Highlighted Topic: World Banks’ Business Ready Framework

The Ease of Doing Business (EODB) index was once a key tool for governments and the private sector to assess and improve business conditions globally. However, concerns about data manipulation led to its discontinuation in 2021. To address these issues, the World Bank introduced a successor, the Business Ready (B-READY) framework, emphasizing transparency and comprehensive analysis.

Launched in October 2024, B-READY evaluates the business environment and investment climate across economies worldwide. On February 10, 2025, the World Bank, in collaboration with Indonesia’s Ministry of Investment, APINDO, and CSIS, introduced the framework in Indonesia. Unlike its predecessor, B-READY incorporates 21 questionnaires and analyzes over 1,200 indicators per economy, offering deeper insights into every phase of a firm’s life cycle, including previously omitted areas such as labor.

The program uses an analytical framework built around 10 topics and 3 pillars as follows:

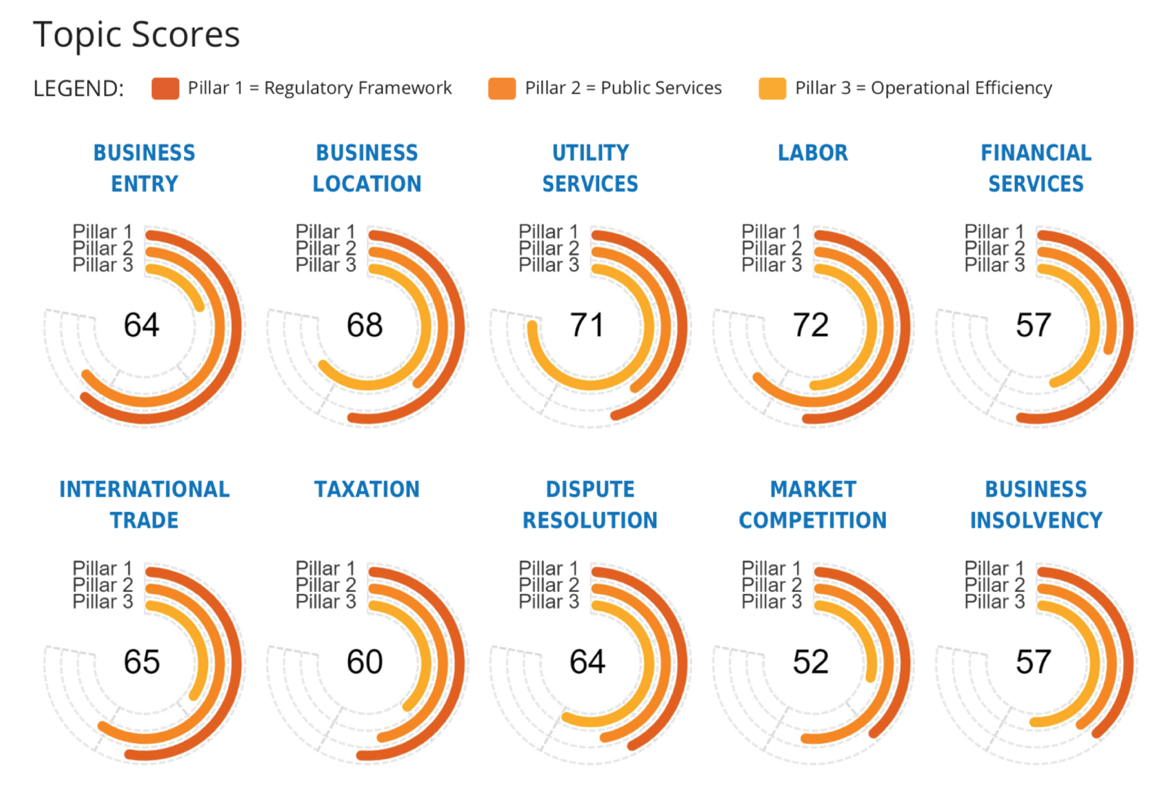

Each economy receives two score sets—10 topic scores and 3 pillar scores—ranging from 0 to 100. Topic scores are calculated by averaging the scores from the three pillars.

B-READY collects data from two main sources:

1. Expert Questionnaires – Input from 60–80 experts per economy, updated annually.

2. Enterprise Surveys – Data from major firms, updated every three years due to high costs.

The initiative is ongoing, with 50 economic reports set for release in 2025, expanding to 100 reports by September. Coverage will grow to include most global economies by 2026, with annual publications accounting for over 180 economies thereafter.

Key Findings of B-READY Research

Research findings reveal that higher-income economies generally exhibit higher levels of business readiness. Notable examples include Estonia, with its highly efficient digitalized public services, and Singapore, renowned for government efficiency and pragmatic policies. However, wealth alone does not guarantee a favorable business environment. Rwanda has doubled its per capita GDP over the past decade, achieving 5% annual growth and increasing foreign investment. Similarly, Vietnam ranks in the top 20% globally for operational efficiency, underscoring the importance of effective governance.

Addressing the Regulatory Gap

A significant challenge identified by the World Bank is the disparity between Regulatory Framework and Public Services, which is three times more pronounced in developing countries than in developed economies. While creating regulations is relatively simple, ensuring effective execution through public services remains a major hurdle. Closing this gap is essential for fostering a truly business-ready environment.

Indonesia’s Performance

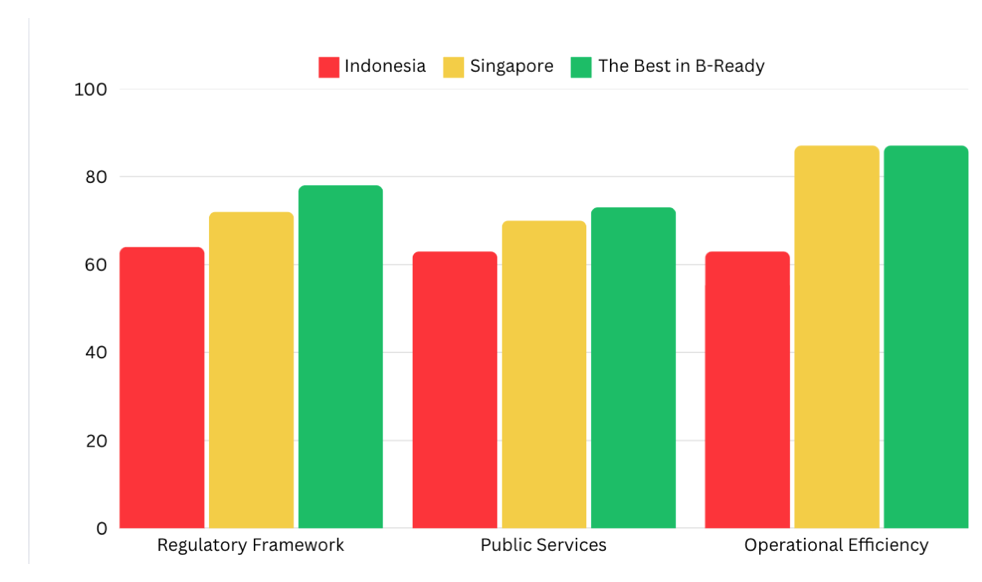

Indonesia scores approximately 60% across all B-READY topics and pillars, indicating stability but highlighting room for improvement. For comparison, Singapore scores notably higher, with Operational Efficiency at 87%—the highest among surveyed economies—and a smaller gap between its Regulatory Framework (72%) and Public Services (70%). Meanwhile, Indonesia shows consistent scores of 64%, 63%, and 63%, across the three pillars, reflecting a balanced, though modest, performance.

To unlock its potential and avoid the middle-income trap, Indonesia must address structural challenges. The private sector, which accounts for 90% of jobs, 75% of investment, and 80% of government revenue, remains underutilized. A more business-friendly environment, with reduced bureaucracy and barriers, is critical to driving private-sector growth and achieving sustainable economic advancement.

Environment Gaps: How Indonesia Compares to the World’s Most Efficient Economies

A comparison of Indonesia’s business environment against the world’s most efficient economies reveals significant gaps across 10 critical topics. These disparities highlight areas where urgent improvements are needed:

1. Business Entry: It takes 65 days to register a foreign company in Indonesia, compared to just 3 days in leading economies.

2. Business Location: Property transfers require 90 days in Indonesia versus 1 day in topperforming economies.

3. Utility Services: Planned internet outages in Indonesia are not communicated to customers, unlike in efficient economies with transparent policies.

4. Labour: Only 8% of firms in Indonesia offer formal training programs, compared to over 66% in leading economies.

5. Financial Services: Just 34% of payments by firms are electronic in Indonesia, while efficient economies exceed 99%.

6. International Trade: Compliance with export/import requirements costs 66% of an imported and 35% of an exported good’s value in Indonesia, compared to only 2% in the best economies.

7. Taxation: Less than 40% of Indonesian firms file and pay taxes electronically, while top economies achieve 100%.

8. Dispute Resolution: Enforcement of final judgments takes 150 days in Indonesia, versus under a week in leading economies.

9. Market Competition: 44% of Indonesian firms report price regulations, compared to less than 4% in competitive economies.

10. Business Insolvency: Resolving in-court liquidation costs 15% of a company’s valuation in Indonesia, while it costs just 2% elsewhere.

Strengths and Weaknesses

Indonesia performs best in Labour, Utility Services, and Business Location, demonstrating efforts in employment support, utility regulation enforcement, and transparent zoning processes. However, its weakest areas—Market Competition, Financial Services, and Business Insolvency—highlight the absence of technology transfer offices, limited collateral registries, and inadequate insolvency proceedings for small enterprises.

Key Messages from B-READY Introduction

1. Renewing Indonesia’s commitment to economic growth is essential.

2. The private sector must take center stage as a driver of sustainable growth.

3. The government should prioritize creating a business-friendly environment to foster investment, innovation, and competitiveness.

Skylight’s Opinion

Indonesia has immense potential to position itself as a regional investment hub, but realizing this depends on collaborative efforts from the government and businesses.

For the Government

Key priorities include simplifying business entry processes, reducing regulatory hurdles, and improving public services. Accelerating property transfers, expanding digital tax systems, and enhancing labor training programs will foster investor confidence. Addressing public service gaps can ensure regulations translate into real-world efficiency.

For Businesses

Businesses are suggested to invest in employee development, adopt digital payment systems, and align with sustainable practices to drive growth. Proactive steps toward ESG goals and operational efficiency can help Indonesia to attract global investors while contributing to long-term economic resilience.

Shared Responsibility

Public-private collaboration is essential to reduce bureaucracy and drive solutions, such as establishing technology hubs and specialized small business support systems. A cohesive effort will create an environment conducive to investment, innovation, and inclusive growth. Together, stakeholders can unlock Indonesia’s potential and secure a thriving, equitable future.

Latest Update

- Japan’s Leading Patisserie Affirms Plan to Build Second Factory in Indonesia

- Minister of Investment and Downstreaming/BKPM Rosan Roeslani met with the CEO of Japan’s largest cake company, Chateraise Holdings Co Ltd Takako Saito, at BKPM Office, on February 7, 2025.

- Chateraise plans to build a second factory in Bekasi and expand its retail network after opening its stores in Jakarta’s malls.

- Back in 2022, Chateraise inaugurated its factory in Citeureup, West Java, with an investment of IDR 60 billion (approximately USD 3.7 million). The Citeureup facility was designed to support the production needs of 12 outlets across Jabodetabek. At the time, the company announced plans for further expansion within 3-5 years, contingent on reaching a milestone of 100 outlets in Indonesia. The proposed expansion would include the construction of a new factory on 1- 2 hectares of land.

- Additionally, Chateraise aims to enhance its manufacturing processes by incorporating locally sourced raw materials, such as chocolate, cocoa, and yam.

- Ijen Geothermal Power Plant Begins Commercial Operations

- PT Medco Cahaya Geothermal (MCG), a joint venture between Medco Power Indonesia and Ormat Technologies, has commenced commercial operations at the Ijen Geothermal Power Plant in East Java. This marks the region’s first geothermal facility and supports Indonesia’s renewable energy targets and energy transition goals.

- The Ijen plant has a planned capacity of 110 MW, with its first phase now operational, contributing 35 MW to the Java electricity grid via a 30-year power purchase agreement. Supported by 83 transmission towers and a 150kV transmission line, the plant is expected to stabilize the grid and supply electricity to approximately 85,000 households in the Java-Bali system.

- This is Medco Power’s second geothermal project, following the Sarulla plant in North Sumatra. The company is also exploring geothermal opportunities in Bonjol (West Sumatra) and Samosir (North Sumatra), further emphasizing its commitment to renewable energy expansion. Medco claimed that the project has received multiple safety and occupational health accolades.

- Jiangsu Lopal Tech Invests USD 200 Million in Indonesian LFP Cathode Project

- China’s Jiangsu Lopal Tech. Co., Ltd. has finalized a USD 200 million investment for its lithium iron phosphate (LFP) cathode material project in Semarang, Indonesia. The funding was secured through contributions from PT Akasya Investasi Indonesia (INA), Indonesia’s sovereign wealth fund, and AISIS Alliance L.P., alongside a follow-up commitment from Changzhou Liyuan New Energy Technology Co., Ltd., an existing shareholder.

- The project aims to develop a 120,000-ton LFP cathode production facility in two phases. The first phase, with a capacity of 30,000 tons, launched in October 2024, while the second phase, adding 90,000 tons, is in its early stages. INA, AISIS, and Changzhou Liyuan will hold respective stakes of 34.01%, 11.34%, and 54.65% in the new project company.

- LFP cathodes are essential for lithium-ion batteries, widely used in electric vehicles and energy storage systems. With lower costs and higher safety than NCM (nickel, cobalt, and manganese) batteries, LFP has gained traction in global EV markets. This project bolsters Indonesia’s role in the global battery supply chain, complementing its existing strengths in nickel-based battery materials.

- Toyota Launches West Java’s First Hydrogen Refuelling Station

- PT Toyota Motor Manufacturing Indonesia (TMMI) has inaugurated West Java’s first hydrogen refuelling station in Karawang Regency, marking a significant milestone in promoting sustainable energy solutions. The station, with a capacity of 700 bar and an investment of IDR 35 billion, exemplifies Toyota’s commitment to reducing carbon emissions through advanced technologies.

- Additionally, TMMI plans to expand hydrogen applications by introducing hydrogen-powered forklifts to industrial operations.

- During the launch, Indonesia’s Director General of New Renewable Energy and Energy Conservation, Eniya Listiani Dewi, highlighted the government’s efforts to prepare a hydrogen roadmap. This plan envisions hydrogen becoming a key energy source for vehicles and power generation by 2038–2040, aligning with Indonesia’s long-term renewable energy goals.

- CNGR Advanced Material’s Strategic Moves in Indonesia and Global Expansion

- CNGR Advanced Material Co., Ltd., recently announced a strategic agreement with Beijing Easpring Material Technology Co., Ltd. to expand production capacity and conduct joint R&D. The partnership targets 30,000–100,000 tons of battery precursors annually, focusing on nickel-based ternary (NCM/NCA), LFP, and solid-state battery technologies.

- CNGR is also collaborating on new energy materials like sodium-ion batteries and battery recycling. Additional partnerships include supply agreements and research initiatives with companies like Tesla, CALB, and SK Ecoplant, as well as alliances with mining firms for raw material stability, reinforcing its vertical integration strategy.

- Indonesia plays a critical role in CNGR’s operations, with over USD 7 billion committed to nickel refining, battery material production, and industrial zone development. CNGR operates four key nickel refining bases, including facilities in Morowali and Weda Bay, with combined annual production exceeding 200,000 metric tons of nickel matte and sulfate.

- It has also announced a USD 10 billion investment to expand battery material production in North Konawe, incorporating hydrogen energy and tin-based applications. The company further proposes USD 288 million in financial assistance for its four Indonesian joint ventures to support smelting, precursor production, and logistics infrastructure.

- CNGR plans to issue H-shares on the Hong Kong Stock Exchange to enhance capital availability for its international projects. The proposed listing aligns with its strategy to grow its battery materials and nickel processing businesses globally.

- Through aggressive investments and partnerships, CNGR is solidifying its position in the global EV battery market while reinforcing Indonesia’s role in the battery supply chain. However, challenges in resource management and execution remain critical for maximizing these initiatives.

- Danantara: Indonesia’s Superholding Institution

- Launched in February 2025, Danantara (Daya Anagata Nusantara Investment Management Agency) is Indonesia’s newly established superholding institution created by President Prabowo Subianto. It consolidates seven major state-owned enterprises—BRI, Mandiri, BNI, MIND ID, PLN, Telkom Indonesia, and Pertamina—alongside assets managed by the Indonesia Investment Authority (INA) to strategically oversee state assets.

- With initial assets under management of IDR 9,520 trillion (USD 605 billion), Danantara aims to drive economic growth and improve global competitiveness. Inspired by successful models like Singapore’s Temasek and Malaysia’s Khazanah Nasional, it seeks to balance profitability with public benefit. Danantara will operate as a Sovereign Wealth Fund Manager, Development Investment Manager, and State Asset Manager, aiming for the world’s 4th largest superholding institution.

- This initiative is hoped to reflect Indonesia’s vision to strengthen its economic future through efficient wealth management and strategic global positioning.

- The Government Stops the Development of Lido Special Economic Zone

- The Ministry of Environment ordered property company PT MNC Land Tbk, to stop the one of its biggest project, the Lido SEZ tourism affiliated with US President Donald Trump.

- The 3,000-hectare integrated resort project, that obtains SEZ status back in 2021, is located about 60 km south of Jakarta and is the site of a Trump golf course that began offering memberships last year.

- The Trump Organization also plans to operate the luxury hotels and residential homes in the future, with MNC Land as the developer, where they signed Management Agreement in 2015.

- Following the findings of problems with water management and environmental issues, The ministry said in its statement that poor stormwater management at the resort had caused sedimentation in Lake Lido, resulting in the lake becoming shallower and reducing its area to just 12 hectares (from its original size of 24 hectares).

- Furthermore, Ardyanto Nugroho, Director of Environmental Supervision at the Ministry of Environment said that the discrepancy between environmental plans and physical implementation has become a serious concern in the effort to safeguard natural resources.

- MNC Land to submit a new environmental assessment if they wish to proceed with the development of Lido, said ministry spokesperson – Sasmita Nugroho.

- However, MNC Land denied and stated that sedimentation has already occurred after they took over the Lido area in 2013. And since starting construction in 2016, they have focused on addressing this sedimentation issue – providing a Silt Retaining Wall.

- Turkish Drone Giant, Baykar Signs JV Deal for UAV Factory in Indonesia

- Baykar, a globally recognized Turkish drone manufacturer, on February 12, 2025, signed a joint venture agreement with Indonesian defense company Republikorp to establish an Unmanned Aerial Vehicle manufacturing facility in Indonesia.

- The deal was among a dozen agreements signed on the sidelines of President Erdoğan’s visit to Indonesia aimed at strengthening economic and defense ties between the two Muslim-majority nations.

- The collaboration aims to enhance Indonesia’s manufacturing capabilities and covers the coproduction of its two types of drone – Bayraktar TB3 and Akıncı drones, which Baykar will export to the country.

- Its other drone type,Bayraktar TB2 combat drones, gained prominence globally after being used by Ukraine’s military against Russian forces as well as in campaigns in Azerbaijan and North Africa.

- The TB3 is the first of its kind, boasting the ability to fold its wings. It made its maiden flight in late October last year.

- Baykar has become the face of Türkiye’s defense and aerospace sector and is one of the most prolific drone exporters worldwide. In 2024, it made USD 1.8 billion in sales alone.

- As a reference, Türkiye dominates 65% of the global drone export market, according to a report by the U.S.-based think tank Center for a New American Security; Baykar alone is said to hold nearly 60% of the market – three times the size of its closest U.S. competitor.

- This joint venture is seen as a major milestone in strengthening Indonesia’s defense sector.

- Indonesia Investment Outlook 2024

- Indonesia’s Investment Outlook for 2024 presents a promising fiscal performance. Minister of Investment and Downstream/BKPM, Rosan Roeslani, announced that Indonesia surpassed its revenue target, achieving IDR 1,714.2 trillion (USD 114.3 billion), which is 103.9% of the set goal. Investment distribution reflects a balanced geographic focus, with 47.8% allocated to Java and 52.2% directed to regions outside Java. Foreign Direct Investment (FDI) contributed 52.5%, while Domestic Direct Investment (DDI) accounted for 47.5%, underscoring robust growth from both international and local investors.

- Top Region for FDI and DDI Investments

1. DKI Jakarta: IDR 241.9 trillion (USD 16.13 billion)

2. West Java: 251.1 trillion (USD 16.74 billion)

3. East Java: 147.3 trillion (USD 9.82 billion)

4. Central Sulawesi: IDR 139.9 trillion (USD 9.33 billion)

5. Banten: IDR 105.6 trillion (USD 7.04 billion)

- Top Countries Invested in Indonesia

1. Singapore: USD 20.1 billion

2. Hongkong, China: USD 8.2 billion

3. China: USD 8.1 billion

4. Malaysia: USD 4.2 billion

5. USA: USD 3.7 billion

- For 2025, Indonesia targets investment realization of IDR 1,905.6 trillion or USD 119.1 billion (USD 1= IDR 16,000) for a 5.30% economic growth, and an increase of an average investment growth of 15.67% per year all the way to IDR 3,414.82 trillion or USD 213.4 billion by 2029, reaching an 8% economic growth.

- American Investment Flowing into Indonesia In Q1 2025

- Rosan Roeslani, Minister of Investment and Downstream / BKPM, shared investment plans from major US companies in Indonesia, with investment commitments worth billions of dollars. o Previously, Apple Inc has made its investment in Indonesia through their vendor partners by building an AirTag factory in Batam, Riau Islands.According to Rosan, Apple vendors have taken concrete steps by purchasing land in Batam.

- One iPhone unit has around 320 vendors. In Vietnam and Malaysia, there are more than 35 vendors, even close to 40, while in Indonesia, there is only one vendor. This disparity highlights an opportunity for Indonesia to attract more vendors, enhance its investment climate, and secure a stronger position in the global supply chain.

- Additional American investments, though not yet disclosed, are confirmed, reflecting high confidence in Indonesia’s growing economic potential.

- Indonesia Launches IETF To Accelerate Energy Transition

- Indonesia officially launched the Indonesia Energy Transition Facility (IETF) on February 5, 2025, in collaboration with the Ministry of Energy and Mineral Resources (MEMR) and the Agence Française de Développement (AFD).

- AFD, an international financial institution, supports over 4,200 projects globally and committed USD 3 billion last year to areas such as renewable energy, energy efficiency, and sustainable development.

- The IETF program is backed by a direct grant agreement signed on November 1, 2024, with a total commitment of EUR 3 million.

- Priority programs under IETF include: Downstreaming of minerals and coal; Increasing oil and gas lifting; Implementing 40% biodiesel.

- Providing gas for domestic industries—all while targeting the reduction of greenhouse gas emissions. Indonesia surpassed its 2024 greenhouse gas emission reduction target in the energy sector, achieving 147.61 million tons of CO2 equivalent (compared to the goal of 142 million tons).

- During the event, PT PLN (Persero) and AFD signed a partnership agreement titled “Joint Initiative of Energy Transition Cooperation in Indonesia.”

- Key elements of this partnership include: Placement of Energy Technical Advisors by AFD within MEMR; Policy reforms supporting the Policy Based Loan Affordable and Sustainable Energy Transition scheme; Initiatives focused on green hydrogen development and sustainable bioenergy production.

- 15 Massive Oil and Gas Projects Targeted to be Onstream in 2025

- The Special Task Force for Upstream Oil and Gas Business Activities (SKK Migas) targets 15 projects to be operational or onstream by 2025. The capital expenditure budget of the onstream plan reaches USD 832 million.

- If these fifteen projects are successfully onstream, they will have the potential to increase and maintain the capacity of national oil and gas production facilities by around 233,389 Barrels of Oil Equivalent Per Day (BOE/D), consisting of 73,335 Barrels of Oil Per Day (BPOD) oil and 896 Million Standard Cubic Feet Per Day (MMSCFD) gas.

- Based on SKK Migas, these 15 oil and gas projects are:

- 1. Terubuk (Medco EP Natuna) – Natuna

- 6,654 BPOD & 60 MMSCFD

- Onstream: Q2/2025

- 2. Bentu Production Line (EMP Bentu) – Riau

- 8 MMSCFD

- Onstream: Q2/2025

- 3. Balam GS Upgrade (PHR) – Riau

- 31,921 BPOD

- Onstream: Q1/2025

- 4. CEOR Minas (PHR) – Riau

- 1,566 BPOD

- Onstream: Q4/2025

- 5. NDD A14 Stage-2 (PHR) – Riau

- 2,814 BPOD

- Onstream: Q3/2025

- 6. SKN New Train (PHE Jambi Merang) – Jambi

- 22 MMSCFD

- Onstream: Q2/2025

- 7. A-24 (Premier Oil Natuna Sea B.V.) – Natuna

- 6.6 MMSCFD

- Onstream: Q3/2025

- 8. Letang Tengah Rawa Expansion (Medco EP Grissik Ltd.) – South Sumatra

- 70 MMSCFD

- Onstream: Q1/2025

- 9. Suban Future Facility Optimization (Revamping) (Medco EP Grissik Ltd.) – South Sumatra

- 4,878 BPOD

- Onstream: Q4/2025

- 10. Karamba (ISOG) – East Kalimantan

- 7 MMSCFD

- Onstream: Q2/2025

- 11. NubI AOl Side 1, 3, 5 (PHM) – East Kalimantan

- 60 MMSCFD

- Onstream: Q4/2025

- 12. Akasia Bagus Stage-1 (Pertamina EP) – South Sumatra

- 7,250 BPOD & 19 MMSCFD

- Onstream: Q1/2025

- 13. Senoro Selatan (JOB Pertamina-Medco E&P Tomori Sulawesi) – Sulawesi

- 110 MMSCFD

- Onstream: Q4/2025

- 14. OPL LES (PHE ONWJ) – Offshore North West Java

- 130 BPOD & 4.5 MMSCFD

- Onstream: Q4/2025

- 15. BUIC-C14 (EMCL) – East Java

- 9,700 BPOD

- Onstream: Q4/2025

- 1. Terubuk (Medco EP Natuna) – Natuna

- Volvo Aims to Keep Lead in Indonesia’s European Truck Market

- Volvo Trucks aims to solidify its leadership in Indonesia’s mining sector, where it held 47% of the European truck market share in 2024. The company aims to maintain this positioning in 2025 as a priority due to its significance.

- Last year, the company sold 780 units, with a major portion coming from PT Sapta Indra Sejati, a coal mining contractor under the Adaro Group.

- The FH16, Volvo’s flagship mining model, stands out with a 700-horsepower engine and a gross combination weight (GCW) capacity of up to 325 tons, making it ideal for demanding operations.

- Volvo is also testing electric mining trucks in Europe, though challenges remain in achieving the high load capacities needed for Indonesia’s mining industry, such as 325 tons GCW. While there are no immediate plans to introduce electric trucks locally, Volvo Trucks remains committed to innovation and maintaining its market dominance.

- Indonesia’s Naval Ambitions: Partnerships and Modernization Efforts

- Indonesia is considering acquiring an aircraft carrier for non-combat missions as part of its naval modernization efforts, according to Admiral Muhammad Ali during a press conference on February 6, 2025.

- The modernization proposals include acquisition of an aircraft carrier for noncombat roles and purchase of frigates from Italy and fast missile-armed patrol boats from Turkey.

- PT PAL Indonesia has presented concepts for helicopter carriers and amphibious assault ships, suggesting potential domestic construction, possibly with a foreign partner.

- Italy is a key potential partner, with Fincantieri supplying frigates to the Indonesian Navy. Rumors suggest the possible acquisition of the Giuseppe Garibaldi aircraft carrier or a modernization and licensed construction agreement with the Italian naval industry.

- Collaboration with South Korea is another option, leveraging existing partnerships with Hyundai Heavy Industries and DSME, which could provide suitable platforms.

- Turkey’s President Erdogan’s visit in February 2024 further solidified defense cooperation, supporting the procurement of naval assets.

- Japan has offered a grant of two patrol vessels, approved by the Indonesian Parliament, to support maritime security at the Balikpapan naval base in East Kalimantan.

- These efforts reflect Indonesia’s broader commitment to enhancing its naval capabilities and maritime security through diversified international partnerships.

- UAE’s Interest In Indonesia’s Infrastructure and National Strategic Projects

- UAE has expressed interest in investing in Indonesia’s infrastructure and National Strategic Projects (PSN), as discussed between Coordinating Minister for Economic Affairs Airlangga Hartarto and UAE Investment Minister Alsuwaidi during the World Government Summit 2025 in Dubai.

- A key area of focus is the development of a reliable data center ecosystem, with investments flowing through multiple Special Economic Zones (SEZs) across Indonesia. Nongsa SEZ is one example, targeting a 400MW investment to establish data centers and support projects in science, technology, semiconductors, and artificial intelligence (AI).

- Aside from the technology sector, discussions included investments in airport and port infrastructure to further strengthen Indonesia’s connectivity and logistics capabilities.

- UAE’s investment interest extends to potential collaboration with companies like Danantara, Pertamina, and PT Garuda Indonesia, exploring strategic partnerships in areas like green field projects and national infrastructure development.

References

- Skylight Analytics Hub

- https://tradingeconomics.com/indonesia/ease-of-doingbusiness#:~:text=The%20Ease%20of%20doing%20business%20index%20ranks%20c ountries%20against%20each,Highest

- https://www.worldbank.org/en/news/statement/2021/09/16/world-bank-group-todiscontinue-doing-business-report § https://finance.detik.com/industri/d-7770062/toko-kue-terbesar-jepang-maubangun-pabrik-di-bekasi § https://rm.id/baca-berita/ekonomi-bisnis/127585/investasi-rp-60-m-chateraiseindonesia-bangun-pabrik-di-citeureup

- https://www.thinkgeoenergy.com/indonesias-35-mw-ijen-geothermal-power-plantstarts-commercial-operations/

- https://www.petromindo.com/news/article/akaya-investasi-aisis-invest-200-millionin-jiangsu-lopal-s-lfp-project

- https://www.petromindo.com/news/article/toyota-launches-hydrogen-refuelingstation-in-west-java

- https://www.asianmetal.com/news/2158894/Easpring-Technology-and-CNGR-signlithium-battery-materials-cooperation-deal/1

- https://www.kompas.id/artikel/bisakah-danantara-menyaingi-temasek-dankhazanah

- https://infobanknews.com/resmi-dibentuk-danantara-bakal-kelola-dividen-daninvestasi-bumn/

- https://industri.kontan.co.id/news/mnc-land-angkat-bicara-soal-perintahpenghentian-proyek-lido

- https://www.dailysabah.com/business/defense/turkish-drone-giant-baykar-signs-jvdeal-for-uav-factory-in-indonesia

- https://www.idnfinancials.com/id/news/52392/apple-investors-set-invest-indonesia

- https://www.afd.fr/en/agence-francaise-de-developpement-group

- https://www.esdm.go.id/id/media-center/arsip-berita/resmi-luncurkan-ietfindonesia-komitmen-percepat-transisi-energi-bersih

- https://www.greenclimate.fund/ae/afd

- https://finance.detik.com/energi/d-7773847/15-proyek-migas-beroperasi-tahun-initotal-investasi-rp-13-6-triliun

- https://www.petromindo.com/news/article/volvo-aims-to-keep-lead-in-indonesia-seuropean-truck-market

- https://armyrecognition.com/news/navy-news/2025/indonesia-weighs-aircraftcarrier-acquisition-to-strengthen-maritime-operations-and-security

- https://en.antaranews.com/news/344621/indonesia-turkey-to-step-up-defensesecurity-cooperation

- https://ekbis.sindonews.com/read/1529137/34/uni-emirat-arab-siap-jajakiinvestasi-infrastruktur-di-psn-1739419321#goog_rewarded

- https://economy.okezone.com/read/2025/02/12/470/3113253/menko-airlanggauea-minat-investasi-di-infrastruktur?page=2