Overview

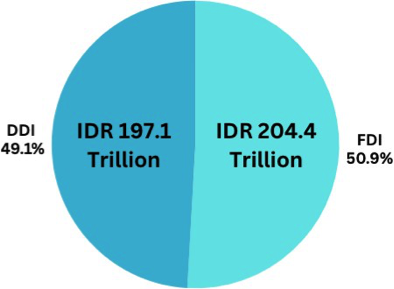

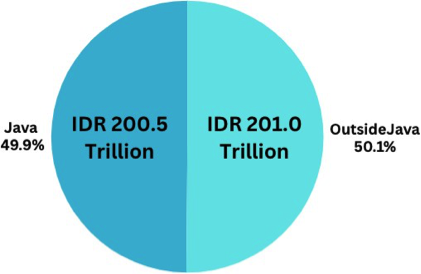

Investment realization in the country in the first quarter of 2024 reached IDR 401.5 trillion, or grew up to 22.1% when compared to the same period in 2023. Based on data from the Ministry of Investment/BKPM, record showed almost equal percentage of investments entering Java (49.9%) and non-Java islands (50.1%). Infrastructure and services recorded 42.1% – the highest investment, followed by 40.2% manufacturing sector, with labor creation of 547,419 workers, the highest in Indonesia’s quartal-based record. FDI Data recorded the first top three investments were in the Basic Metal industry (20.2%), Mining (10.3%), and Transportation, Warehouse and Telecommunication (8.7%). While DDI recorded Transportation, Warehouse and Telecommunication (15.3%), Mining (10.8%) and Food Industry (9.6) as its top three.

BKPM data shows 6 top Islands of FDI and DDI investment realization as the following:

- Java: IDR 5 Trillion (49.9%)

- Sumatera: IDR 73.7 Trillion (18.3%)

- Kalimantan: IDR 2 Trillion (10.3%)

- Sulawesi: IDR 9 Trillion (8.9%)

- Maluku and Papua: IDR 9 Trillion (7.0%)

- Bali and Nusa Tenggara: IDR 3 Trillion (5.5%)

BKPM data shows 5 top locations for FDI and DDI as the following:

- West Java: IDR 7 Trillion (16.1%)

- Jakarta: IDR 4 Trillion (14.5%)

- East Java: IDR 2 Trillion (9.0%)

- Central Sulawesi: IDR 0 Trillion (6.7%)

- Banten: IDR 3 Trillion (6.3%)

Latest Update

- Djarum Group Acquired PT Surya Cipta Swadaya

- PT Surya Semesta Internusa Tbk (SSIA) and PT Anarawata Puspa Utama (APU), entity of Djarum Group agreed on a Sales and Purchase Agreement and Acquisition of shares in the subsidiary company PT Suryacipta Swadaya (SCS). The agreed transaction value is IDR 3.1 trillion, amounting to 36.5% share ownership of PT SCS, while SSIA share of ownership becomes 63.5%.

- SCS has developed the “Suryacipta City of Industry” Industrial Area in Karawang Regency, which has been operating commercially since 1995 and is currently carrying out further development to Subang The Subang Smartpolitan Industrial Park is planned to start commercial operations in 2024.

- It was explained that the industrial area business sector requires large capital, including for the acquisition of land and infrastructure development.

- This capital injection will be used to reduce PT Suryacipta Swadaya’s bank loans, which can indirectly reduce interest costs and increase PT Suryacipta Swadaya competitiveness in the industrial estate business.

- Low Occupancy in West Java’s Industrial Estates

- The West Java Investment and One-Stop Integrated Services (DPMPTSP) Office encourages investment in industrial estates, which currently have a low occupancy Head of DPMPTSP West Java Nining Yulistiani said that of the 38 industrial estates in West Java with an area of more than 28,328 Ha, the tenant occupancy rate in the industrial estate are still low.

- Total occupancy in West Java’s Industrial Estate only reached 54%, some even are still 0, located around Majalengka, Subang and Sukabumi.

- The low level of occupancy occurs in relatively new Industrial Estates, and challenges such as incomplete infrastructure support such as the availability of water, energy, plus a lack of promotion.

- This prompted West Java DPMPTSP to make an agreement with Industrial Estates to conduct joint promotions around West Java, to increase exposure for investors during Forum Percepatan Investor Kawasan Industri 2024.

- New Government Regulation No. 20/2024

- New breakthroughs are being rolled out by the government to polish the attractiveness of industrial estates that are expected to become the center of manufacturing growth in the Most recently, on May 7, 2024 the government issued Government Regulation 20/2024 on Industrial Areas that redesigns industrial clustering and incentive schemes for industrial estates.

- One of the new government regulations regulates fiscal and non-fiscal incentives based on Wilayah Pengembangan Industri (WPI) and Wilayah Pusat Pertumbuhan Industri (WPPI). On the fiscal side, the facilities provided by policy makers are relatively the same as the previous policy, which concerns tax cuts and ease in the customs sector.

- Meanwhile, non-fiscal incentives take the form of land or location provision, training, competency certification, delegation of production rights for a technology whose patent license is owned by the government and other facilities that can be provided by the technical ministry.

- The new Government Regulation also introduces Eco-Industrial Park and its parameter, which will be further stipulated in a Ministerial Regulation.

- US Investment in East Java’s Geothermal Plant

- The U.S. International Development Finance Corporation’s (DFC) Deputy Chief Executive Officer (DCEO) Nisha Biswal announced $126 million investment commitment for the Indonesian power company PT Medco Cahaya Geothermal, an investment that will help strengthen Indonesia’s energy security and contribute to advancing its shared economic goals with the United States.

- The DFC commitment for the company is in coordination with Indonesian infrastructure bank PT Sarana Multi Infrastruktur, the current project financing It will support the development and operation of a new 31MW Phase I power plant, Blawan Ijen Geothermal, which will increase renewable power generation in East Java and provide low-carbon base load power generation capacity to the Java-Bali grid.

- As part of PT Medco’s project, the Blawan Ijen geothermal site in East Java is under a 35-year concession under the Ministry of Energy and Mineral Resources with the plan to develop 2 x 55 MW of power generation capacity.

- Microsoft Announces US$ 1.7 Billion Investment in Indonesia’s cloud and AI Ecosystem

- In April 30, 2024 Microsoft announced it will invest US$1.7 billion over the next four years in new cloud and AI infrastructure in Indonesia. It represents the single largest investment in Microsoft’s 29-year history in the country. The investment announced will enable Microsoft to meet the growing demand for cloud computing services that is growing in Indonesia. It will also allow Indonesia to capitalize on the significant economic and productivity opportunities presented by the latest AI technology.

- According to Kearney, AI could contribute nearly US$1 trillion to Southeast Asia’s GDP by 2030, of which Indonesia alone is poised to capture US$366 billion, and Indonesia Cloud Analytics Market was valued at around USD 13 billion in 2024, and is expected to reach USD 4.21 billion by 2029, reflecting a Compound Annual Growth Rate (CAGR) of 14.52% during the forecast period.

- Microsoft also said it will partner with governments, organizations and communities to provide AI skilling opportunities for 840,000 people in Indonesia. This will help Indonesia face the huge challenge in leveling up its workforce to compete in a technological and globalized era.

- Microsoft announced plans to develop an Indonesian cloud region in Jakarta in February 2021 and is currently building data center in the greater West Java region (KIIC Karawang International Industrial City, the JV of Itochu and Sinar Mas Group). The company hasn’t specified how the new funding will further its previously announced build-out in the country.

- Companies already using Microsoft cloud and AI solutions include Dana, an Indonesian fintech company; PT Kereta Api, a public railway operator; and Telkomsel.

- Other cloud companies operating, or planning to operate, in Indonesia includeHuawei, Google, Alibaba, Tencent and AWS.

- EDGENEX Data Center Announces Investment in Indonesia

- EDGNEX Data Centres by DAMAC Group, a global digital infrastructure provider and part of DAMAC Group, one of Saudi Arabia’s biggest corporations in Real Estate established in the 1982, has announced its investment into the Indonesian market with a state of the art data center to be built in This announcement was made on May 16, 2024. Its investment value is not yet disclosed.

- The first phase of the construction is scheduled to be completed in the fourth quarter of 2025, marking a significant step in the company’s strategic efforts to support the dynamic digital economy and startup economy in This step is part of Jakarta’s preparation to increase its data center capacity to 1GW.

- To support this growth, more colocation data center adhering to sustainable Tier III standards and offering high uptime and reliability are needed to meet the rising demand for internet usage in the region. In response to those needs, EDGNEX helps provide Cloud Service Provider (CSP) and AI Deployment in Indonesia.

- There are 4 Tiers adhering to Data Center given by Uptime Institute classification system, the best tier would be Tier The Indonesian government is actively investing in digital infrastructure, with plans to build four national data centers with Tier IV certification. These centers aim to support the country’s digital transformation by providing highly reliable and resilient data storage and processing capabilities.

- Overall, while Tier III data centers dominate the landscape, the emergence and development of Tier IV facilities mark significant progress in Indonesia’s data center industry, positioning the country as a competitive player in the region.

Flash News

- Potential Investment on Indonesia’s First Nuclear Power Plant

- PT ThorCon Power Indonesia (TPI), a nuclear reactor company originated from the United States (US), is targeting the construction of the very first Nuclear Power Plant in Indonesia with a capacity of 500 MW and total investment value of Rp 17 trillion (USD 1.1 billion).

- The plan to build a nuclear power plant has been communicated by TPI’s party to the government, in this case the Ministry of Energy and Mineral Resources to the Coordinating Ministry for Maritime Affairs and Investment, and is in the middle of proposal making, together with Dewan Energi Nasional for kick-starting the

- The construction of the nuclear power plant may be built in Bangka Belitung Province, which operational target in 2030.

- Evaluation on National Strategic Project

- President Joko Widodo will evaluate all 233 National Strategic Project and 23 Special Economic Zones (SEZs) by the end of June. Projects that do not pass the evaluation will not be continued.

- Susiwijono Moegiarso, Acting Chairman of Deputy 6, Komite Percepatan Penyediaan Infrastruktur Prioritas (KPPIP), said that warnings to business entities have been socialized. The notice was presented through the National Working Meeting Acceleration of National Strategic Project Completion and Pre-Evaluation on May 15,

- The Coordinating Ministry for Economic Affairs gathered more than 200 business entities and persons in charge of the project, giving them 1 month to resolve issues such as land acquisition and permits, before decision is made at the end of June.

- The government divides the evaluation into three stages: preparation, construction and operation, where each project will be supervised. Each project is supervised to ensure feasibility. Key factors in the preparation stage include secured financing, completed land acquisition, and obtained licenses from relevant ministries and

- 81 Indonesian Projects Tendered to China

- China remains a vital source of capital for Indonesia. The investment authority is currently tendering 81 projects across diverse business sectors to Chinese investors, who have consistently contributed to foreign direct investment in Indonesia.

- The 81 projects are included on the list of Regional Investment Potentials that encompasses various sectors, including economic zones, real estate, and tourism.

- In detail, there are currently 14 projects in the agro-industry sector, 2 in the renewable energy sector, 39 in the industry sector, 9 in the infrastructure sector, 4 in the industrial estate and real estate sector, and 13 in the tourism sector, reaching IDR 239 Trillion (around US$ 14.7 billion).

- At the end of last year at the 3rd Belt and Road Summit, Indonesia obtained US$13.7 billion investment commitments at the Indonesia-China business forum, with more potentials to secure investment worth US$29 billion.

- China’s property crisis and weakening consumption should be carefully handled by

- 27 Joint Studies in Oil & Gas Sector

- The Ministry of Energy and Mineral Resources has disclosed plans for 27 joint study projects to be carried out by upstream companies across various oil and gas open areas in Indonesia from 2024 to 2026.

- Seven joint studies have been finalized, while 11 are still ongoing, and 9 areas are being proposed for joint studies. Upon completion of these joint studies, the areas will be converted into new oil and gas exploration blocks and auctioned by the government, with the participating companies granted the right to match the highest bid.

- INPEX and TIS are collaborating on a joint study in Barong, East Java, while TIS is also pursuing separate initiatives in Perkasa, East Java, and Gagah, South Sumatra.

- Petronas has undertaken a joint study project in Seram Aru within the Seram Aru area, and Mubadala is exploring SW Andaman in North Sumatra.

- Kufpec’s joint study efforts are concentrated on Natuna-D Alpha in the Eastern Natuna region, and Enquest is exploring Gaea in the Bintuni area. ExxonMobil is currently conducting a joint study project in the open areas of West Andaman I & II, North Sumatra.

- 10th World Water Forum (WWF)

- The World Water Forum is one of the largest water-related gathering that is jointly organized by the World Water Council, takes place every three years. This year Indonesia became the host for the 10th World Water Forum, with a total participant of 64,000, 106 countries and 27 organizations.

- The 10th World Water Forum produced three main points in its declaration

- First, establish Center of Excellence to support water and climate

- Second, pursue discussions related to integrated water resources for a number of countries and small islands.

- Third, propose for World Lake Day to increase dam construction and maintenance of existing dams.

- Ministerial Declaration also puts in Compendium of Concrete Deliverables and Actions, covering 113 water and sanitation projects worth US$9.4 billion with 33 countries and 53 international organizations as proponents, donors and beneficiaries of water and sanitation.

-end-

REFERENCES

- Skylight Analytics Hub

- https://www.bkpm.go.id/id/info/siaran-pers/investasi-luar-jawa-kembali-unggul-bahlil-ungkap- ekosistem-investasi-berkualitas-terus-terbentuk

- https://investasi.kontan.co.id/news/grup-djarum-jadi-investor-di-anak-usaha-ini-rekomendasi- saham-surya-semesta-ssia

- https://bandung.bisnis.com/read/20240515/550/1765769/okupansi-31-kawasan-industri-di- jabar-masih-rendah

- https://id.usembassy.gov/united-states-announces-new-126-million-commitment-for-ambitious- indonesian-geothermal-project/

- https://www.goodnewsfromindonesia.id/2024/05/27/as-investasi-rp2-triliun-untuk-proyek-plt- panas-bumi-di-jawa-timur

- https://www.datacenterdynamics.com/en/news/microsoft-to-invest-17bn-in-indonesia-cloud- and-ai- computing/#:~:text=Microsoft%20announced%20plans%20to%20develop,build%2Dout%20in%20 the%20country.

- https://www.linkedin.com/pulse/indonesia-cloud-analytics-market-forecast-2024-2030-sai-prem- uhfnc/

- https://ciosea.economictimes.indiatimes.com/news/data-center/edgnex-data-centres- announces-a-15-mw-data-center-investment-in- indonesia/110378663#:~:text=EDGNEX%20Data%20Centres%20by%20DAMAC,2024%20on%20M ay%2016%2C%202024.

- https://www.cnbcindonesia.com/news/20240430121325-4-534601/perusahaan-as-mau-bangun- nuklir-di-ri-senilai-rp-17-triliun

- https://bisnis.tempo.co/read/1867691/agar-tak-jadi-proyek-mangkrak-jokowi-akan-evaluasi- seluruh-psn-dan-kek-juni-mendatang

- https://www.pwc.com/id/en/media-centre/infrastructure-news/may-2024/81-projects-tendered- to-china.html

- https://www.petromindo.com/news/article/government-unveils-27-joint-study-projects-in-oil- and-gas-sector

- https://kemenparekraf.go.id/berita/siaran-pers-world-water-forum-2024-world-water-forum-ke- 10-resmi-ditutup-indonesia-mendapat-apresiasi

Disclaimer

The content provided within this biweekly update (“Report”) is proprietary to Skylight and protected under copyright and intellectual property laws. This Report may be shared with relevant parties strictly for informational purposes, provided it remains unaltered and is attributed to Skylight. Unauthorized reproduction, distribution, or use of this Report beyond this condition requires prior written consent. The information and insights shared are intended for general informational purposes only and do not constitute professional advice. Please note that the data, projections, and insights presented herein are subject to updates and changes over time, and may not reflect the latest industry developments. Skylight and its contributors disclaim all liability for decisions or actions taken based on this Report, and no guarantees are made regarding the accuracy, completeness, or outcomes derived from the content. Accessing and using this Report does not create any contractual, professional, or advisory relationship with Skylight. By reviewing this Report, you acknowledge and agree to these terms.

© 2025 Skylight Strategic Indonesia. All rights reserved.