industrial parks. Main concern for Korean players is said to be cost and compliance.

-end-

REFERENCES

- Skylight Analytics Hub

- https://www.petromindo.com/news/article/concerns-arise-over-revised-solar-rooftop-rules

- https://www.petromindo.com/news/article/pln-provides-additional-power-supply-for-freeport-s- smelter-project-1

- https://jakartaglobe.id/business/east-java-explores-mrt-project-in-partnership-with-japan

- https://jakartaglobe.id/business/china-to-build-petrochemical-plant-in-north-kalimantan-luhut

- https://www.petromindo.com/news/article/sembcorp-pln-team-up-to-build-solar-pv-ess-in- nusantara

- https://bit.ly/NewsUpdate04032024

- https://www.petromindo.com/news/article/easterntex-switches-to-pln-for-power-supply-source

- https://wartakota.tribunnews.com/2024/03/09/aen-mall-deltamas-akan-dibuka-22-maret-2024- diklaim-terbesar-se-asia-tenggara

- https://www.sojitz.com/en/csr/priority/advance/post-5.php

- https://www.itochu.co.jp/en/business/general/project/10.html

- https://www.sumitomocorp.com/en/jp/business/case/group/industrial-park

- https://vietnamnews.vn/economy/1550695/sumitomo-group-explores-400m-investment-in- industrial-park-in-thanh-hoa-province.html

- https://marubeni-industrialpark.com/en/

- https://www.sojitz.com/en/csr/priority/advance/post-5.php

- https://loteco.com.vn/en/about-us

- https://www.sojitz.com/en/news/2011/08/20110827.php

- https://www.sojitz.com/en/news/2017/11/20171110.php

- https://www.sojitz.com/en/news/2019/06/20190628.php

- Japan’s Sojitz, Vinamilk builds $500 mln breeding, beef processing complex (theinvestor.vn)

- https://www.kawasanindustri.net/daftar-nama-alamat-pt-di-kawasan-industri-hyundai-lippo- cikarang.html

Disclaimer

The content provided within this biweekly update (“Report”) is proprietary to Skylight and protected under copyright and intellectual property laws. This Report may be shared with relevant parties strictly for informational purposes, provided it remains unaltered and is attributed to Skylight. Unauthorized reproduction, distribution, or use of this Report beyond this condition requires prior written consent. The information and insights shared are intended for general informational purposes only and do not constitute professional advice. Please note that the data, projections, and insights presented herein are subject to updates and changes over time, and may not reflect the latest industry developments. Skylight and its contributors disclaim all liability for decisions or actions taken based on this Report, and no guarantees are made regarding the accuracy, completeness, or outcomes derived from the content. Accessing and using this Report does not create any contractual, professional, or advisory relationship with Skylight. By reviewing this Report, you acknowledge and agree to these terms.

© 2025 Skylight Strategic Indonesia. All rights reserved.