Government Regulation No. 20 of 2024: Industrial Zoning as a Catalyst for Economic Growth

By Sonia Adriaty – Industrial Park

Planned industrial zoning plays a critical role in Indonesia’s national economic development strategy. The manufacturing sector remains a key contributor to both GDP—accounting for 19.02% as of August 2024—and employment, supporting over 20 million jobs. However, to remain competitive with regional peers such as China, India, Vietnam, and Malaysia, Indonesia must adopt more structured, equitable, and investment-friendly industrial development policies.

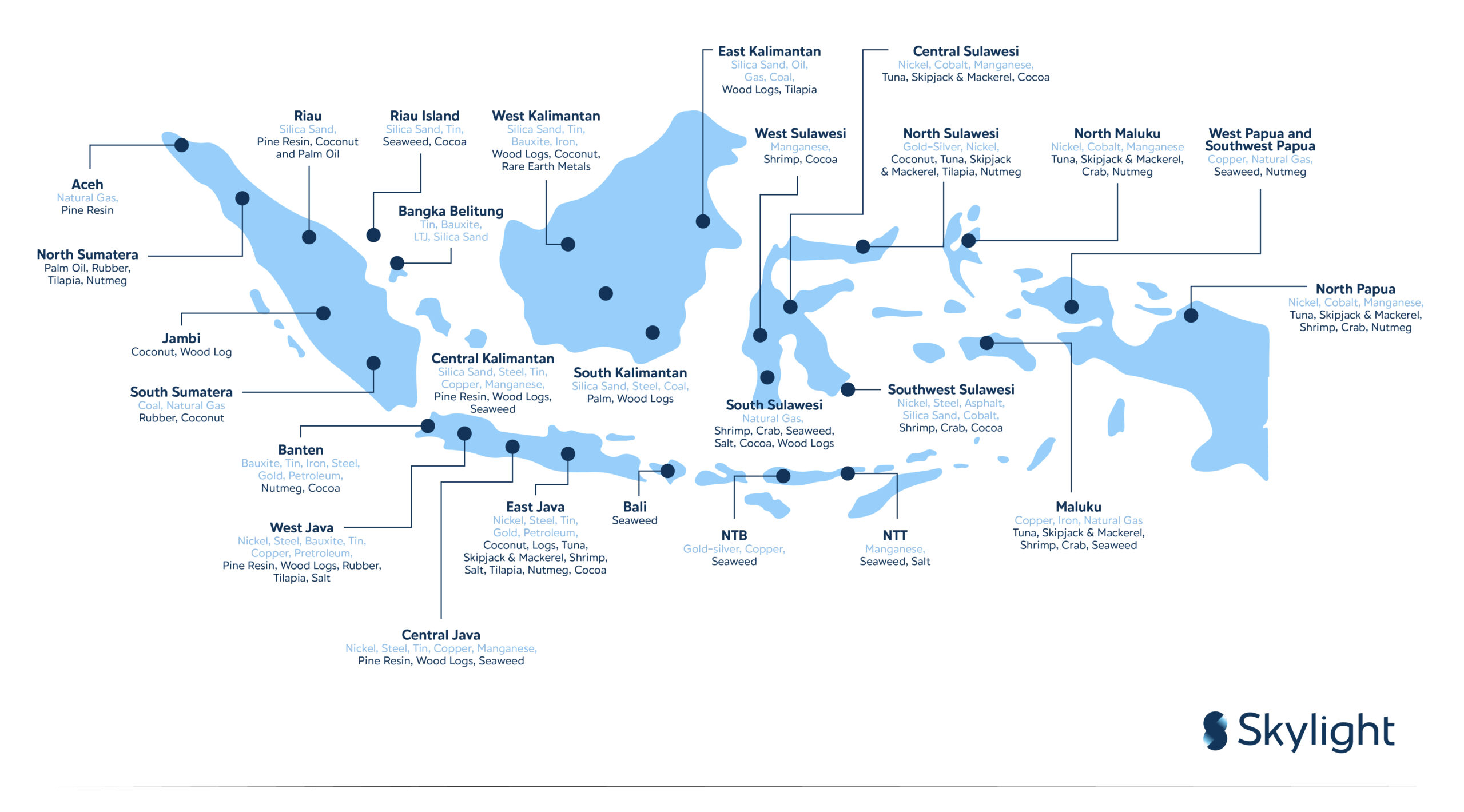

In line with the national economic growth target of 8% for the 2024–2029 period, President Prabowo has emphasized downstream processing as a core strategy. This policy aims to boost the value-added potential of natural resources, accelerate industrialization, and attract investment into the manufacturing sector. In this context, industrial zoning must support more efficient supply chains and enhance the global competitiveness of Indonesian products.

To this end, the government has enacted Government Regulation (PP-Peraturan Pemerintah) No. 20 of 2024 on Industrial Zoning, designed to improve production efficiency, promote balanced regional development, and strengthen the competitiveness of Indonesian industry. The regulation is expected to stimulate greater manufacturing investment across the country, foster new economic growth centers, and enable more inclusive and sustainable industrialization.

PP No. 20/2024: A Framework for Expanding the Manufacturing Sector

PP No. 20/2024 outlines several key objectives:

- Distribute industrial activity more evenly across Indonesia’s territory.

- Increase investment in manufacturing outside Java.

- Develop new industrial growth centers.

- Maximize the use of local resources to produce high-value, competitive products.

- Build a competent industrial workforce as part of a sustainable resource ecosystem.

- Streamline coordination across levels of government in regional industrial development.

Zoning Structure: 4 Industrial Growth Regions

Indonesia’s territory is divided into four types of Industrial Growth Regions (WPI-Wilayah Pertumbuhan Industri) based on resource connectivity, infrastructure availability, and economic linkages:

- Advanced Industrial Growth Regions: Java and Northern Sumatra (Batam, Bintan, Karimun)

- Developing Industrial Growth Regions: Southern Sulawesi, Eastern Kalimantan, the rest of Northern Sumatra, Southern Sumatra

- Potential Industrial Growth Regions I: Northern Sulawesi and Maluku, Western Kalimantan, Bali and Nusa Tenggara

- Potential Industrial Growth Regions II: Eastern and Western Papua

To drive economy for the Industrial Growth Regions, there are 4 Pillars of Industrial Zoning Implementation:

- Industrial Growth Centers (WPPI-Wilayah Pusat Pertumbuhan Industri) Designated hubs for regional economic development, prioritizing resource utilization, infrastructure enhancement, and integrated economic planning.

- Industrial Designated Areas (KPI-Kawasan Peruntukan Industri) Zones marked in spatial plans specifically for industrial use to prevent land-use conflicts and improve infrastructure planning. These are managed by local governments.

- Industrial Parks Fully developed industrial parks equipped with utilities, logistics, and services. Managed by state entities or private developers, these Parks offer a conducive environment for industrial investment.

- SME Industrial Clusters (IKM-Industri Kecil dan Menengah) Areas focused on the development of small and medium-sized industries through access to facilities, training, and market development, often managed by local governments or cooperatives.

Well-planned industrial zoning also enhances access to infrastructure, streamlines logistics, reduces distribution costs, and improves manufacturing competitiveness. Integrated industrial ecosystems—where raw materials, labor, and production are co-located—offer a major productivity advantage.

From an investment perspective, the regulation brings greater clarity and certainty, reinforced by fiscal incentives such as tax holidays, streamlined permitting, and government-backed infrastructure development. This pro-investment approach makes Indonesia increasingly attractive to both domestic and international manufacturers.

Industrial Zoning as the Engine of Downstreaming and Industrialization

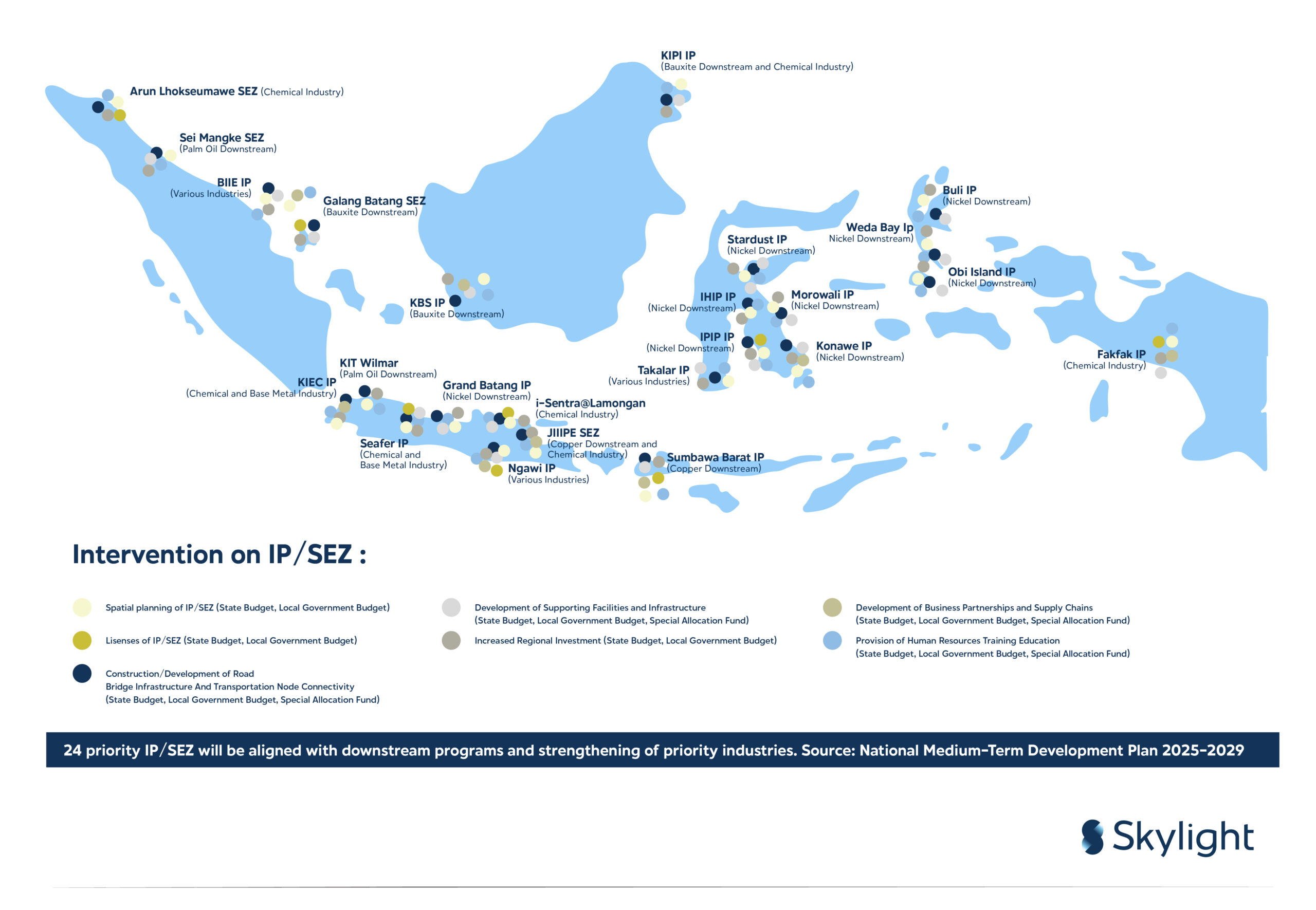

Industrial zoning is pivotal in supporting Indonesia’s economic growth ambitions. As of November 2024, 165 Industrial Parks were operating across the country, contributing significantly to GDP. Notably, Jababeka and Batam Free Trade Zone accounted for 12% of manufacturing output and 7% of national exports, respectively.

Each 1% increase in industrial growth creates 400,000–500,000 jobs. The manufacturing sector employed over 19 million workers in 2024 and is expected to expand further with Industrial Park development. Investment in industrial zones grew by 15% YoY in 2023, while rising wages have supported a 5.2% increase in domestic consumption.

Despite manufacturing’s 19.02% GDP share in 2024, it remains below its 2010 peak of 25% (World Bank). The government’s industrial downstreaming policies—such as the ban on raw nickel exports—have increased the value of processed nickel exports from $3.3 billion (2019) to $30 billion (2023). Similarly, palm-based biodiesel exports rose by 45% in 2023 following the B35 mandate (GAPKI).

Downstreaming is focused on three key sectors: agro-based industries, mining and minerals, and oil and gas. This strategy has spurred the emergence of high-value industries and enhanced Indonesia’s global trade competitiveness.

Aligning Zoning with Investment and Export Strategies

To catalyse Industrial Park growth, the government has strengthened fiscal incentives, attracting $22.3 billion in manufacturing FDI in 2023—the highest since 2019 (BKPM). In parallel, import regulations are being tightened to support domestic industries.

Import substitution policies such as the Domestic Product Use Program (P3DN) have saved $8.2 billion in foreign exchange by reducing reliance on textile and steel imports. Industrial zoning, together with these import-substitution and export-promotion efforts, forms the backbone of Indonesia’s industrial policy—reducing trade deficits and improving global competitiveness.

The next priority is accelerating Industrial Park development outside Java, particularly in Kalimantan and Sulawesi, to distribute economic benefits more evenly across the archipelago.

Strategic Instruments to Achieve 8% Economic Growth

PP No. 20/2024 serves as a strategic instrument to foster inclusive and sustainable economic growth by strengthening industrial ecosystems, enhancing competitiveness, and accelerating investment. Nonetheless, several challenges must be addressed—uneven infrastructure, bureaucratic bottlenecks, and limited workforce readiness among them.

Key Strategic Opportunities

- Natural Resource-Based Downstreaming: Indonesia holds the world’s largest nickel reserves (5.24 billion tons), the highest global palm oil output (49.7 million tons), and is the second-largest producer of seaweed (9.2 million tons). Targeted downstreaming in regions such as Obi Island (Maluku) and North Kalimantan can unlock significant value-added potential.

The 2025–2029 National Medium-Term Development Plan (RPJMN) emphasizes continued downstreaming, focusing on:

- Nickel, copper, and bauxite processing

- Labor-intensive industries (e.g., textiles)

- High-tech sectors (e.g., semiconductors, aerospace)

- Basic industries (e.g., steel, chemicals)

- Strategic industrial zones such as Batang, Sei Mangkei, and Weda Bay

2. Green Industry and Smart Industrial Parks: The global green economy is projected to reach $10 trillion by 2030. Indonesia is piloting eco-industrial parks (e.g., KIIC, supported by UNIDO). Smart park models using IoT and AI have demonstrated up to 30% operational efficiency improvements.

3. Public-Private Partnerships (PPP) for Infrastructure: Successful PPP projects, such as Kendal Industrial Park (Java) and the Halmahera nickel downstreaming initiative, highlight the viability of co-investment strategies between the government and international partners (e.g., Singapore, China).

4. Digital Manufacturing and Innovation: Adoption of cloud computing and AI in manufacturing is growing at 25% annually (Google–Temasek, 2023), supported by the Making Indonesia 4.0 roadmap. The government has allocated IDR 1,200 trillion for industrial R&D.

Conclusion: A Platform for Industrial Transformation

PP No. 20/2024 provides the regulatory foundation for a transformative shift in Indonesia’s industrial landscape. While technical guidelines and implementation plans are still being finalized, regulatory acceleration is urgently needed.

In parallel, the government should consider introducing a dedicated regulation—or even an Industrial Parks Law—to further strengthen legal certainty and investment attractiveness. With robust infrastructure, clear regulations, and strong support for innovation and exports, Indonesia is well-positioned to emerge as a globally competitive manufacturing hub.

Achieving this vision requires close collaboration between the government, private sector, and civil society to build a sustainable and globally competitive industrial ecosystem.

Source

- Skylight Analytics Hub

- Ministry of Investment/BKPM, Investment Realization Report (2024)

- World Bank, Logistics and Doing Business Reports (2023)

- Coordinating Ministry for Economic Affairs, National Infrastructure Evaluation (2023)

- Google-Temasek, Southeast Asia Digital Economy Report (2023)

- Ministry of Industry, Making Indonesia 4.0 (2018)

- Government Regulation No. 20/2024 on Industrial Zoning

- National Medium-Term Development Plan (RPJMN) 2025–2029

- Statistics Indonesia (BPS), Official Releases (2024)

Disclaimer

The content on this platform (“Platform”) is proprietary to Skylight, protected under copyright and intellectual property laws, and cannot be reproduced or used without written authorization. The insights shared are for informational purposes only, do not constitute professional advice, and may not reflect the latest industry developments. Skylight and its contributors disclaim all liability for actions taken based on the content and do not guarantee specific outcomes from past insights or case studies. Use of the Platform does not establish any contractual or advisory relationship with Skylight. By accessing this Platform, you agree to these terms. © 2025 Skylight Strategic Indonesia. All rights reserved.