Overview

The Minister of Energy and Mineral Resources issued Keputusan Dirjen Ketenagalistrikan Nomor 279.k/TL.03/DJL.2/2024 tentang Kuota Pengembangan Sistem PLTS Atap PLN Tahun 2024-2028, to stipulate rooftop solar panel quota from 2024-2028.

The Indonesian Solar Energy Association (AESI) welcomes the decision as it provides certainty to domestic businesses, giving a positive sentiment for the country’s solar power industry. The Government of Indonesia set an installed capacity quota throughout Indonesia for rooftop solar power plants of 901 megawatts (MW) in 2024; 1,004 MW in 2025; 1,065 MW in 2026; 1,183 MW in 2027; and 1,593 MW in 2028. From these numbers, Java, Madura and Bali as one of the 11 clusters still dominates the quotas with 825 MW in 2024; 900 MW in 2025; 910 MW; 1,010 MW and 1,400 MW from 2026 to 2028 respectively.

Highlighting Pharmaceutical Industry Development In Indonesia

The Indonesian pharmaceutical market has been growing at a steady pace in recent years, driven by a number of factors. One key trend is the increased availability of healthcare services, particularly in rural areas. This has led to a growing demand for pharmaceuticals as more people have access to healthcare. Another trend in the Indonesian pharmaceutical market is the increasing use of e-commerce platforms to purchase drugs. This has made it easier for consumers to access pharmaceutical products, particularly in areas where traditional brick-and-mortar pharmacies are scarce.

Minister of Industry, Agus Gumiwang, has stated that the Government of Indonesia is prioritizing the development of the pharmaceutical and medical device industries to enhance global competitiveness in line with the National Industrial Development Master Plan (Rencana Induk Pengembangan Industri Nasional / RIPIN) 2015-2035, the Job Creation Law, and the Domestic Product Use Improvement (P3DN) program.

Data shows total investment in Indonesia’s pharmaceutical sector reached USD 1.46 billion in 2019, USD 1.74 billion in 2020 and USD 1.69 billion in 2021. In 2022, the investment increased to around USD 1.8 billion. Notably, in the first semester of 2022, Indonesia secured a significant investment of USD 1.7 billion from Japan, which accounted 94% of the total pharmaceutical investment in that period. Japan has secured positioning in Indonesian pharmaceutical market, nevertheless there are some entry barriers for the existing and new players for business expansion and new product development. Indonesia and Japan have been seeking more collaboration opportunities to grow the industry through various platforms, seeking more support from Japan with its advancement in drug monitoring system and technology in biological products, generative medicine and therapeutic medicine.

South Korea has conveyed interests in investing in the Indonesian pharmaceutical industry, looking at the annual 5%-6% growth of the global pharmaceutical market and Indonesia’s growing population, increased spending power and health awareness will lead to an average 11.8% growth of the domestic pharmaceutical market over the next five years. It was recorded that in 2012, Daewoong Pharmaceutical explored the Indonesian market by establishing Daewoong Infion, collaborating with the local pharmaceutical company ‘Infion’ to localize the pharmaceutical business by building the first biopharmaceutical factory in Pandaan – Pasuruan, East Java, producing erythropoetin (a biosimilar product to help the formation of red blood cells in anemia for people with kidney failure and cancer). The Epodion product, which is produced by Daewoong in Indonesia, has secured a significant market share in Indonesia since 2017 and obtained halal certification in 2020. The success of mapping the domestic supply chain and handling challenges in the Indonesian pharmaceutical sector has encouraged Daewoong Pharmaceutical to bring in more investments to generate high added value in the Indonesian biopharmaceutical industry. Construction of medical clinics and production facilities is currently underway in Bali and Cikarang. In 2024 Daewoong Pharmaceutical has obtained permission to establish a stem cell processing laboratory in Indonesia, which will strengthen its steps in developing the regenerative medicine business in Indonesia.

Indonesia’s pharmaceutical market is projected to reach a revenue of USD 3.52 billion by 2024, with an expected annual growth rate of 6.04% from 2024 to 2028, culminating in a market volume of USD 4.45 billion by 2028. As of 2023, European Union countries remain the largest investors in the pharmaceutical industry and the 8th largest investors in healthcare.

Indonesian consumers have become increasingly health-conscious in recent years, leading to a growing demand for pharmaceutical products. The country’s large and growing middle class is also driving demand for higher-quality healthcare, including pharmaceuticals. As a result, there is a growing demand for both branded and generic drugs, while Indonesia has a large and highly fragmented pharmaceutical market with a large number of domestic and international players which has led to intense competition in the market, with companies vying for market share through aggressive marketing and pricing strategies. Data shows that local manufacturers primarily focus on producing low-cost generic products, over-the-counter (OTC) medicines, and traditional treatments. Pharmaceutical industry in Indonesia has a heavy reliance on imported raw materials, which increases production costs for local pharmaceutical products. This dependency on imports also makes patented medicines unattractive for many Indonesian consumers, leading to a preference for low-cost generic medicines. For that reason, the government continues to open promising opportunities for companies to invest in the raw material sector for the pharmaceutical and medical device industries by providing incentives of Tax Holiday, Mini Tax Holiday or Super Deduction Tax, a gross income reduction of up to 300% to companies involved in vocational education programs, including research and development to encourage more innovation. The incentives are deemed insufficient in stimulating more investments in the industry.

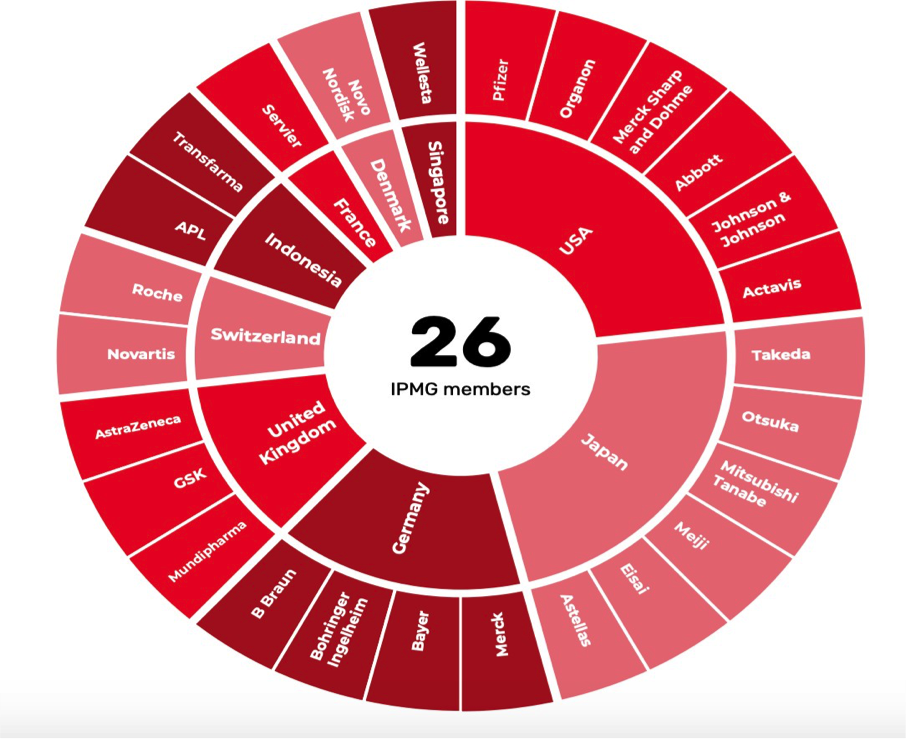

According to Fitch Solutions, a part of the Fitch Group which is one of the Big Three Rating Agencies alongside S&P Global and Moody’s, Indonesia hosts over 200 pharmaceutical manufacturers and distributors, including 29 multinational companies. Out of the 29 multinational companies, most are registered as part of the International Pharmaceutical Manufacturers Group (IPMG) association, one of the biggest research and development-based for multinational pharmaceutical industry association in Indonesia. Our desktop review managed to identify 26 out of the 29 multinational companies as shown in the following figure.

Most of the 26 companies’ manufacturing facilities are located in West Java such as Jakarta, Bogor, Bekasi, Cikarang, Karawang and Bandung. Glaxo Welcome and Smithkline, the 6th biggest pharmaceutical company in the world is located in Jakarta Industrial Estate (JIEP), alongside 2 of Indonesia’s biggest pharmaceutical company, Kimia Farma and Kalbe Farma; B Braun, a pharmaceutical from German, is located in Kawasan Industri Indotaise Karawang.

Some chose their facilities development in East Java, such as Japan Otsuka in Lawang on a 4 Ha of land; USA Organon in Pandaan; Japan Meiji in Pasuruan; and Bayer’s Crop Science’s supply centre production facility, producing chemical plants, grain and product protection for the environment located in SIER Surabaya. Astellas Pharma, AstraZenecca, MSD, Novo Nordisk, Roche, only operate their representative offices in Jakarta. Other Japanese pharmaceutical companies that are not part of IPMG such as Taisho Pharmaceutical Indonesia, one of Japan’s leading pharmaceutical, has its facilities located in Depok – West Java; Hisamitsu Pharma Indonesia, known for their Salonpas products, is located in Sidoarjo – East Java.

Latest Update

- Handal Motor’s New Automotive Factory

- PT Handal Motor Indonesia, a car assembly company for Chery, Neta and Jetour is building a new car assembly factory in Intergrated Industrial Park Purwakarta or IIP Purawakarta, with a land area of 38 Ha, and a total investment of IDR 1 Trillion.

- It is claimed that Handal’s factory in Purwakarta will have 3x more capacity than the one they have currently in Pondok Ungu, Bekasi for the production of Chery, Neta and Jetour. The factory in Pondok Ungu, Bekasi is located on a 12 Ha of land, with a production capacity 30,000 units per year, while the one in IIP Purwakarta will be able to produce 90,000 units per year.

- One reason for its expansion is due to the new collaboration with 3 Chinese automotive companies—Zeekr, Xpeng, and Geely.

- Sumitomo Exits Kayan Hydropower Project

- Sumitomo Corporation and PT Kayan Hydro Energy (KHE) have officially ended their cooperation in the development of the Kayan Cascade Hydropower Plant (PLTA), in Bulungan Regency, North Kalimantan.

- Sumitomo entered the Kayan Cascade hydropower project in 2022 and ended the cooperation in the 1st Quarter of 2024 due to a different perspective with KHE.

- Kayan Hydropower has an estimated investment value of USD 17.8 Billion, will be Southeast Asia’s largest hydropower with an ultimate capacity of 9000 MW, supplying some new industrial parks in Kalimantan and Nusantara new capital city.

- The project targeted completion in 2035 through staging development of 900 MW as its initial capacity, followed by the second phase of 1,200 MW, the third and fourth phases of 1,800 MW each, and the fifth phase of 3,300 MW.

- KHE is in talks with alternative investors. The project owner is targeting to secure partnerships with Japanese top players, while opening potential collaborations with South Korea and China.

- Indonesia Investment Forum Tokyo 2024

- Indonesia Investment Forum Tokyo 2024, which was held on June 5 in Embassy of Indonesia in Tokyo, was attended by 100 Japanese participants. Mitsubishi Logistics was one of the attendees shared their experience and investment prospects in

- The event was wrapped up by a One-on-One Business Matching for six projects namely: Candi Umbul Telomoyo Geothermal Power Plant Central Java, Hydroelectric Power Plant South Kalimantan, Solar PV Plant in West Nusa Tenggara, Bakung Waste to Refuse Derived Fuel (RDF) in Lampung, LNG/Energy Hub in East Java, and Seaweed Farming in South Sulawesi.

- This forum resulted in six investment deals, including:

- Cooperation agreement in developing battery energy storage system projects of collaboration between Gotion Japan, Wiraraja Indonesia, Dravara Investama and Greenbank Japan.

- Letter of Intent (LoI) for Geothermal Project in Central Java

- LoI for Seaweed Farming in South Sulawesi

- LoI for Investment in Japanese restaurants in Indonesia by Treat Ltd. and JP Nusantara Inc.

Flash News

- Minister of Industry Offers Turkey the Development of Halal Industry

- Minister of Industry, Agus Gumiwang Kartasasmita, paid a working visit to Istanbul and Ankara, Turkey, on June 4-5, 2024.

- Turkey’s total investment in Indonesia from 2019 to 2023 reached USD 42.758 mio, bringing Turkey ranked 43rd among countries investing in Indonesia.

- Some of the potential priority sectors to be further explored include the defense industry, EV battery industry, cooperation between Industrial Parks, and the development of halal industry since both Indonesia and Turkey are considered as Muslim-majority country.

- Turkey is considered to have good capabilities in the food and beverage industry, and Indonesia can become its production hub for halal products.

- Some of Turkish companies that have already invested in Indonesia are Consumer Durables, Arcelik, a home appliance company and the second largest in the world, and part of KOC Holding. In Indonesia, the company has partnered with Hitachi to produce washing machines at a plant located in Karawang, West Java.

- Arcelik also plans to expand its production capacity in Indonesia by establishing a new factory for air-conditioning and refrigerator products in Semarang, Central

- Another company is Kordsa, that has invested USD 21 mio and currently has a manufacturing facility in Bogor, West Java, to produce export-oriented nylon, yarn and other rubber industry preparation.

- Potential of New Freeport Smelter in Papua

- Investment Minister Bahlil Lahadalia said the government asked PT Freeport Indonesia (PTFI) to build a copper smelter either in Timika or Industrial Park Fakfak, located in Papua, after the completion of its Gresik refining facilities. The construction of this smelter is one of the main conditions for extending Freeport Indonesia’ special mining business permit expiring in 2041.

- Another condition is a 10% share divestment from Freeport Indonesia to the Indonesian government through MIND ID. The new Papua smelter and 10% additional shares are some of the conditions for early approval of the permit extension, which will give Freeport investment certainty to 2061.

- Nusantara Capital City Obtains New Investment Commitment of IDR 45 Trillion

- The Authority Agency of Nusantara New Capital City has received an additional investment commitment of IDR 45 trillion for the development of the new capital in Kalimantan from 9 foreign companies originated from Malaysia, China and the United Arab Emirates. The companies began conducting feasibility studies (FS) to build projects in the housing and renewable energy sectors.

- The total investment in the Nusantara Project from 2023 to June 2024 has reached IDR 51.3 trillion from private investment. The Indonesian Authority targeted more investments to IDR 100 trillion in 2024. President Jokowi has conducted 6 groundbreaking ceremonies in Nusantara.

- Currently investors who have invested in Nusantara only have the status of Right to Build (HGB) on Right to Manage (HPL). Continuous discussions are in progress within government institutions to discuss whether investors can have extended Right to Build or conversion to pure Right to Build. Further rules will be regulated in an upcoming Presidential Regulation.

- Emaar Property’s Interest in Building Financial Center in Nusantara

- The developer of the world’s tallest building Burj Khalifa, Emaar Properties, is reportedly interested in investing in Nusantara Capital City Project, after being invited to consecutive tour to Bali Nusa Dua, Lombok Mandalika, and Kalimantan

- Minister of Public Works and Public Housing (PUPR) as the Acting Head of the Nusantara Capital Authority, Basuki Hadimuljono revealed that Emaar Properties plans to build an economic center or financial center, with similar concept to Jakarta’ Sudirman Central Business District (SCBD).

- President Jokowi is sending a team led by the Ministry of State-Owned Enterprises and Investment to Abu Dhabi for further discussions with Mohamed Ali Rashed Alababbar, Board of Director of Emaar Property, expecting a signing agreement this upcoming July 2024 in Abu Dhabi, opening more opportunities for investments coming from the Middle East.

- The United Arab Emirates (UAE) ranked the 27th for FDI in Indonesia since 2018, pouring at least USD 213 mio from 2018-2023, making UAE as the lead country from the Middle East investing in Indonesia. This investment realization is considered small considering UAE’s reputation in their money spending.

-end-

REFERENCES

- Skylight Analytics Hub

- https://www.cnbcindonesia.com/news/20240604104152-4-543613/sah-esdm-tetapkan-kuota- plts-atap-pln-2024-2028-ini-datanya

- https://ekonomi.bisnis.com/read/20221009/257/1585616/investasi-jumbo-dari-jepang-masuk- ke-industri-farmasi-indonesia

- https://www.pom.go.id/berita/bpom-kolaborasi-dengan-pmda-jepang-untuk-perkuat-hubungan- indonesia-jepang

- https://www.marketeers.com/daewoong-pharmaceutical-dorong-pertumbuhan-industri- kesehatan-indonesia/

- https://industri.kontan.co.id/news/daewoong-pharmaceutical-mendapat-izin-laboratorium- pengolahan-sel-punca-di-indonesia

- https://www.diklatkerja.com/blog/menilik-peta-persaingan-industri-farmasi-di-indonesia https://www.pwc.com/id/en/publications/deals/mergers-acquisition-update-2023.pdf https://www.statista.com/outlook/hmo/pharmaceuticals/indonesia#analyst-opinion

- https://www.bayer.com/en/id/indonesia-supply-center-crop- science#:~:text=Crop%20Science’s%20supply%20center%20is,protection%20products%20for%20t he%20environment.

- https://www.liputan6.com/saham/read/4591906/melihat-peta-persaingan-sektor-farmasi-di- indonesia?page=3

- https://oto.detik.com/berita/d-7368893/handal-bangun-pabrik-mobil-baru-di-purwakarta-3-kali- lebih-besar-dari-pabrik- bekasi#:~:text=PT%20Handal%20Indonesia%20Motor%20(HIM,yakni%20Chery%2C%20Neta%20d an%20Jetour.

- https://ekonomi.bisnis.com/read/20240531/44/1769922/proyek-plta-kayan-ditinggal-sumitomo- dilirik-hashim-djojohadikusumo

- https://m.antaranews.com/berita/4138899/indonesia-investment-forum-tokyo-hasilkan-enam- kesepakatan-investasi

- https://industri.kontan.co.id/news/dua-wilayah-ini-dipertimbangkan-jadi-lokasi-pembangunan- smelter-freeport-di-papua

- https://ekonomi.bisnis.com/read/20240610/45/1772776/klaim-investasi-ikn-9-perusahaan-siap- gelontorkan-rp45-triliun

- https://nasional.kontan.co.id/news/pengembang-burj-khalifa-minat-investasi-di-ikn-garap-apa

- https://www.cnnindonesia.com/ekonomi/20230515130219-532-949684/daftar-investasi-negara- muslim-di-ri-yang-disebut-bahlil-minim