Highlighted Topic: Indonesia’s Interest for a Family Office

The government is currently developing various measures to ensure the success of Family Office implementation. On January 16, 2025, Luhut Binsar Pandjaitan, as the head of National Economy Council (DEN), proposed for Family Office to be established in the country in February 2025. The establishment of Family Office initiated by the Indonesian government has been fervently discussed since mid-2024. A Family Office itself is a private wealth management advisory firm that serves Ultra-High-Net-Worth Individuals (UHNW). Family Offices are different from traditional wealth management shops, in that they offer a total solution to managing the financial and investment needs of an affluent individual or family of a minimum USD 50 million –USD 100 million, to billions of dollars of wealth management.

InvestHK’s Associate Director-General of Investment Promotions, Charles Ng welcomed the Indonesian government’s plan and is willing to help in establishing a Family Office in Indonesia. He believes that Indonesia can adopt the Family Office model as implemented in Hong Kong with adjustments to local needs. Invest Hongkong or InvestHK is the Hong Kong Special Administrative Region (HKSAR) Government Department responsible for Foreign Direct Investment in the country.

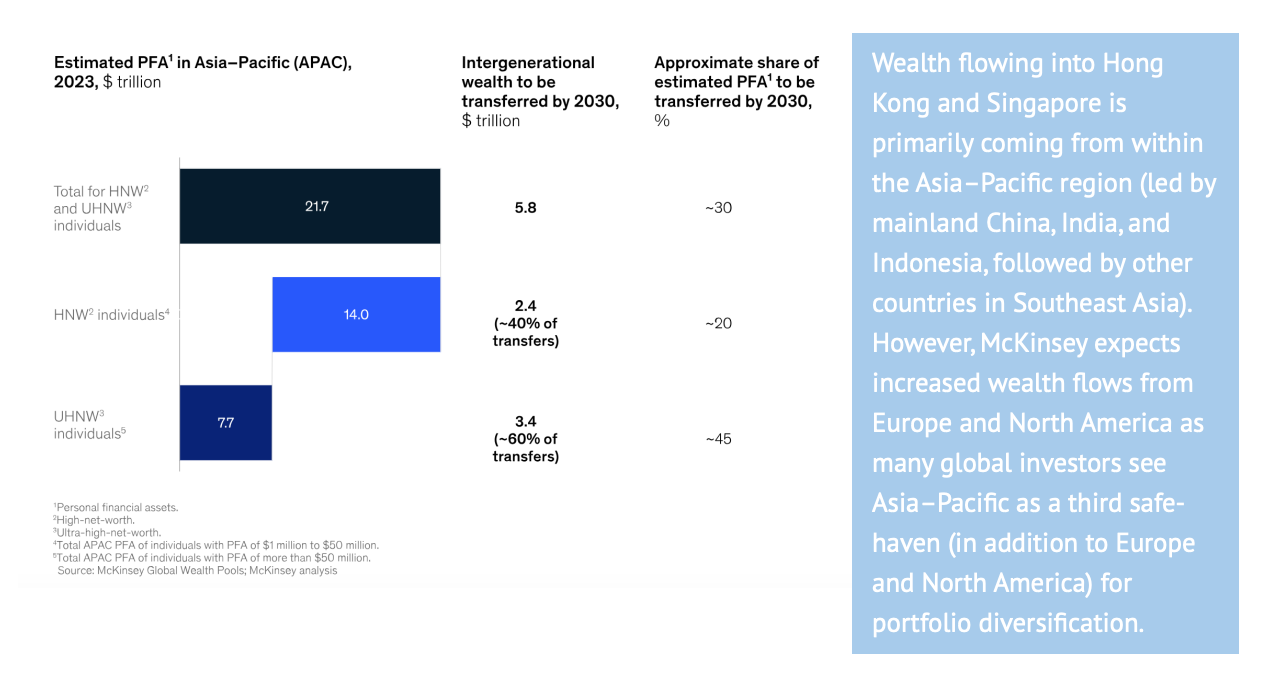

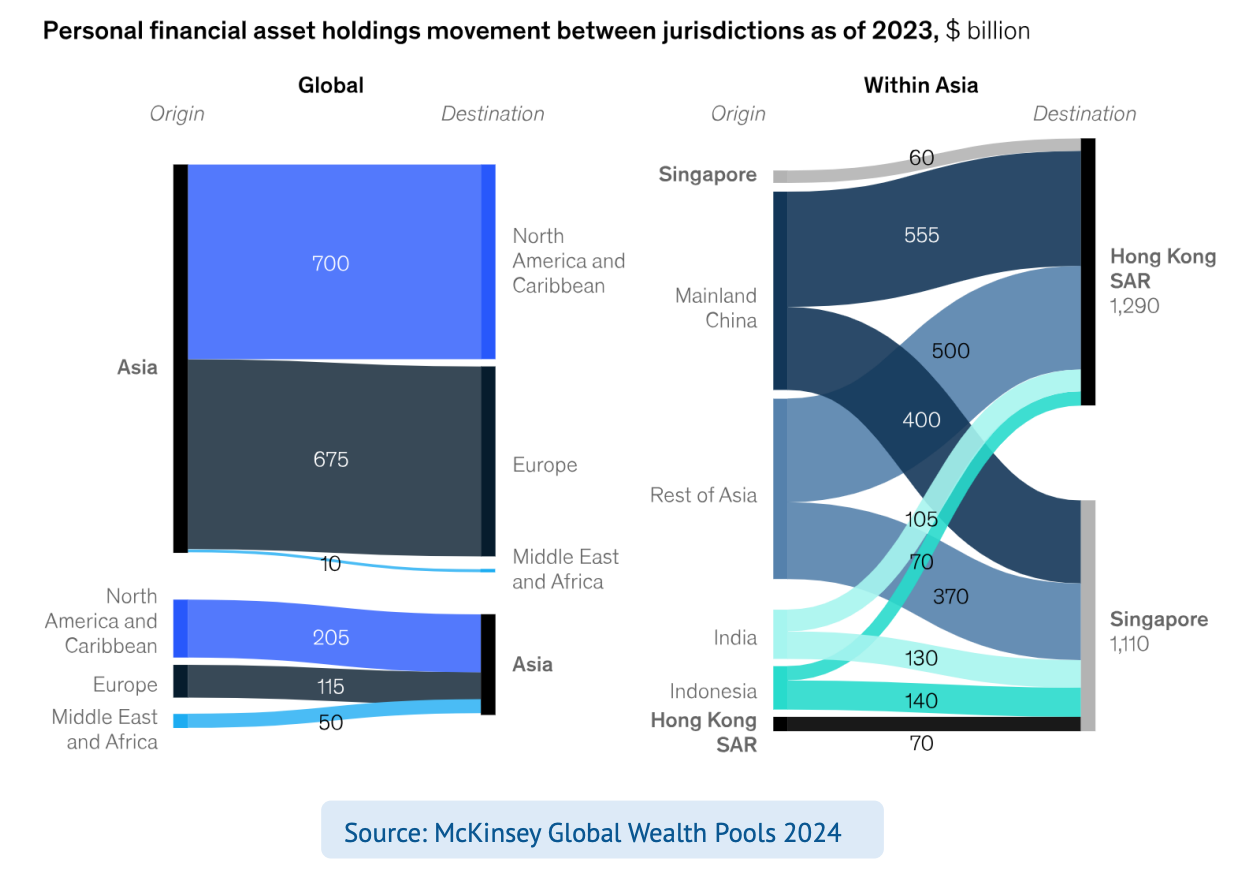

Indonesia’s decision is well-supported by data presented by McKinsey analysis that between 2023 and 2030, ultra-high-net-worth (UHNW) and high-net-worth (HNW) families in the Asia–Pacific region are set to experience an intergenerational wealth transfer estimated at a staggering amount of USD 5.8 trillion, triggering a Family Office boom in Asia.

Hongkong and Singapore As Family Office Hub

UHNW families are expected to account for about 60% of the total wealth transfer and many are setting up Family Offices to facilitate the process. Accordingly, the number of singleFamily Offices in Hong Kong and Singapore, which hosts 15% of the worlds single-Family Office, each managing over USD 1.3 trillion and hubs for such entities in Asia–Pacific, has quadrupled since 2020 to about 4,000 across both jurisdictions.

The growth trend presents a substantial opportunity for banks, insurers, multi-Family Offices (MFOs), asset managers, and WealthTechs (technology-enabled wealth fintech’s that offer low-cost, personalized, automated advice), all of which can offer differentiated services to new and established Family Offices.

Family Office Categories in Indonesia

There will be 8 categories of Family Offices classified in Indonesia.

These are:

- Founder’s Office: Supports business founders in managing assets outside of the company’s operational activities.

- Shareholders Office: Manages the wealth of shareholder families with a focus on business development.

- Family Enterprise Office: Preserves family wealth with a cross-generational approach and investment risk.

- Multi-Generational Office: Serving various branches of the family with diversified financial services.

- Investment Office: Focus on investment strategies across multiple asset classes to diversify the portfolio.

- Compliance Office: Provides services related to legal compliance and financial administration.

- Trustee Office: Manages family trusts with fiduciary responsibility.

- Philanthropy Office: Supports the philanthropic and charitable activities of wealthy families.

Positive Impact of Family Office in Indonesia

Some of the positive impacts of Family Office being established in Indonesia are:

- Increased Foreign Investment: Family Offices will drive capital flows from global investors into strategic sectors in Indonesia.

- Economic Stability: Long-term investments from Family Offices are expected to provide stability to the capital and financial markets.

- Job Creation: Mandatory use of local labor will open up great opportunities for Indonesian professionals in the financial sector.

- Strengthening Global Positioning: With competitive regulations, Indonesia can become an internationally competitive wealth management center.

To attract this market, the government decides as a starter to nominate New capital – IKN project, and two Bali SEZs, namely Sanur Health SEZ and Kura-Kura SEZ, to be projected as Family Office locations, with policy relaxation that is in process to incentivize tax cuts and other non-tax incentives.

Skylight’s Opinion

Indonesia’s Family Office plan holds promise for Foreign Direct Investment but must tackle critical challenges. The underdevelopment of strategic locations like IKN and Bali SEZs requires time and proven functionality before they can inspire investor confidence. Regulatory uncertainty, with frequent policy changes and bureaucratic hurdles, further complicates long-term trust. Additionally, Indonesia must address global scepticism regarding governance and stability to compete with established hubs like Singapore and Hong Kong.

To overcome these hurdles, Indonesia can implement a phased approach to developing locations, focusing on transparent updates and realistic timelines. Regulatory reform is crucial to simplify procedures, ensure policy consistency, and align with global standards. Building relationships with international wealth managers and showcasing successful pilot projects can foster trust and attract early adopters.

While short-term progress may face limitations due to unresolved challenges, a consistent and strategic effort can gradually position Indonesia as a credible and competitive wealth management destination. This initiative, with patience and persistence, has the potential to significantly boost foreign investment and strengthen the economy over time.

Latest Update

- Super Energy Signs GSA for East Java’s Gas Supply

- Gas distribution PT Super Energy Tbk announced that its subsidiary, PT Sumber Aneka Gas (SAG), has secured a gas supply allocation from the Sumber Field in the Tuban Working Area.

- SAG signed a Gas Sale and Purchase Agreement (GSPA) with PT Pertamina Hulu Energi Tuban East Java (PHETEJ) on January 15, 2025, formalizing the agreement to utilize the gas allocation for domestic industrial needs.

- Under the agreement, SAG will purchase a total of 71.01 billion standard cubic feet (BSCF) of natural gas from PHETEJ, with the contract set to run until December 31, 2036. The gas allocation, granted by the Indonesian government and supported by SKK Migas, aims to fulfill energy needs for industrial applications in Indonesia.

- The additional gas supply from the Sumber Field is expected to enhance Super Energy’s operational capacity by ensuring a stable gas supply for its consumers. SAG is currently constructing a Mini LNG Plant, which is anticipated to be completed by the end of 2025. The plant will process the gas from the Sumber Field.

- Coca-Cola Launches Rooftop Solar Power Plant in Pasuruan

- Coca-Cola Europacific Partners Indonesia (CCEP Indonesia) inaugurated on January 21, 2025, a new rooftop solar power plant at its Mega Distribution Center and PSD Pandaan factory in Pasuruan, East Java, as part of its commitment to support Indonesia’s energy transition and the government’s renewable energy goals.

- The solar power plant, covering 27,967 square meters, has a capacity of 2.4 MegaWatt peak (MWp) and is expected to reduce carbon emissions by approximately 2 million kilograms of CO2 annually. This move aligns with Indonesia’s target of achieving Net Zero Emissions by 2060 and increasing its renewable energy mix to 23% by 2025.

- Pasuruan Regent, Nurkholis, emphasized East Java’s role as a hub for industrial development and the importance of accelerating energy transitions in the manufacturing sector. He noted that the region aims to boost its renewable energy mix to 12.5% by 2025.

- Lucia Karina, Director of Public Affairs, Communications, and Sustainability at CCEP Indonesia, highlighted that the installation is part of the company’s broader sustainability efforts, including the global RE100 initiative, which targets 100% renewable energy by 2030.

- The initiative builds on CCEP Indonesia’s previous success in 2020 when the company commissioned Southeast Asia’s largest rooftop solar power plant, with a capacity of 7.134 MWp, significantly reducing emissions.

- Shanghai Electric Installs First Wind Turbine at IWIP

- Shanghai Electric Wind Power Group Co., Ltd., part of Shanghai Electric Group, is one of the largest offshore wind turbine manufacturers in China, has successfully installed the first wind turbine at the Indonesia Weda Bay Industrial Park (IWIP) in North Maluku Province, on January 20, 2025.

- This wind power initiative is part of IWIP developer, Tsingshan Group’s broader efforts to expand its green energy portfolio.

- IWIP is a vast industrial hub, spanning 50,000 Ha of mining areas and 2,500 Ha of industrial land, focusing on nickel smelting, high-grade nickel matte production, and lithium battery projects.

- The park is integrating renewable energy sources such as solar, thermal, energy storage, and wind power, with a combined capacity exceeding 2GW.

- The current phase of the wind power project, led by Tsingshan Yongqing Group, includes two turbine installations, with plans to expand to 70 turbines, ultimately reaching 500 MW of installed capacity. Once completed, the project is expected to generate approximately 800 million kWh annually, contributing significantly to Indonesia’s carbon neutrality and green development objectives.

- Additionally, IWIP plans to expand its port capacity to 550,000 DWT, increase its coal-fired power plant capacity to 760 MW, boost solar energy capacity to 1,000 MW, and develop a wind power plant with an 800 MW capacity.

- PLN Indonesia Power Collaborates with ACWA to Develop PLTS in Singkarak for 50 Megawatt

- PT PLN Indonesia Power (PLN IP) is ready to develop a 50 MW floating solar power plant (PLTS) in Lake Singkarak, Tanah Datar Regency, West Sumatra.

- PLN IP has entered into a strategic partnership with ACWA Power from Saudi Arabia to develop the 50 MW Singkarak Floating Solar Power Plant

- The project is part of the implementations of the Hijaunesia program, which was launched in 2020 to accelerate new and renewable energy in Indonesia and to support the net zero emission target by 2060 as part of PLN’s assignment from the government to build several PLTS spread throughout Indonesia.

- The Singkarak PLTS project, which is planned to operate or commercial operation date (COD) in 2027, will utilize an area of 49 Ha or 0.45% of the total area of Lake Singkarak, which reaches 10,780 Ha, so as to maintain environmental balance and the function of the lake ecosystem.

- World’s Largest Tin Downstream Center to Be Built in Batam for IDR 1.2 Trillion

- Deputy Minister of Investment and Downstream/Deputy Head of the Investment Coordinating Board (BKPM) Todotua Pasaribu inaugurated the groundbreaking of a tin downstream project in Batam City in January 24, 2025.

- The project includes the construction of a tin chemical facility by PT Batam Timah Sinergi (BTS) and a tin soldering facility by PT Tri Charislink Indoasia (TCI), both subsidiaries of PT Cipta Persada Mulia (CPM).

- CPM is tin mining company established in 2006 with a total licensed mining area of approximately 11,550 Ha located Riau Island. o With an initial investment and working capital of IDR 1.2 trillion, the facility is designed to become one of the largest tin downstream centers in the world. Todotua stated that the groundbreaking is an important moment in the transformation of the national tin industry.

- According to him, CPM’s activities include tin ore mining through its Mining Business License (IUP) and tin ingot production at its smelter. The tin ingot products are then further processed by BTS for the production of tin chemicals and by TCI for the development of tin solder and tin heat stabilizer.

- The BTS groundbreaking was carried out to support the construction of the tin chemical facility, which is currently entering the initial stage of construction land work. Meanwhile, TCI has entered the commissioning and full production stage. § Indonesia Seeks Collaboration with India for Investment and Partnership Between Two Countries o Indonesian President Prabowo visited India from January 23-26, 2025 to attend as chief guest for India’s 76th Republic Day on January 26, 2025.

- During the visit, both leaders agreed to strengthen partnerships in various sectors, including trade, investment, tourism, energy, digital technology, artificial intelligence (AI), and infrastructure. o In the defense sector, Prabowo stated that Indonesia had just ratified a defense cooperation agreement with India for three years focusing on search and rescue, pollution response, and law enforcement to enhance safety in the Indo-Pacific region.

- The Indonesian Chamber of Commerce and Industry (Kadin) attended the Indonesia-India CEO Forum and Business Matching held in New Delhi, India, on January 24-28, 2025. In this forum, Kadin sends 100 (25 Indonesian CEOs and 75 national entrepreneurs) entrepreneurs to explore strategic cooperation opportunities with business partners in India.

- On the sidelines of the CEO Forum and Business Matching Indonesia-India event, 6 MoUs were produced between both countries, these are:

- MoU between Kadin Indonesia and Confederation of Indian Industry (CII).

- MoU between PT Indosat Tbk and AIon OS India Private Limited for AI and digital talent.

- MoU between PT Indosat Tbk and Wadhwani Operating Foundation for digital talent.

- MoU between PT Sejahteraraya Anugrahjaya Tbk (Mayapada Healthcare Group) and Apollo Hospitals Enterprise Limited, India for Operation Maintenance (Hospital Project in Batam), digitalization diagnostic (monitoring), and upskilling talent.

- MoU between Nodeflux (Indonesia) and XDXLink (India) in the field of Low Orbit Earth satellite, AI technology. The cooperation goal is for disaster management, food security, mine monitoring, and environmental sustainability.

- MoU between Biotis (Indonesia, maker of the red and white vaccine) and Biological E (India), namely in the field of vaccine manufacturing, technology transfer from India to Indonesia.

- The event was organized in cooperation with Kadin Indonesia and CII and facilitated by the Indian and Indonesian Embassy; sponsored by GoTo, KPN Corp, First Resources, Pertamina, and supported by Indosat, Mayapada Hospital, Sinar Mas, Bukaka, PT Bina Insan Sukses Mandiri (BISM), PT Bara Prima Mandiri, and Adani.

- Shikoku Electric Power Company Invests in Hero Global Investment for Renewable Energy Development in Indonesia

- The Tokyo-based electricity provider Shikoku Electric Power Co. Inc. (Yonden) listed on the Tokyo Stock Exchange, through its subsidiary SEP International Netherlands BV (SEPI) has completed the transaction with Hero Global Investment (HGII), an Independent Power Producer for renewable energy, to acquire a 25% stake for IDR 325 million (USD 20.97 million) in the Indonesian renewable energy company, after HGII manage to Go Public in Indonesian Stock Exchange (BEI) on January 9, 2024.

- The sales and purchase agreement was signed on November 8, 2024, signing of share sale and purchase agreement was completed on January 24, 2025.

- The acquisition of Yonden in HGII enables them to penetrate the Indonesian market and also ASEAN in the fields of energy, power and renewable energy since both companies’ shares the same business field; furthermore Yonden’s extensive experience in power plant construction, operation and maintenance (O&M), will further enhance the capability of HGII to expand their scope in the renewable energy sectors.

- Through the support of Yonden, HGII will develop renewable energy projects, including hydropower, solar power, biogas, and biomass, with a combined capacity of 100 megawatts by 2031, and building a nuclear power plant is also a possibility for HGII considering the expertise of Yonden in that field.

- Currently, HGII owns the Parmonangan-1 Minihydro Power Plant (PLTM) with a capacity of 9 MW and the Parmonangan-2 PLTM with a capacity of 10 MW. Both plants are located in North Sumatra.

- In addition, HGII also invested a minority stake in the 3 MW Ujung Batu Biogas Power Plant (PLTBg) in Riau.

- In HGII’s expansion pipeline, the additional renewable energy capacity will be based on water-based energy with a total capacity of 58 MW. In addition, HGII will develop 6 MW of biogas, 8 MW of biomass, and 10 MW of solar power.

- Organically, HGII is currently working on a 25 MW Hydroelectric Power Plant (PLTA) and a 10 MW PLTM, in North Sumatra which will begin construction this year, with target of Commercial Operation Date (COD) in 2028.

- BYD to Complete the USD 1 Billion Investment for the Indonesian Plant by YearEnd

- China’s top electric vehicle maker BYD aims to complete its USD 1 billion plant in Indonesia at the end of 2025, the head of its local unit said on January 20, 2025, underscoring the firm’s ambition to dominate in the market where Japanese automakers are popular. o The plant, which is being built at an industrial complex in Subang, West Java, will have a production capacity of 150,000 EV units annually, with a long-term plan for the plant to produce cars to be exported to other regions.

- With the investment, BYD has been allowed to temporarily ship its cars into Indonesia without import duties, a policy aimed to stimulate demand for EVs while attracting investment by automakers. The government aims for 600,000 EVs to be domestically produced by 2030.

- In 2024, its first year of sales in Indonesia, BYD sold 15,429 units, auto association data showed. According to January to November figures, BYD was the leader in terms of battery-based EV sales with about 36% of the market share. Eagle Zhao, the President Director of Indonesian BYD said that he expected the new plant to produce its first cars not long after the completion of construction.

- Indonesian Workforce Productivity Lags Behind Southeast Asian Peers

- The Industry Ministry stated that Indonesian workforce productivity falls behind its Southeast Asian counterparts. This was stated by Wulan Aprilian6 Permatasari, Head of the Industrial Vocational Education Development Center (PPPVI) at the Ministry’s Industrial Human Resources Development Agency (BPSDMI).

- Indonesian workforce productvity still ranks fifth in Southeast Asia, with each worker generating approximately USD 26,328 in 2023.

- Wulan highlighted that the income per Indonesian worker is far behind the productivity levels of Singapore, Brunei Darussalam, and Malaysia.

- This finding aligns with data from the International Labor Organization (ILO), which measures the output of each worker within a specific period to determine productivity levels.

- The ILO reported that in 2023, each Indonesian worker contributed USD 14 to the gross domestic product (GDP) per hour of work. In contrast, Singapore achieved USD 74 per hour, Brunei Darussalam reached USD 49, Malaysia recorded USD 26, and Thailand generated USD 15 per hour.

- ASEAN Studies also indicated a low labor productivity level in Indonesia. This is evident in the GDP per worker figure, which stands at only USD 23,870, falling below the ASEAN average of USD 24,270 per worker.

- Red and White Smelter in Kolaka Operational in April 2025

- PT Ceria Nugraha Indotama (Ceria), part of Ceria Group, will soon operate Ceria’s Merah Putih smelter. This Merah Putih smelter uses the latest technology Rectangular Rotary Kiln Electric Furnace (RKEF) which has one of the largest furnaces in Indonesia of 72 MVA. The furnace is to process saprolite nickel ore that produces ferronickel output with a nickel content of 22%.

- The project started back in 2019, obtaining the status of National Strategic Project; by end of 2024, it has reached the final phase of commissioning with a completion rate of 97.05%, and currently preparing for the construction of its High-Pressure Acid Leach (HPAL) project. o Ceria Group’s nickel smelter is located in Kolaka, Southeast Sulawesi, with a target to operate in April 2025. Upon completion, the smelter claimed itself to be one of the first to produce green nickel products due to its utilization in renewable energy sources.

- The Ceria Group smelter’s use of clean energy sourced from the Bakaru hydropower plant (in the PLN transmission network) which is stated with a Renewable Energy Certificate (REC).

- Ceria Nugraha Indotama is highly appreciated as 100% Direct Domestic Investment (DDI) that fully utilized local workers.

- Currently, Glencore, Swiss multinational commodity trading and mining is looking to acquire the rights issue shares of Ceria Nugraha Indotama in the upcoming Pre-IPO Fund raising this year for the construction of HPAL smelter, and a pathway for Ceria to go international.

- Indonesian Government Wants Boeing to Build Factory in Batam

- The government has asked US aircraft manufacturer Boeing to build a component factory in Indonesia. The request was conveyed by Deputy Minister of Industry, Faisol Riza, when he received a visit from Boeing representatives at the Ministry of Industry Office in Jakarta.

- The Deputy Minister of Industry encouraged Boeing to expand collaboration with Indonesia in several sectors, including the granting of licenses for the aircraft Maintenance, Repair, and Overhaul (MRO) industry, as well as the construction of flight training centers in Indonesia, as what Boeing did in India for the flight training centers.

- He mentioned that Indonesia has GMF AeroAsia, and Batam AeroTechnic that need capability enhancement to develop their industrial ecosystem, that Boeing can support by providing licenses to Indonesia’s MRO, since currently most commercial airplanes still perform maintenance abroad, due to limited spare parts.

- GMF AeroAsia is Indonesian company specializing in aircraft MRO employing more than 4,000 people and Batam AeroTechnic an aircraft MRO owned by Lion, with integrated facilities with Hang Nadim Airport, such as aircraft runway, aircraft fuel, water, and electricity on a land of 30 Ha, and has an Special Economic Zone status.

- Faisol assessed the need for follow-up by conducting cooperation between the Ministry of Industry and Boeing in the form of a memorandum of understanding (MoU).

- President of Boeing Southeast Asia, Penny Burt mentioned that Boeing sees Indonesia as having the potential to contribute to the sustainable development of the aviation industry, and is willing to continue the cooperation with Indonesian companies to improve its capabilities and bring Indonesia to become global Boeing component providers.

-end-

REFERENCES

- Skylight Analytics Hub

- https://www.mckinsey.com/industries/financial-services/our-insights/asia-pacifics-familyoffice-boom-opportunity-knocks

- https://keuangan.kontan.co.id/news/hong-kong-siap-bantu-indonesia-dalam-membangunfamily-office-ini-strateginya

- https://www.liputan6.com/hot/read/5883798/jenis-family-office-diusulkan-luhut-untukdijalankan-februari-2025?page=4

- https://www.petromindo.com/news/article/shanghai-electric-installs-first-wind-turbine-atiwip-1

- https://www.shanghai-electric.com/group_en/windpower/

- https://www.tempo.co/ekonomi/pln-indonesia-power-akan-kembangkan-plts-singkarak-50- mw-1196373

- https://bkpm.go.id/id/info/siaran-pers/perkuat-hilirisasi-mineral-wakil-menteri-investasidan-hilirisasi-wakil-kepala-bkpm-groundbreaking-pengolahan-timah-rp1-2-t-di-batam

- https://ciptapersadamulia.co.id/bisnis-kami/

- https://www.beritasatu.com/network/jambisatu/431092/kadin-indonesia-kirim-100- pengusaha-ke-india-untuk-perkuat-kerja-sama-ekonomi

- https://www.antaranews.com/berita/4614034/ketum-kadin-sampaikan-hasil-forum-ceodan-bisnis-ri-india-ke-prabowo

- https://www.metrotvnews.com/read/NQACY7g5-hasil-forum-ceo-dan-business-matchingindonesia-india-disampaikan-ke-presiden-prabowo

- https://www.petromindo.com/news/article/coca-cola-launches-rooftop-solar-power-plantin-pasuruan https://heroglobalinvestment.com/tentang-kami/

- https://jakartaglobe.id/business/japans-shikoku-electric-to-buy-25-stake-in-hero-globalinvestment

- https://swa.co.id/read/455829/yonden-resmi-akuisisi-25-saham-hero-globalinvestmenthgii-perluas-portofolio-energi-terbarukan

- https://industri.kontan.co.id/news/intip-ekspansi-hero-global-hgii-kejar-kapasitas-ebt-100- mw-pada-2031

- https://www.cnbcindonesia.com/market/20250124132931-17-605703/raksasa-jepangmasuk-hgii-guyur-rp-325-m-buka-opsi-masuk-nuklir

- https://www.reuters.com/business/autos-transportation/chinas-byd-complete-1-billionindonesia-plant-by-end-2025-executive-says-2025-01-20/

- https://investor.id/business/387435/proyek-smelter-ceria-group-menuju-penyelesaian-siapdukung-hilirisasi-nikel

- https://ekonomi.bisnis.com/read/20250124/44/1834708/smelter-nikel-ceria-groupditargetkan-beroperasi-kuartal-ii2025

- https://www.liputan6.com/bisnis/read/5897321/kejar-asta-cita-prabowo-smelter-nikel-dikolaka-target-beroperasi-april-2025?page=2

- https://www.bloombergtechnoz.com/detail-news/40823/ada-modal-glencore-di-balik-niatipo-ceria-nugraha-pada-2025

- https://finance.detik.com/industri/d-7754657/pemerintah-minta-bangun-pabrik-komponendi-ri-boeing-respons-begini

- https://kek.go.id/id/investment/distribution/kek-batam-aero-technic

- https://www.gmf-aeroasia.co.id/